Intermediate Financial Management (MindTap Course List)

13th Edition

ISBN: 9781337395083

Author: Eugene F. Brigham, Phillip R. Daves

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Question

1-3

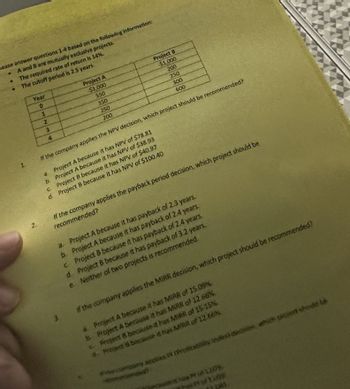

Transcribed Image Text:lease answer questions 1-4 based on the following information:

A and B are mutually exclusive projects.

The required rate of return is 14%.

•

The cutoff period is 2.5 years.

Year

Project A

Project B

0

$1,000

$1,000

200

1

550

250

Z

350

300

3

250

600

4

200

3.

2

If the company applies the NPV decision, which project should be recommended?

a Project A because it has NPV of $78.81

b. Project A because it has NPV of $38.93

c Project B because it has NPV of $40.97

d. Project B because it has NPV of $100.40

If the company applies the payback period decision, which project should be

recommended?

a. Project A because it has payback of 2.3 years.

b. Project A because it has payback of 2.4 years.

c. Project B because it has payback of 2.4 years.

d. Project B because it has payback of 3.2 years.

e. Neither of two projects is recommended.

If the company applies the MIRR decision, which project should be recommended?

a. Project A because it has MIRR of 15.09%.

b. Project A because it has MIRR of 12.66%.

Project 8 because it has MIRR of 15-15%

d. Project & because it has MIRR of 12.66%

company applies P (Profitability index) decision, which project should b

mended

Chos Pt of 1.078

has Pf of 1099

041

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps with 2 images

Knowledge Booster

Similar questions

- Problem 3-63 (Algo) CVP, Operating Leverage, and Margin of Safety (LO 3-1, 2, 4) Maryland Manufacturing (M2) produces a part using an expensive proprietary machine that can only be leased. The leasing company offers two contracts. The first (unit-rate lease) is one where M2 would pay $20 per unit produced, regardless of the number of units. The second lease option (flat-rate lease) is one where M2 would pay $450,000 annually, regardless of the number produced. The lease will run one year and the lease option chosen cannot be changed during the lease. All other lease terms are the same. M2 sells the part for $218 per unit and unit variable cost (excluding any machine lease costs) are $118. Annual fixed costs (excluding any machine lease costs) are $1,458,000. Required: a. What is the annual break-even level assuming 1. The unit-rate lease? 2. The flat-rate lease? b. At what annual volume would the operating profit be the same regardless of the royalty option chosen? c. Suppose M2 is…arrow_forwardA firm requires a payback period of 2 years or less. According to the payback period rule, which of the following projects is acceptable to this firm? Year Project A Project B Project C 0 -$86 -$128 -$77 1 30 40 100 2 40 20 -50 3 50 10 4 60 130 a. If you use payback period as a decision rule, you would choose (No answer given) Project A Project B Project Carrow_forward1-4arrow_forward

