FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

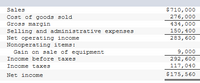

Joyner Company's income statement for Year 2 follows (first image):

Its

Equipment that had cost $31,100 and on which there was

Required:

1. Using the indirect method, compute the net cash provided by/used in operating activities for Year 2 (Statement of

2. Prepare a statement of cash flows for Year 2.

3. Compute the

Transcribed Image Text:$710,000

276,000

Sales

Cost of goods sold

Gross margin

434,000

150,400

Selling and administrative expenses

Net operating income

Nonoperating items:

Gain on sale of equipment

283, 600

9,000

292,600

117,040

Income before taxes

Income taxes

Net income

$175,560

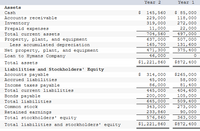

Transcribed Image Text:Year 2

Year 1

Assets

$ 85,000

118,000

272,000

22,000

497,000

Cash

145,560

229,000

319,000

11,000

Accounts receivable

Inventory

Prepaid expenses

Total current assets

704,560

507,000

131,600

375,400

Property, plant, and equipment

637,000

165,700

Less accumulated depreciation

Net property, plant, and equipment

Loan to Hymans Company

471,300

46,000

Total assets

$1,221,860

$872,400

Liabilities and Stockholders' Equity

Accounts payable

314,000

45,000

86,000

445,000

200,000

645,000

343,000

$265,000

Accrued liabilities

58,000

81,400

Income taxes payable

404,400

105,000

509,400

Total current liabilities

Bonds payable

Total liabilities

Common stock

273,000

Retained earnings

233,860

90,000

Total stockholders' equity

576,860

363,000

Total liabilities and stockholders' equity

$1,221,860

$872,400

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 7 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Hurricanes plc has operating profit for the year ended 30 December 2021 of £98,200, after charging depreciation of £17,500. The balance sheet shows the following changes over the year: Debtors: increase by £8,500 Stock: decrease by £5,200 Creditors: increase by £7,800 What is the net cash from operating activities?arrow_forwardSol Limited. reported earnings of $510,000 in 20X8. The company has $91,000 of depreciation expense this year, and claimed CCA of $142,000. The tax rate was 25%. At the end of 20X7, there was a $122,000 loss carryforward that was not recorded because use was considered less than probable. The company also reported a deferred tax liability of $71,000 caused by capital assets with a net book value of $1,310,000 and UCC of $1,010,000. The tax rate had been 20% in 20X7. Required:What is the amount of income tax expense in 20X8? Prepare the income tax entry or entries. - Record the entry income tax expense. - Record the entry loss carryforward.arrow_forwardOn June 30, Pronghorn Corp discontinued its operations in Mexico. During the year, the operating income was $270,000 before taxes. On September 1, Pronghorn disposed of the Mexico facility at a pretax loss of $670,000. The applicable tax rate is 30%. Show the discontinued operations section of Pronghorn’s income statement. PRONGHORN CORPPartial Income Statement select an opening section name enter an income statement item $enter a dollar amount enter an income statement item $enter a dollar amount $enter a total dollar amountarrow_forward

- Bayelsa Corp. had the following transactions in the current year: Short term capital gain Short term capital loss Long term capital gain Long term capital loss If Bayelsa has taxable income of $70,000 before considering the capital transactions, what is Bayelsa's net capital loss that cannot be deducted in the current year? O SO $12,000 -$3,000 $5,000 -$16,000 O $19,000 net capital loss O $11,000 net capital loss O $2,000 net capital lossarrow_forwardorking with the income statement) At the end of its third year of operations, the Sandifer Manufacturing Co. had $4,540,000 in revenues, $3,332,000 in cost of goods sold, $455,000 in erating expenses which included depreciation expense of $144,000, and a tax liability equal to 34 percent of the firm's taxable income. Sandifer Manufacturing Co. plans to reinvest $52.000 its earnings back into the firm, What does this plan leave for the payment of a cash dividend to Sandifer's stockholders? Complete the income statement for Sandifer Manufacturing Co.: (Round to the nearest dollar) 4,540,000 3,332,000 Revenues Less: Cost of Goods Sold Less: Operating Expenses- Less: Interest Expense $ Less: Income Taxes $ $ $ Equals: Gross Profit 455,000 Equals: Net Operating income- 이 $ $ $ $ 1,208,000 753,000 Equals: Earings before Taxes 256,020 Equals: Net Income 5 496,080 The amount that the company will be able to pay as a cash dividend is 5 (Round to the nearest dollar) 753,000arrow_forwardSolvarrow_forward

- Powder Company spent $240,000 to acquire all of Sawmill Corporation's stock on January 1, 20X2. The balance sheets of the two companies on December 31, 20X3, showed the following amounts: Cash Accounts Receivable Land Buildings and Equipment Less: Accumulated Depreciation Investment in Sawmill Corporation Accounts Payable Taxes Payable Notes Payable Common Stock Retained Earnings Powder Company $ 30,000 100,000 60,000 500,000 (230,000) 252,000 $ 712,000 $ 80,000 40,000 100,000 200,000 292,000 $ 712,000 Sawmill Corporation $ 20,000 40,000 50,000 350,000 (75,000) $385,000 $ 10,000 70,000 85,000 100,000 120,000 $385,000 Sawmill reported retained earnings of $100,000 at the date of acquisition. The difference between the acquisition price and underlying book value is assigned to buildings and equipment with a remaining economic life of 10 years from the date of acquisition. Assume Sawmill's accumulated depreciation on the acquisition date was $25,000. Required: Prepare a consolidated…arrow_forwardThe following items were taken from the adjusted trial balance of the Dylex Corporation for the year ended December 31, 2020. Assume an average 25% income tax on all ens. The accounting period ends December 31, and all amounts given are pre-tax. Dylex Corporation had 11,000 common shares outstanding in 2020 and follows IFRS Cost of goods sold Depreciation expense, building Gain on exchange Gain on sale of assets from discontinued operations Insurance expense Interest expense Interest income Loss on sale of trading investment 140,000 23,000 a) Prepare a multi-step income statement in good form. Please make sure your final anewarts) are accurate to 2 decimal places Dylex Corporation For the Year Ended December 31, 200 125,000 100,000 54,000 52,000 X 58,000 135,000 Operating loss of discontinued operation to disposal date 100,000 Salaries expense 160.000 Sales ** 900,000 REQUIRED DISCLOSURES b) Calculate basic eamings per share (EPS) from continuing operations. Please make sure your final…arrow_forwardTrident Corporation had the following cash flows in the current year. Which of the following will be categorized under the financing activities section of the statement of cash flows? O Purchase of $125,000 worth of five-year bonds issued by Towson Utilities O Rent on a warehouse amounting to $1.1 million O Lease income received on a piece of land O Preferred dividends of $330,000 paid to shareholdersarrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education