Principles of Accounting Volume 1

19th Edition

ISBN: 9781947172685

Author: OpenStax

Publisher: OpenStax College

expand_more

expand_more

format_list_bulleted

Question

thumb_up100%

Can you please give me correct answer for this accounting question

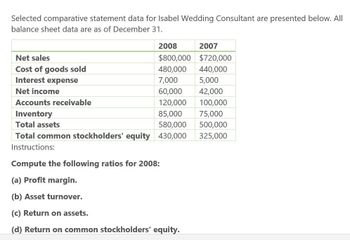

Transcribed Image Text:Selected comparative statement data for Isabel Wedding Consultant are presented below. All

balance sheet data are as of December 31.

Net sales

Cost of goods sold

2008

2007

$800,000

$720,000

480,000

440,000

7,000

5,000

Interest expense

Net income

60,000 42,000

Accounts receivable

120,000 100,000

Inventory

85,000

75,000

Total assets

580,000

500,000

Total common stockholders' equity 430,000

325,000

Instructions:

Compute the following ratios for 2008:

(a) Profit margin.

(b) Asset turnover.

(c) Return on assets.

(d) Return on common stockholders' equity.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Use the following comparative income statements and balance sheets to complete the required ratio analysis. Comparative Income StatementFor the Years Ended December 31, 20-C and 20-B 20-C 20-B Net Sales $965,400 $1,028,600 Cost of goods sold 515,100 590,300 Gross profit $450,300 $438,300 Operating expenses Selling expenses $142,000 $173,400 Administrative expenses 150,200 182,400 Interest expense 29,300 34,100 Total operating expenses $321,500 $389,900 Income tax expense 45,500 18,200 Total expenses $367,000 $408,100 Net income $83,300 $30,200 Comparative Balance SheetDecember 31, 20-C and 20-B Assets 20-C 20-B Cash $45,100 $48,500 Accounts receivable (net) 59,800 101,500 Merchandise inventory 150,900 171,600 Property, plant, and equipment (net) 710,500 808,800 Total…arrow_forwardThe following select account data is taken from the records of Reese Industries for 2019. A. Use the data provided to compute net sales for 2019. B. Prepare a simple income statement for the year ended December 31, 2019. C. Compute the gross margin for 2019. D. Prepare a multi-step income statement for the year ended December 31, 2019.arrow_forwardJuroe Company provided the following income statement for last year: Juroes balance sheet as of December 31 last year showed total liabilities of 10,250,000, total equity of 6,150,000, and total assets of 16,400,000. Required: 1. Calculate the return on sales. (Note: Round the percent to two decimal places.) 2. CONCEPTUAL CONNECTION Briefly explain the meaning of the return on sales ratio, and comment on whether Juroes return on sales ratio appears appropriate.arrow_forward

- CAN SOMEONE HELP ME WITH THE RATIOS? The comparative statements of Wahlberg Company are presented here. Wahlberg CompanyIncome StatementFor the Years Ended December 31 2020 2019 Net sales $1,813,600 $1,750,700 Cost of goods sold 1,007,100 978,000 Gross profit 806,500 772,700 Selling and administrative expenses 519,800 472,000 Income from operations 286,700 300,700 Other expenses and losses Interest expense 17,100 14,200 Income before income taxes 269,600 286,500 Income tax expense 80,015 77,500 Net income $ 189,585 $ 209,000 Wahlberg CompanyBalance SheetsDecember 31 Assets 2020 2019 Current assets Cash $60,600 $64,600 Debt investments (short-term) 69,100 50,300 Accounts receivable 117,500 102,800 Inventory 123,600 115,600 Total…arrow_forwardCAN SOMEONE HELP ME WITH THE RATIOS? The comparative statements of Wahlberg Company are presented here. Wahlberg CompanyIncome StatementFor the Years Ended December 31 2020 2019 Net sales $1,813,600 $1,750,700 Cost of goods sold 1,007,100 978,000 Gross profit 806,500 772,700 Selling and administrative expenses 519,800 472,000 Income from operations 286,700 300,700 Other expenses and losses Interest expense 17,100 14,200 Income before income taxes 269,600 286,500 Income tax expense 80,015 77,500 Net income $ 189,585 $ 209,000 Wahlberg CompanyBalance SheetsDecember 31 Assets 2020 2019 Current assets Cash $60,600 $64,600 Debt investments (short-term) 69,100 50,300 Accounts receivable 117,500 102,800 Inventory 123,600 115,600…arrow_forwardPlease find the following ratios for both year 2017 and year 2018 based on following data RATIO AT ROA L ROEarrow_forward

