Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

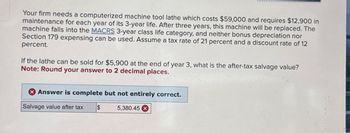

Transcribed Image Text:Your firm needs a computerized machine tool lathe which costs $59,000 and requires $12,900 in

maintenance for each year of its 3-year life. After three years, this machine will be replaced. The

machine falls into the MACRS 3-year class life category, and neither bonus depreciation nor

Section 179 expensing can be used. Assume a tax rate of 21 percent and a discount rate of 12

percent.

If the lathe can be sold for $5,900 at the end of year 3, what is the after-tax salvage value?

Note: Round your answer to 2 decimal places.

Answer is complete but not entirely correct.

Salvage value after tax

$

5,380.45

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 4 images

Knowledge Booster

Similar questions

- You must evaluate a proposal to buy a new milling machine. The purchase price of the milling machine, including shipping and installation costs, is $116,000, and the equipment will be fully depreciated at the time of purchase. The machine would be sold after 3 years for $57,000. The machine would require a $4,000 increase in net operating working capital (increased inventory less increased accounts payable). There would be no effect on revenues, but pretax labor costs would decline by $48,000 per year. The marginal tax rate is 25%, and the WACC is 8%. Also, the firm spent $4,500 last year investigating the feasibility of using the machine. How should the $4,500 spent last year be handled? Only the tax effect of the research expenses should be included in the analysis. Last year's expenditure should be treated as a terminal cash flow and dealt with at the end of the project's life. Hence, it should not be included in the initial investment outlay. Last year's expenditure is considered…arrow_forwardA project has to sell a machine that is obsolete. The market department finds a buyer who is willing to pay $100, 000 for the machine. The machine was purchased 4 years ago for $1.1 million. The accounting department notes that the depreciation method for this machine is straight line, and the machine will be depreciated to zero over a five - year time period after purchase. What is the machine's after - tax salvage value? Tax rate is 21%. Question 1 options: $1, 635.24 $2, 314.05 $142, 000.00 $2,784.62 - $289.26arrow_forwardAm. 140.arrow_forward

- Hello. Need help with the solution to question. Calculate the annual straight-line depreciation for a machine that costs $30,000 and has installation and shipping costs that total $2,000. The machine will be depreciated over a period of 15 years. The company’s marginal tax rate is 40 percent. Round your answer to the nearest dollar.arrow_forwardAcefacto Inc., has asked for you to calculate the after-tax salvage value of an asset it plans on using in a construction project. The project will be depreciated straight line to a value of$670,000at the end of the project's and assets ten year life. Ace's marginal tax rate is32%. The firm will have to pay$8,047,675to buy the asset. You have estimated that they could sell the asset for$787,309to a Brazilian firm at the end of the project. Answer in dollars and cents.arrow_forwardYou must evaluate a proposal to buy a new milling machine. The purchase price of the milling machine, including shipping and installation costs, is $162,000, and the equipment will be fully depreciated at the time of purchase. The machine would be sold after 3 years for $111,000. The machine would require a $9,000 increase in net operating working capital (increased Inventory less increased accounts payable). There would be no effect on revenues, but pretax labor costs would decline by $42,000 per year. The marginal tax rate is 25%, and the WACC is 11%. Also, the firm spent $4,500 last year investigating the feasibility of using the machine. a. How should the $4,500 spent last year be handled? 1. Last year's expenditure should be treated as a terminal cash flow and dealt with at the end of the project's life. Hence, it should not be included in the initial investment outlay. II. Last year's expenditure is considered an opportunity cost and does not represent an incremental cash flow.…arrow_forward

- Please show proper steps.arrow_forwardDaily Enterprises is purchasing a $10.33 million machine. It will cost $69,436.00 to transport and install the machine. The machine has a depreciable life of five years using the straight-line depreciation and will have no salvage value. The machine will generate incremental revenues of $4.10 million per year along with incremental costs of $1.19 million per year. Daily's marginal tax rate is 37.00%. The cost of capital for the firm is 13.00%. (answer in dollars..so convert millions to dollars) The project will run for 5 years. What is the NPV of the project at the current cost of capital?arrow_forwardmani.5arrow_forward

- A corporation is considering purchasing a machine that will save $150,000 per year before taxes. The cost of operating the machine (including maintenance) is $30,000 per year. The machine will be needed for five years, after which it will have a zero salvage value. MACRS depreciation will be used, assuming a three-year class life. The marginal income tax rate is 25%. If the firm wants 15% return on investment after taxes, how much can it afford to pay for this machine? Click the icon to view the MACRS depreciation schedules Click the icon to view the interest factors for discrete compounding when /- 15% per year. If the firm wants 15% return on investment after taxes, it can afford to pay thousand for this machine. (Round to one decimal place.)arrow_forwardIlana Industries Incorporated needs a new lathe. It can buy a new high-speed lathe for $2.0 million. The lathe will cost $31,000 per year to run, but it will save the firm $184,000 in labor costs and will be useful for 10 years. Suppose that, for tax purposes, the lathe is entitled to 100% bonus depreciation. At the end of the 10 years, the lathe can be sold for $470,000. The discount rate is 10%, and the corporate tax rate is 21%. What is the NPV of buying the new lathe? Note: A negative amount should be indicated by a minus sign. Enter your answer in dollars not in millions. Do not round intermediate calculations. Round your answer to 2 decimal places. NPVarrow_forwardYou must evaluate a proposal to buy a new milling machine. The purchase price of the milling machine, including shipping and installation costs, is $104,000, and the equipment will be fully depreciated at the time of purchase. The machine would be sold after 3 years for $43,000. The machine would require a $5,500 increase in net operating working capital (increased inventory less increased accounts payable). There would be no effect on revenues, but pretax labor costs would decline by $56,000 per year. The marginal tax rate is 25%, and the WACC is 8%. Also, the firm spent $4,500 last year investigating the feasibility of using the machine. a. How should the $4,500 spent last year be handled? I. Last year's expenditure is considered a sunk cost and does not represent an incremental cash flow. Hence, it should not be included in the analysis. II. The cost of research is an incremental cash flow and should be included in the analysis. III. Only the tax effect of the research expenses…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education