FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

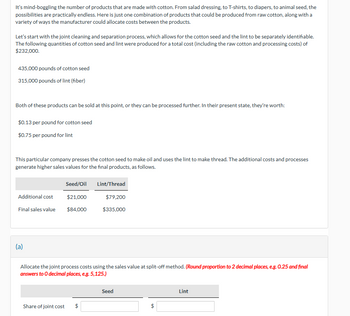

Transcribed Image Text:It's mind-boggling the number of products that are made with cotton. From salad dressing, to T-shirts, to diapers, to animal seed, the

possibilities are practically endless. Here is just one combination of products that could be produced from raw cotton, along with a

variety of ways the manufacturer could allocate costs between the products.

Let's start with the joint cleaning and separation process, which allows for the cotton seed and the lint to be separately identifiable.

The following quantities of cotton seed and lint were produced for a total cost (including the raw cotton and processing costs) of

$232,000.

435,000 pounds of cotton seed

315,000 pounds of lint (fiber)

Both of these products can be sold at this point, or they can be processed further. In their present state, they're worth:

$0.13 per pound for cotton seed

$0.75 per pound for lint

This particular company presses the cotton seed to make oil and uses the lint to make thread. The additional costs and processes

generate higher sales values for the final products, as follows.

Seed/Oil

Lint/Thread

Additional cost

Final sales value

$21,000

$79,200

$84,000

$335,000

(a)

Allocate the joint process costs using the sales value at split-off method. (Round proportion to 2 decimal places, e.g. 0.25 and final

answers to O decimal places, e.g. 5,125.)

Seed

Share of joint cost

$

Lint

SAVE

AI-Generated Solution

info

AI-generated content may present inaccurate or offensive content that does not represent bartleby’s views.

Unlock instant AI solutions

Tap the button

to generate a solution

to generate a solution

Click the button to generate

a solution

a solution

Knowledge Booster

Similar questions

- Moisha is developing material standards for her company. The operations manager wants grade A widgets because they are the easiest to work with and are the quality the customers want. Grade B will not work because customers do not want the lower grade, and it takes more time to assemble the product than with grade A materials. Moisha calls several suppliers to get prices for the widget. All are within $0.05 of each other. Since they will use millions of widgets, she decides that the $0.05 difference is important. The supplier who has the lowest price is known for delivering late and low-quality materials. Moisha decides to use the supplier who is $0.02 more but delivers on time and at the right quality. This supplier charges $0.42 per widget. Each unit of product requires 5 widgets. What is the standard cost per unit for widgets? Round your answer to two decimal places. Standard cost per unit $fill in the blank 1arrow_forwardBuzz Ltd is a toy manufacturer. For many years Buzz Ltd produced and sold just one toy, a plastic car, but it has recently started to produce and sell a range of different toys including trains, buses, trucks and caravans. Buzz Ltd is concerned that its current traditional system of allocating overheads is leading to inaccurate product costs. Describe Activity Based Costing and explain why it may be useful for a company such as Buzz Ltd.arrow_forwardChocolate Bars, Inc. (CBI), manufactures creamy deluxe chocolate candy bars. The firm has developed three distinct products: Almond Dream, Krispy Krackle, and Creamy Crunch. CBI is profitable, but management is quite concerned about the profitability of each product and the product costing methods currently employed. In particular, management questions whether the overhead allocation base of direct labor-hours accurately reflects the costs incurred during the production process of each product. In reviewing cost reports with the marketing manager, Steve Hoffman, who is the cost accountant, notices that Creamy Crunch appears exceptionally profitable and that Almond Dream appears to be produced at a loss. This surprises both him and the manager, and after much discussion, they are convinced that the cost accounting system is at fault and that Almond Dream is performing very well at the current market price. Steve decides to hire Jean Sharpe, a management consultant, to study the…arrow_forward

- Vishanuarrow_forward'Brisbane Refinery Ltd' (BRL) processes canola oil for the Supermarket Chain G-Mart. It is involved in continuous processing to produce canola oil and uses FIFO process costing to account for its production costs. The FIFO is suitable for BRL as costs are quite unstable due to the volatile price of the canola seeds it uses in production. The canola seeds are processed through one department. Overhead is applied based on direct labour costs, and the application rate has not changed over the period covered by the problem. The Work-in-Process Inventory account showed the following balances at the start of the current period. Direct materials $195,500 Direct labour 390,000 Overhead applied 487,500 These costs were related to 78,000 litres that were in process at the start of the period. During the period, 90,000 litres were transferred to finished goods inventory. Of the litres finished during this period, 80 percent were sold. After litres have been transferred to finished goods…arrow_forwardHaving trouble with prior chapter work still and we are moving on to another chapter.arrow_forward

- As you learned in the previous chapters, Current Designs has two main product lines-composite kayaks, which are handmade and very labor-intensive, and rotomolded kayaks, which require less labor but employ more expensive equipment. Current Designs' controller, Diane Buswell, is now evaluating several different methods of assigning overhead to these products. It is important to ensure that costs are appropriately assigned to the company's products. At the same time, the system that is used must not be so complex that its costs are greater than its benefits. Diane has decided to use the following activities and costs to evaluate the methods of assigning overhead. Activities Cost Designing new models Creating and testing prototypes $120,000 144,000 Creating molds for kayaks 208,000 Operating oven for the rotomolded kayaks 38,000 Operating the vacuum line for the composite kayaks 27,000 192,000 Supervising production employees Curing time (the time that is needed for the chemical processes…arrow_forwardCan you fix the bottom questionarrow_forwardMary Jones and Jack Smart have joined forces to start M&J Food Products, a processor of packaged shredded lettuce for institutional use. Jack has years of food processing experience, and Mary has extensive commercial food preparation experience. The process will consist of opening crates of lettuce and then sorting, washing, slicing, preserving, and finally packaging the prepared lettuce. Together, with help from vendors, they think they can adequately estimate demand, fixed costs, revenues, and variable cost per 5-pound bag of lettuce. They think a largely manual process will have monthly fixed cost of $50,000 and a variable cost of $2.50 per bag. They expect to sell 75,000 bags of lettuce per month. They expect to sell the shredded lettuce for $3.25 per 5-pound bag. Jack and Mary has been contacted by a vendor to consider a more mechanized process. This new process will have monthly fixed cost of $125,000 per month with a variable cost of $1.75 per bag. Based on the above…arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education