- Data for Micatin Designs, Inc. follow: Data table Micatin Designs, Inc. Comparative Income Statement Years Ended December 31, 2024 and 2023 2024 2023 Net Sales Revenue $429,000 $374,000 Expenses: Cost of Goods Sold 201,000 187,000 Selling and Administrative Expenses 97,450 92,750 Other Expenses 8,500 3,250 Total Expenses 306,950 283,000 Net Income $122,050 $91,000 . Requirements 1. Prepare a comparative common-size income statement for Micatin Designs, Inc. using the 2024 and 2023 data. Round percentages to one-tenth percent. 2. To an investor, how does 2024 compare with 2023? Explain your reasoning.arrow_forwardSelected comparative financial statements of Korbin Company follow. KORBIN COMPANY Comparative Income Statements For Years Ended December 31, 2019, 2018, and 2017 2019 2018 2017 $ 292,600 Sales $ 550,381 331,329 $ 421,637 Cost of goods sold 266,053 155,584 58,186 187,264 Gross profit 219,052 105,336 38,623 Selling expenses 78,154 49,534 127,688 91,364 16,994 Administrative expenses 37,104 24,286 Total expenses 95,290 60,294 12,360 62,909 Income before taxes 42,427 Income tax expense 8,613 Net income 74,370 47,934 33,814 KORBIN COMPANY Comparative Balance Sheets December 31, 2019, 2018, and 2017 2019 2018 2017 Assets Current assets Long-term investments Plant assets, net 2$ 61,979 %24 41,483 24 55,453 600 4,440 111,633 102.135 59,592 Total assets 173,612 24 144,218 $ 119,485 Liabilities and Equity Current liabilities 2$ 25,347 21,488 $ 64,000 $ 20,910 Common stock 64,000 46,000 Other paid-in capital Retained earnings 8,000 8,000 5,111 47,464 76,265 50,730 Total liabilities and equity 24…arrow_forwardplease answerarrow_forward

- Prepare an income statement for Hansen Realty for the year ended December 31, 2023. Beginning inventory was $1,242. Ending inventory was $1,594. Note: Input all amounts as positive values. Sales Sales returns and allowances Sales discount Purchases Purchase discounts Depreciation expense Salary expense Insurance expense Utilities expense Plumbing expense Rent expense HANSEN REALTY Income Statement For Year Ended December 31, 2023 Gross profit from sales Operating expenses: $ 34,300 1,086 1,146 10,212 Total operating expenses 534 109 4,900 2,300 204 244 174arrow_forwardRevenue and expense data for Rogan Technologies Co. are as follows: 20Y8 20Y7 Sales $701,000 $610,000 Cost of goods sold 434,620 347,700 Selling expenses 105,150 103,700 Administrative expenses 119,170 122,000 Income tax expense 21,030 12,200 a. Prepare an income statement in comparative form, stating each item for both 20Y8 and 20Y7 as a percent of sales. If required, round percentages to one decimal place. Enter all amounts as a positive number. Rogan Technologies Co. Comparative Income Statement For the Years Ended December 31, 20Y8 and 20Y7 20Y8 Amount 20Y8 Percent 20Y7 Amount 20Y7 Percent $fill in the blank 6de34503cfdf061_2 fill in the blank 6de34503cfdf061_3% $fill in the blank 6de34503cfdf061_4 fill in the blank 6de34503cfdf061_5% fill in the blank 6de34503cfdf061_7 fill in the blank 6de34503cfdf061_8% fill in the blank 6de34503cfdf061_9 fill in the blank 6de34503cfdf061_10% Gross profit $fill in the blank…arrow_forwardSelected comparative financial Statements of Kordin Company follow. Comparative Income Statements For Years Ended December 31 Sales Cost of goods sold Gross profit Selling expenses KORBIN COMPANY Administrative expenses Total expenses Income before taxes Income tax expense Net income Assets Current assets Long-term investments. Plant assets, net Total assets Liabilities and Equity Current liabilities KORBIN COMPANY Comparative Balance Sheets Assets Current assets Long-term investments Plant assets, net Total assets 2021 2020 2019 $548,688 $ 420,340 $ 291,700 330, 310 263,974 186,688 156,366 105,012 58,007 38,504 36,990 24,211 94,997 61,369 12,581 $ 48,788 Common stock Other paid-in capital Retained earnings Total liabilities and equity Liabilities and Equity Current liabilities Common stock Other paid-in capital Retained earnings Total liabilities and equity 218,378 77,914 49,382 127,296 91,082 16,941 $74,141 December 31 2021 $ 62,574 0 114,438 $177,012 $ 25,844 65,000 8,125 78,043…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

- Principles of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:9781947172685

Author:OpenStax

Publisher:OpenStax College

Managerial Accounting: The Cornerstone of Busines...

Accounting

ISBN:9781337115773

Author:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:Cengage Learning