CONCEPTS IN FED.TAX.,2020-W/ACCESS

20th Edition

ISBN: 9780357110362

Author: Murphy

Publisher: CENGAGE L

expand_more

expand_more

format_list_bulleted

Question

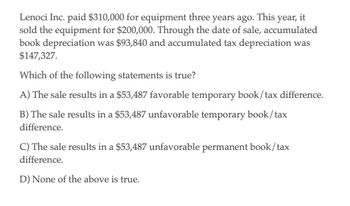

Transcribed Image Text:Lenoci Inc. paid $310,000 for equipment three years ago. This year, it

sold the equipment for $200,000. Through the date of sale, accumulated

book depreciation was $93,840 and accumulated tax depreciation was

$147,327.

Which of the following statements is true?

A) The sale results in a $53,487 favorable temporary book/tax difference.

B) The sale results in a $53,487 unfavorable temporary book/tax

difference.

C) The sale results in a $53,487 unfavorable permanent book/tax

difference.

D) None of the above is true.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- At the beginning of 2019, Conley Company purchased an asset at a cost of 10,000. For financial reporting purposes, the asset has a 4-year life with no residual value and is depreciated by the straight-line method beginning in 2019. For tax purposes, the asset is depreciated under MACRS using a 5-year recovery period. Prior to 2019, Conley had no deferred tax liability or asset. The difference between depreciation for financial reporting purposes and income tax purposes is the only temporary difference between pretax financial income and taxable income. The current income tax rate is 30%, and no change in the tax rate has been enacted for future years. In 2019 and 2020, taxable income will be higher or lower than financial income by what amount?arrow_forwardTurnip Company purchased an asset at a cost of 10,000 with a 10-year life during the current year. Turnip uses differing depreciation methods for financial reporting and income tax purposes. The depreciation expense during the current year for financial reporting is 1,000 and for income tax purposes is 2,000. Turnip is subject to a 30% enacted future tax rate. Prepare a schedule to compute Turnips (a) ending future taxable amount, (b) ending deferred tax liability, and (c) change in deferred tax liability (deferred tax expense) for the current year.arrow_forwardAyres Services acquired an asset for $82 million in 2018. The asset is depreciated for financial reporting purposes over four years on a straight-line basis (no residual value). For tax purposes the asset's cost is depreciated by MACRS. The enacted tax rate is 40%. Amounts for pretax accounting income, depreciation, and taxable income in 2018, 2019, 2020, and 2021 are as follows: Pretax accounting income Depreciation on the income statement Depreciation on the tax return. Taxable income. ($ in millions) 2019 355 $ 20.5 (33.5) Temporary Difference Deferred Tax Liability 2018 $ 335 $ 20.5 (25.5) $ 330 $ 342 $ 375 2020 2021 370 $ 405 20.5 20.5 (15.5) (7.5) $ 418 Required: Determine (a) the temporary book-tax difference for the depreciable asset and (b) the balance to be reported in the deferred tax liability account. (Leave no cell blank, enter "0" wherever applicable. Show all amounts as positive amounts. Enter your answers in millions rounded to 1 decimal place (i.e., 5,500,000 should…arrow_forward

- Ayres Services acquired an asset for $116 million in 2018. The asset is depreciated for financial reporting purposes over four years on a straight-line basis (no residual value). For tax purposes the asset's cost is depreciated by MACRS. The enacted tax rate is 40%. Amounts for pretax accounting income, depreciation, and taxable income in 2018, 2019, 2020, and 2021 are as follows: (S in millions) 2019 $ 420 $ 440 $ 455 29.0 2018 2020 2021 $ 490 Pretax accounting income Depreciation on the income statement Depreciation on the tax return 29.0 29.0 29.0 (34.0) (42.0) (24.0) 415 $ 427 (16.0) $ 503 Taxable income $ 460 Required: Determine (a) the temporary book-tax difference for the depreciable asset and (b) the balance to be reported in the deferred tax liability account. (Leave no cell blank, enter "0" wherever applicable. Show all amounts as positive amounts. Enter your answers in millions rounded to 1 decimal place (i.e., 5,500,000 should be entered as 5.5).) Beginning of 2018 End of…arrow_forwardCan you please give me true answer this accounting question?arrow_forwardDuring the current year, Hill Corporation sold equipment for $600,000 (adjusted basis of $360,000). The equipment was purchased a few years ago fo $760,000 and $400,000in MACRS deductions have been claimed. ADS depreciation would have been $300,000. As a result of the sale, the adjustment to taxable income needed to determine current E & P is A) No agjustment is required B) Subtract $100,000 C) Add $100,000 D) Add $80,000 E) None of the abovearrow_forward