- Seroja Berhad (Seroja) wishes to evaluate the following two alternatives available to acquire a machine: Lease Alternative Seroja can lease the machine under a 5-year lease requiring lease payment of RM5,000 at the beginning of each year. All maintenance costs will be borne by the lessor and the insurance and other costs will be borne by the lessee. “Borrowing to Buy” Alternative The machine costs RM20,000 and will have a 5-year life. The purchase will be financed by a 5year, 15% interest. Seroja will pay RM1,000 per year for a service contract that covers insurance and other costs. Seroja Berhad plans to keep the machine and use it beyond its 5-year life. The machine will be depreciated as given below: Year Depreciation RM 1 5,000 2 4,000 3 3,000 4 2,000 5 1,000 Given that the corporate tax rate is 30%. Prepare the Cash Flows Analysis by clearly showing the Net Advantage of Leasing (NAL).…arrow_forwardSeroja Berhad (Seroja) wishes to evaluate the following two alternatives available to acquire a machine: Lease Alternative Seroja can lease the machine under a 5-year lease requiring lease payment of RM5,000 at the beginning of each year. All maintenance costs will be borne by the lessor and the insurance and other costs will be borne by the lessee. “Borrowing to Buy” Alternative The machine costs RM20,000 and will have a 5-year life. The purchase will be financed by a 5year, 15% interest. Seroja will pay RM1,000 per year for a service contract that covers insurance and other costs. Seroja Berhad plans to keep the machine and use it beyond its 5-year life. The machine will be depreciated as given below: Year Depreciation RM 1 5,000 2 4,000 3 3,000 4 2,000 5 1,000 Given that the corporate tax rate is 30%. From the above information you are required to answer the following questions. Give explanation to Seroja on ONE (1) benefit of…arrow_forwardSeroja Berhad (Seroja) wishes to evaluate the following two alternatives available to acquire a machine: Lease Alternative Seroja can lease the machine under a 5-year lease requiring lease payment of RM5,000 at the beginning of each year. All maintenance costs will be borne by the lessor and the insurance and other costs will be borne by the lessee. “Borrowing to Buy” Alternative The machine costs RM20,000 and will have a 5-year life. The purchase will be financed by a 5year, 15% interest. Seroja will pay RM1,000 per year for a service contract that covers insurance and other costs. Seroja Berhad plans to keep the machine and use it beyond its 5-year life. The machine will be depreciated as given below: Year Depreciation RM 1 5,000 2 4,000 3 3,000 4 2,000 5 1,000 Given that the corporate tax rate is 30%. From the above information you are required to answer the following questions. Give explanation to Seroja on ONE (1) benefit of…arrow_forward

- Seroja Berhad (Seroja) wishes to evaluate the following two alternatives available to acquire a machine: Lease Alternative Seroja can lease the machine under a 5-year lease requiring lease payment of RM5,000 at the beginning of each year. All maintenance costs will be borne by the lessor and the insurance and other costs will be borne by the lessee. “Borrowing to Buy” Alternative The machine costs RM20,000 and will have a 5-year life. The purchase will be financed by a 5year, 15% interest. Seroja will pay RM1,000 per year for a service contract that covers insurance and other costs. Seroja Berhad plans to keep the machine and use it beyond its 5-year life. The machine will be depreciated as given below: Year Depreciation RM 1 5,000 2 4,000 3 3,000 4 2,000 5 1,000 Given that the corporate tax rate is 30%. From the above information you are required to answer the following questions. Give explanation to Seroja on ONE (1) benefit of leasing.…arrow_forwardi need the answer quicklyarrow_forwardSolving this problemarrow_forward

- Please don't use AI Solve it properly with correct answer and explanationarrow_forwardQuestion A company owes 500 and 1000 to be paid at the end of year one and year four, respectively. The company will set up an investment program to match the duration and the present value of the above obligation using an annual effective interest rate of 10%. The investment program produces asset cash flows of X today and Y in three years. Calculate X and determine whether the investment program satisfies the conditions for Redington immunization. Possible Answers A B C D X = 75 and the Redington immunization conditions are not satisfied. X = 75 and the Redington immunization conditions are satisfied. X = 1138 and the Redington immunization conditions are not satisfied. X = 1138 and the Redington immunization conditions are satisfied. E X = 1414 and the Redington immunization conditions are satisfied.arrow_forwardLease versus Buy Consider the data in Problem 19-1. Assume that RCs tax rate is 40% and that the equipments depreciation would be 100 per year. If the company leased the asset on a 2-year lease, the payment would be 110 at the beginning of each year. If RC borrowed and bought, the bank would charge 10% interest on the loan. In either case, the equipment is worth nothing after 2 years and will be discarded. Should RC lease or buy the equipment?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Financial Management (MindTap Course...

Finance

ISBN:9781337395083

Author:Eugene F. Brigham, Phillip R. Daves

Publisher:Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:Cengage Learning