FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

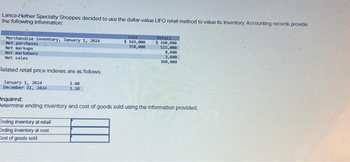

Transcribed Image Text:Lance-Hefner Specialty Shoppes decided to use the dollar-value LIFO retall method to value its inventory. Accounting records provide

the following Information:

Merchandise inventory, January 1, 2024

Net purchases

Net markups

Net markdowns

Net sales

Related retail price Indexes are as follows:

January 1, 2924

December 31, 2824

1.00

1.20

Ending inventory at retail

Ending inventory at cost

Cost of goods sold

Cost

$ 169,000

358,800

Retall

$250,000

515,000

8,000

3,000

360,000

Required:

Betermine ending Inventory and cost of goods sold using the information provided.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- On January 1, 2024, HGC Camera Store adopted the dollar-value LIFO retail inventory method. Inventory transactions at both cost and retail, and cost indexes for 2024 and 2025 are as follows: Beginning inventory Net purchases Freight-in Net markups Net markdowns Net sales to customers Sales to employees (net of 20% discount) Price Index: January 1, 2024 December 31, 2024 December 31, 2025 Estimated ending inventory at retail Estimated ending inventory at cost Estimated cost of goods sold 2024 2024 Cost $ 48,000 103,040 3,200 Retail $ 64,000 120,000 2025 16,000 3,200 117,850 3,800 Cost 2025 $ 115,150 3,700 Retail Required: Estimate the 2024 and 2025 ending inventory and cost of goods sold using the dollar-value LIFO retail inventory method. Note: Do not round other intermediate calculations. Round your cost-to-retail percentage calculation to 2 decimal places and final answers to the nearest whole dollar. $ 133,000 10,400 3,400 119,440 5,920 1.00 1.06 1.12arrow_forwardKnowledge Check Crane Works' uses a periodic inventory system. Its accounting records show the following as of December 31, 2025. Inventory, Dec. 31, 2025 Purchase Returns and Allowances Inventory, Jan. 1, 2025 Cost of goods purchased Cost of goods sold $ $4,050 $ 730 5,550 Compute cost of goods purchased and cost of goods sold. Freight-In Purchases Purchase Discounts $1,800 95,100 1,480 Sused Submit Answerarrow_forwardUMET's Stores had the following inventory transactions in 2020: Transaction Units Cost per unit 1/1 Balance 50 $6 2/14 Sale 25 5/23 Purchase 100 8 8/21 Sale 50 11/5 Purchase 25 12 11/18 Sale 95 Required: Compute tge cost of goods sold and the ending inventory using the periodic inventory system for each of the following cost flow assumptions: a. FIFO b. LIFO c. Weighted averagearrow_forward

- On January 1, 2024, HGC Camera Store adopted the dollar-value LIFO retail inventory method. Inventory transactions at both cost and retail, and cost indexes for 2024 and 2025 are as follows: Beginning inventory Net purchases Freight-in Net markups Net markdowns Net sales to customers Sales to employees (net of 20 % discount) Price Index: January 1, 2024 December 31, 2024 December 31, 2025 Estimated ending inventory at retail Estimated ending inventory at cost Estimated cost of goods sold 2024 2024 Cost $ 56,000 104,000 4,000 Retail $ 80,000 128,000 2025 20,000 4,000 129,465 2,700 Cost 2025 $ 109,695 4,500 Required: Estimate the 2024 and 2025 ending inventory and cost of goods sold using the dollar-value LIFO retail inventory method. Note: Do not round other intermediate calculations. Round your cost-to-retail percentage calculation to 2 decimal places and final answers to the nearest whole dollar. Retail $ 134,200 12,000 4,200 121,260 4,400 1.00 1.06 1.12arrow_forwardManjiarrow_forwardMemanarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education