- For the following scenario, determine the dollar amount of book-tax difference (if any) written as a positive number. Ramco Tooling purchased new equipment on January 1, Year 1 for $90,000. In Year 1, Ramco took $21,000 in Sec. 179 expense on the equipment and $20,000 in bonus depreciation on the equipment. In addition, it took $13,000 in regular MACRS depreciation on the equipment in Year 1. For book purposes, Ramco estimates the useful life of the equipment is 9 years and uses straight-line depreciation. OI. $23,000 O II. $44,000 O III. $3,000 O IV. $0 OV. None of the answers given here. O VI. $24,000arrow_forwardSeveral years ago, PTR purchased business equipment for $50,000. PTR’saccumulated book depreciation with respect to the equipment is $37,200, and itsaccumulated tax depreciation is $41,000.Required:a.Compute PTR’s book and tax basis in the equipment.b. Using a 21 percent tax rate, compute PTR’s deferred tax asset or liability (identifywhich) resulting from the difference between accumulated book and taxdepreciation.c. Compute PTR’s book and tax gain if it sells the equipment for $14,750.arrow_forwardBridgeport Corp. purchased depreciable assets costing $36,600 on January 2, 2023. For tax purposes, the company uses CCA in a class that has a 30% rate. For financial reporting purposes, the company uses straight-line depreciation over five years. The enacted tax rate is 25% for all years. This depreciation difference is the only reversing difference the company has. Calculate the amount of capital cost allowance and depreciation expense from 2023 to 2027, as well as the corresponding balances for the carrying amount and undepreciated capital cost of the depreciable assets at the end of each of the years 2023 to 2027. Assume that these assets are considered “eligible equipment” for purposes of the Accelerated Investment Incentive (under the AII, insteadarrow_forward

- At the end of the preceding year, JP Motors had a deferred tax asset of $14,750,000, attributable to its only temporary difference of $59,000,000 for estimated expenses. At the end of the current year, the temporary difference is $54,000,000. At the beginning of the year there was no valuation account for the deferred tax asset. At year-end, JP Motors now estimates that it is more likely than not that one-third of the deferred tax asset will never be realized. Taxable income is $12,900,000 for the current year and the tax rate is 25% for all years. Required: Prepare journal entries to record JP Motors' income tax expense for the current year.arrow_forwardPurple Ltd purchased a depreciable asset for $900,000 on 1 July 2014. For accounting purposes, it is estimated to have a useful life of 8 years with no residual value. For taxation purposes, the useful life is 6 years with no residual value. The asset is depreciated on a straight-line basis for both accounting and tax purposes. Tax rate is 30%. What is the adjustment required in the deferred tax liability account for the year ended 30 June 2020 and 30 June 2021 respectively in accordance with the requirements of AASB112 Income Taxes? $11,250; $11,250 $11,250; $33,750 $11,250; ($33,750) $11,250; ($11,250)arrow_forwardA distribution center purchased an equipment for $100,000 and has depreciated the equipment using the MACRS depreciation schedule as a 7-year property. The operating income in year 2 was $200,000 and the expenses were $87,000. If the company is in the 40% income tax bracket. i) What is the depreciation in year 2? $ ii) What is the taxable income in year 2? $ iii) What is the tax in year 2? $ iv) What is the book value of the equipment after year 2? $arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning Individual Income TaxesAccountingISBN:9780357109731Author:HoffmanPublisher:CENGAGE LEARNING - CONSIGNMENT

Individual Income TaxesAccountingISBN:9780357109731Author:HoffmanPublisher:CENGAGE LEARNING - CONSIGNMENT

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:Cengage Learning

Individual Income Taxes

Accounting

ISBN:9780357109731

Author:Hoffman

Publisher:CENGAGE LEARNING - CONSIGNMENT