Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

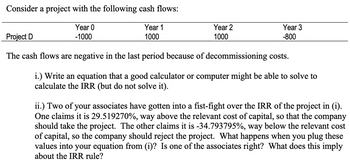

Transcribed Image Text:Consider a project with the following cash flows:

Year 0

-1000

Year 1

1000

Year 2

1000

Year 3

-800

Project D

The cash flows are negative in the last period because of decommissioning costs.

i.) Write an equation that a good calculator or computer might be able to solve to

calculate the IRR (but do not solve it).

ii.) Two of your associates have gotten into a fist-fight over the IRR of the project in (i).

One claims it is 29.519270%, way above the relevant cost of capital, so that the company

should take the project. The other claims it is -34.793795%, way below the relevant cost

of capital, so the company should reject the project. What happens when you plug these

values into your equation from (i)? Is one of the associates right? What does this imply

about the IRR rule?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Use the following information for the Quick Study below. (Algo) [The following information applies to the questions displayed below.] Following is information on an investment in a manufacturing machine. The machine has zero salvage value. The company requires a 6% return from its investments. Initial investment Net cash flows: Year 1 Year 2 Year 3 Year 1 Year 2 Year 3 QS 24-19 (Algo) Net present value with unequal cash flows LO P3 Compute this machine's net present value. (PV of $1, FV of $1, PVA of $1, and FVA of $1) (Use appropriate factor(s) from the tables provided. Round all present value factors to 4 decimal places. Round present value amounts to the nearest dollar.) Totals Initial investment Net present value Net Cash Flow $ $ $ (240,000) 195,000 90,000 103,000 388,000 195,000 90,000 103,000 Present Value Factor Present Value of Net Cash Flows $ $ 0 0arrow_forwardGive me correct answer with explanation..jarrow_forward1. what amount should be used as the initial cash flow for this project and why?? 2. What is the after-tax salvage value for the spectrometer? 3. What is the MPV of the project? Should the firm accept or reject this project?arrow_forward

- Note:- Do not provide handwritten solution. Maintain accuracy and quality in your answer. Take care of plagiarism. Answer completely. You will get up vote for sure.arrow_forwardOverall, you should find conflicting recommendations based on the various criteria. Why is this occuring?arrow_forwardTLT Ltd is considering the purchase of a new machine for use in its production process. Management has developed three alternative proposals to help evaluate the machine purchase. Only one of these proposals can be implemented. Proposals A and B both have the same cost to set up, but the output from proposal A (as measured by future net cash flows) commences at a high rate and then declines over time, while Proposal B starts at a low rate and then increases over time. Proposal C involves buying two of the machines considered under proposal B. That is, proposal C is simply Proposal B scaled by a factor of two. Proposal C results in net cash flows which are similar in magnitude to proposal A's net cash flows in the first two years. The estimated net cash flows, internal rates of return and net present values at 9% and 11% for each proposal are given in the following table. Proposal A -$290,000 $100,000 $90,000 Proposal B -$290,000 $40,000 $50,000 Proposal C -$580,000 $80,000 $100,000 End…arrow_forward

- makabhai this problem, given the same data has several different answers for the NPV. Please show in excel with formulas that correct answer. TexMex Food Company is considering a new salsa whose data are shown below. The equipment to be used would be depreciated by the straight-line method over its 3-year life and would have a zero salvage value, and no new working capital would be required. Revenues and other operating costs are expected to be constant over the project's 3-year life. However, this project would compete with other TexMex products and would reduce their pre-tax annual cash flows. What is the project's NPV? WACC 10.0% Pre-tax cash flow reduction for other products (cannibalization) -$5,000 Investment cost (depreciable basis) $80,000 Straight-line deprec. rate 33.333% Sales revenues, each year for 3 years $67,500 Annual operating costs (excl. deprec.) -$25,000 Tax rate 35.0%arrow_forwardCullumber Clinic is considering investing in new heart-monitoring equipment. It has two options. Option A would have an initial lower cost but would require a significant expenditure for rebuilding after 4 years. Option B would require no rebuilding expenditure, but its maintenance costs would be higher. Since the Option B machine is of initial higher quality, it is expected to have a salvage value at the end of its useful life. The following estimates were made of the cash flows. The company's cost of capital is 5%. Initial cost Annual cash inflows Annual cash outflows Cost to rebuild (end of year 4) Salvage value Estimated useful life Click here to view the factor table Your answer is partially correct Option A Option B Option A $170,000 $70,200 $30,700 $49,000 $ Compute the (1) net present value. (2) profitability index, and (3) internal rate of return for each option. (Hint: To solve for internal rate of return, experiment with alternative discount rates to arrive at a net present…arrow_forwardIRR of an uneven cash flow stream) Microwave Oven Programming in comidering the construction of a new plant. The plant will have an intal cash oulay of 16 1 milion (= $61 milion) and will produce can fows of 57 9 month and of year 1, 157 milion at the end of your 2, and $15 million at the end of years 3 through 5 What is the internal cale of retam on th The Wd of the project is (ound to two decinal places)arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education