FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

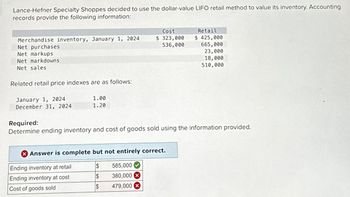

Transcribed Image Text:Lance-Hefner Specialty Shoppes decided to use the dollar-value LIFO retail method to value its inventory. Accounting

records provide the following information:

Merchandise inventory, January 1, 2024

Net purchases

Cost

$ 323,000

536,000

Retail

$ 425,000

665,000

Net markups

Net markdowns

Net sales

Related retail price indexes are as follows:

23,000

18,000

510,000

January 1, 2024

1.00

December 31, 2024

1.20

Required:

Determine ending inventory and cost of goods sold using the information provided.

Answer is complete but not entirely correct.

Ending inventory at retail

$

585,000

Ending inventory at cost

$

380,000 x

Cost of goods sold

$

479,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 5 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- On January 1, 2018, the Brunswick Hat Company adopted the dollar-value LIFO retail method. The following data are available for 2018: Cost Retail Beginning inventory $ 72,420 $ 142,000 Net purchases 107,100 264,000 Net markups 6,000 Net markdowns 15,000 Net sales 229,000 Retail price index, 12/31/18 1.05 Required: Calculate the estimated ending inventory and cost of goods sold for 2018. Please don't provide answer in image format thank youarrow_forwardPlease do not give solution in image formatarrow_forwardOn January 1, 2024, HGC Camera Store adopted the dollar-value LIFO retail inventory method. Inventory transactions at both cost and retail, and cost indexes for 2024 and 2025 are as follows: Beginning inventory Net purchases Freight-in Net markups Net markdowns Net sales to customers Sales to employees (net of 20% discount) Price Index: January 1, 2024 December 31, 2024 December 31, 2025 Estimated ending inventory at retail Estimated ending inventory at cost Estimated cost of goods sold 2024 2024 Cost $ 48,000 103,040 3,200 Retail $ 64,000 120,000 2025 16,000 3,200 117,850 3,800 Cost 2025 $ 115,150 3,700 Retail Required: Estimate the 2024 and 2025 ending inventory and cost of goods sold using the dollar-value LIFO retail inventory method. Note: Do not round other intermediate calculations. Round your cost-to-retail percentage calculation to 2 decimal places and final answers to the nearest whole dollar. $ 133,000 10,400 3,400 119,440 5,920 1.00 1.06 1.12arrow_forward

- On January 1, 2024, HGC Camera Store adopted the dollar-value LIFO retail inventory method. Inventory transactions at both cost and retail, and cost indexes for 2024 and 2025 are as follows: Beginning inventory Net purchases Freight-in Net markups Net markdowns Net sales to customers Sales to employees (net of 20 % discount) Price Index: January 1, 2024 December 31, 2024 December 31, 2025 Estimated ending inventory at retail Estimated ending inventory at cost Estimated cost of goods sold 2024 2024 Cost $ 56,000 104,000 4,000 Retail $ 80,000 128,000 2025 20,000 4,000 129,465 2,700 Cost 2025 $ 109,695 4,500 Required: Estimate the 2024 and 2025 ending inventory and cost of goods sold using the dollar-value LIFO retail inventory method. Note: Do not round other intermediate calculations. Round your cost-to-retail percentage calculation to 2 decimal places and final answers to the nearest whole dollar. Retail $ 134,200 12,000 4,200 121,260 4,400 1.00 1.06 1.12arrow_forwardExit Marilee's Electronics uses a periodic inventory system and the average cost retail method to estimate ending inventory and cost of goods sold, The following data is available from the company records for the month of June 2021: Cost Retail Beginning inventory Net purchases Net markups Net markdowns Net sales $ 82,500 $131, 000 505,000 269,000 25,500 36,000 525, 000 The average cost-to-retail percentage is: Muitipte Choice O 56.0%. < Prev 15 of 15 Nextarrow_forward4. On January 1, 2010, Rachael Ray Corporation had merchandise inventory of $50,000. At December 31, 2010, Rachael Ray had the following account balances. $ 4,000 500,000 6,000 2,000 800,000 5,000 10,000 At December 31, 2010, Rachael Ray determines that its ending inventory is $60,000. Freight-in Purchases Purchase discounts Purchase returns and allowances Sales Sales discounts Sales returns and allowances Instructions (a) Compute Rachael Ray's 2010 gross profit. (b) Compute Rachael Ray's 2010 operating expenses if net income is $130,000 and there are no non-operating activitiesarrow_forward

- Hansabenarrow_forward9arrow_forward10. The Kansas Company provided the following data for its December 31, 2020, inventory maintained on the retail basis. At Cost At Retail Beginning inventory Purchases $120,000 $224,000 280,000 396,000 20,000 Markups (net) Markdowns (net) Sales (40,000) 520,000 What is the estimated inventory at December 31, 2020, valued at lower of average cost or market? a. $53,333 b. $75,000 c. $56,000 d. $50,000arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education