FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

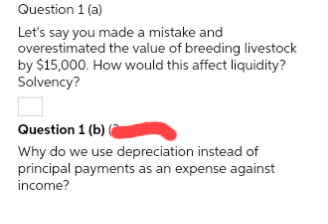

Transcribed Image Text:Question 1 (a)

Let's say you made a mistake and

overestimated the value of breeding livestock

by $15,000. How would this affect liquidity?

Solvency?

Question 1 (b) (

Why do we use depreciation instead of

principal payments as an expense against

income?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Hello about the calculation, shouldn't be surplus because the BOP result is positive? and negative when the BOP is negative? Explain why 20,000 is deficitarrow_forwardUse the following information for the Quick Study below. (Algo) [The following information applies to the questions displayed below.] Following is information on an investment in a manufacturing machine. The machine has zero salvage value. The company requires a 6% return from its investments. Initial investment Net cash flows: Year 1 Year 2 Year 3 Year 1 Year 2 Year 3 QS 24-19 (Algo) Net present value with unequal cash flows LO P3 Compute this machine's net present value. (PV of $1, FV of $1, PVA of $1, and FVA of $1) (Use appropriate factor(s) from the tables provided. Round all present value factors to 4 decimal places. Round present value amounts to the nearest dollar.) Totals Initial investment Net present value Net Cash Flow $ $ $ (240,000) 195,000 90,000 103,000 388,000 195,000 90,000 103,000 Present Value Factor Present Value of Net Cash Flows $ $ 0 0arrow_forwardAs a company, to minimize the present worth of taxes paid to the federal government, use longest MACRS recovery period. true or false?arrow_forward

- A potential new project involves an up-front (year 0) increase in inventories of $760. In your cash flow table, the cash flow impact of that change in year 0 only should be $__________. Do not round any intermediate work, but round your final answer to 2 decimal places (ex: 12.34567 should be entered as 12.35). Do not enter the $ sign. Include a negative sign if your answer is negative.arrow_forwardHi, number 3 still appears to be unanswered for this problem. How do you determine relevant cash flow (after-tax) at project disposal (termination)?arrow_forward15. Since a financial manager prefers to receive cash flows as fast as possible,____.A. a longer depreciable life is preferred to a shorter oneB. a shorter depreciable life is preferred to a longer oneC. the manager is not concerned with depreciable life, because depreciation is a noncash expenseD. the manager is not concerned with depreciable life, because once depreciation is a sunk cost.arrow_forward

- Nonearrow_forwardA business executive once stated, “Depreciation is one of our biggest operating cash inflows.” Do you agree? Explain.arrow_forwardThe TRUTH about Free Cash Flow (FCF): FCF decreases when additional investments in working capital are needed Terminal value is deducted from the PV of FCF to arrive at valuation Accelerated depreciation methods reduces FCF O FCF is estimated on a before tax basisarrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education