FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

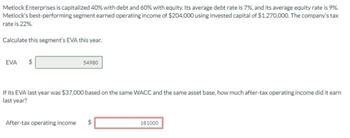

Transcribed Image Text:Metlock Enterprises is capitalized 40% with debt and 60% with equity. Its average debt rate is 7%, and its average equity rate is 9%.

Metlock's best-performing segment earned operating income of $204,000 using invested capital of $1,270,000. The company's tax

rate is 22%.

Calculate this segment's EVA this year.

EVA

$

54980

If its EVA last year was $37,000 based on the same WACC and the same asset base, how much after-tax operating income did it earn

last year?

After-tax operating income

181000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps with 3 images

Knowledge Booster

Similar questions

- Genie Company has operating income after taxes of P50,000. It has P200,000 of equity capital, which has an after-tax weighted-average cost of 12%. Genie also has P10,000 of current liabilities (noninterest-bearing) and no long-term liabilities. What is the company's economic value added (EVA) for the period?arrow_forwardThe Paulson Company's year-end balance sheet is shown below. Its cost of common equity is 14%, its before-tax cost of debt is 10%, and its marginal tax rate is 25%. Assume that the firm's long-term debt sells at par value. The firm's total debt, which is the sum of the company's short-term debt and long-term debt, equals $1,183. The firm has 576 shares of common stock outstanding that sell for $4.00 per share. Cash Assets Accounts receivable Inventories Liabilities And Equity $ 120 Accounts payable and accruals $ 10 53 240 360 Short-term debt Long-term debt 1,130 30 Plant and equipment, net Total assets 2,160 $2,880 Common equity Total liabilities and equity 1,687 $2,880 Calculate Paulson's WACC using market-value weights. Do not round intermediate calculations. Round your answer to two decimal places. %arrow_forwardA company finances its operations with 57 percent debt and the rest using equity. The annual yield on the company's debt is 6% and the required rate of return on the stock is 14.6%. What is company's WACC? Assume the tax rate is 30%arrow_forward

- Gibson Company sales for the Year 1 were $2 million. The firm’s variable operating cost ratio was 0.45, and fixed costs (that is, overhead and depreciation) were $700,000. Its average (and marginal) income tax rate is 40 percent. Currently, the firm has $2.4 million of long-term bank loans outstanding at an average interest rate of 13.0 percent. The remainder of the firm’s capital structure consists of common stock (140,000 shares outstanding at the present time). Calculate Gibson’s degree of combined leverage for Year 1. Round your answer to two decimal places. Gibson is forecasting a 8 percent increase in sales for next year (Year 2). Furthermore, the firm is planning to purchase additional labor-saving equipment, which will increase fixed costs by $130,000 and reduce the variable cost ratio to 0.430. Financing this equipment with debt will require additional bank loans of $400,000 at an interest rate of 13.0 percent. Calculate Gibson’s expected degree of combined leverage for…arrow_forwardEhrlich & Czarnecki Consulting, Inc. recently reported the following information: Net income = $800,000 Sales = $4,200,000 Total Assets = $9.5 million Tax rate = 40% Interest expense = 20,000 Accounts Payable = 36,000 Notes Payable = 300,000 Accruals = 50,000 After-tax cost of capital = 11% What is the company’s EVA? $-296,358 $-223,540 $-452,391 $-488,029 None of the above is within $100 of the correct answer.arrow_forwardBroward Manufacturing recently reported the following information: Net income ROA BEP: 26.73 Interest expense $102,120 Accounts payable and accruals $950,000 Broward's tax rate is 25%. Broward finances with only debt and common equity, so it has no preferred stock. 40% of its total invested capital is debt, and 60% of its total invested capital is common equity. Calculate its basic earning power (BEP), its return on equity (ROE), and its return on invested capital (ROIC). Do not round intermediate calculations. Round your answers to two decimal places. ROE: 73.60 ROIC: 44.55 % % $276,000 % 8%arrow_forward

- Lauryn's Doll Company had EBIT last year of $58 million, which is net of a depreciation expense of $5.8 million. In addition, Lauryn's made $6.3 million in capital expenditures and increased net working capital by $2.5 million. Assume that Lauryn's has a reported equity beta of 1.9, a debt-to-equity ratio of 0.6, and a tax rate of 21 percent. What is Lauryn's FCF for the year? Note: Do not round intermediate calculations. Enter your answer in millions rounded to 2 decimal places. FCF millionarrow_forwardLast year, Cayman Corporation had sales of $6 million, total variable costs of $2 million, and total fixed costs of $1 million. In addition, they paid $480,000 in interest to bondholders. Cayman has a 21% marginal tax rate. If Cayman's sales increase 6%, what should be the increase in operating income?arrow_forwardRivera Corporation has an operating income of $3 million and a tax rate of 32%. Capital invested is $12 million and the after-tax percentage cost of capital is 9%. Determine the economic value added (EVA) of the company.arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education