FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

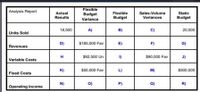

Koye’s most recent data is provided in the report below, however some amounts are missing. The actual sales price per unit was $110 compared to the budget price of $100 per unit. Actual variable costs per unit produced were $65. Use the following information to replace the lost data. Missing amounts are indicated alphabetically. For each letter in a square below, provide the missing amount:

(1) The Static

Transcribed Image Text:Flexible

Budget

Analysis Report

Actual

Flexible

Sales-Volume

Static

Results

Variance

Budget

Variances

Budget

18,500

A)

B)

C)

20,000

Units Sold

D)

$185,000 Fav

E)

F)

G)

Revenues

H

$92,500 Un

I)

$90,000 Fav

J)

Variable Costs

K)

$50,000 Fav

L)

M)

$500,000

Fixed Costs

N)

O)

P)

Q)

R)

Operating Income

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Blue Industries has a Flexible Budget Variance of $474, favorable and a Sales Activity Variance of $274, unfavorable. What is the Master Budget Variance for Blue Industries? Master budget variance tAarrow_forwardYou have asked your sales manager to explain why budgeted revenues for your division are below expectations. The budget indicated $1,039,500 of revenues based on a sales volume of 1,485,000 units. Sales records indicate that 1,500,400 product units were actually sold, but revenues were only $1,020,272. Calculate the sales price variance, the sale volume variance, and the total revenue variance. Sales price variance $ Unfavorable Sales volume variance $ Favorable Total revenue variance $ Unfavorablearrow_forwardRequired information [The following information applies to the questions displayed below.) AMP Corporation (calendar-year-end) has 2023 taxable income of $1,900,000 for purposes of computing the $179 expense. During 2023, AMP acquired the following assets: (Use MACRS Table 1. Table 2. Table 3. Table 4, and Table 5.) Asset Machinery Computer equipment office building Total Placed in Service September 12 February 10 April 2 Basis $1,510,000 475,000 590,000 $ 2,575,000 b. What is the maximum total depreciation, including §179 expense, that AMP may deduct in 2023 on the assets it placed in service in 2023, assuming no bonus depreciation? Note: Round your intermediate calculations and final answer to the nearest whole dollar amount. Maximum total depreciation (including $179 expense)arrow_forward

- Ray Company provided the following excerpts from its Production Department's flexible budget performance report. Required: Complete the Production Department's Flexible Budget Performance Report. Note: Indicate the effect of each variance by selecting "F" for favorable, "U" for unfavorable, and "None" for no effect (i.e., zero variance). Input all amounts as positive values. Round "rate per hour" answers to 2 decimal places. Labor-hours (q) Direct labor Indirect labor Utilities Supplies Equipment depreciation Factory administration Total expenses $ $ $ 7,300 (9) + + + 80,400 18.860 + Ray Company Production Department Flexible Budget Performance Report For the Month Ended August 31 Actual Results $ $ 1.70 (q) (9) (9) 1.70 (9) $ $ 9,560 174,170 5,052 339,328 Spending Variances 1,108 F 1,530 U 0 None Flexible Budget $ 172,080 23,752 4,524 Activity Variances 720 U 0 None Planning Budget 9,080 20,920 4,380arrow_forwardss.arrow_forwardIn analyzing company operations, the controller of the Carson Corporation found a $250,000 favorable flexible budget revenue variance. The variance was calculated by comparing the actual results with the flexible budget. This variance can be wholly explained by: (CMA adapted) Multiple Choice О the total flexible budget variance. О the total static budget variance. О changes in unit selling prices. changes in the number of units sold.arrow_forward

- The following data were collected by Pete Inc. for the month of May: Static budget data: Sales Variable costs Total fixed costs Actual results: Sales Variable costs Total fixed costs Sales (units) Revenue Variable expenses Contribution margin 11,500 units @ 40/unit $28.00 per unit $ 24,150 Required: 1, 2 & 3. Prepare the static and flexible budgets and show the variances by completing the table given below. (Indicate the effect of each variance by selecting "F" for favorable, "U" for unfavorable, and "None" for no effect (i.e., zero variance).) Fixed expenses Income 12,600 units @ $39/unit $30.00 per unit $ 23,050 Actual Pete Inc. Static Budget Performance Report For the Month Ended May 31 Flexible Budget Flexible Budget Variance Sales Volume Variance Static Budget Static Variancearrow_forward* Your answer is incorrect. Ayayai Company has prepared a graph of flexible budget data. At zero direct labor hours, the total budgeted cost line intersects the vertical axis at $18,400. At 8,000 direct labor hours, the line drawn from the total budgeted cost line intersects the vertical axis at $68,000. How may the fixed and variable costs be expressed? (Round variable cost per direct labor hour to 2 decimal places, e.g. 1.25.) Total budgeted costs are $ 6.2 fixed plus $ 18400 per direct labor hour.arrow_forwardRay Company provided the following excerpts from its Production Department's flexible budget performance report. Required: Complete the Production Department's Flexible Budget Performance Report. Note: Indicate the effect of each variance by selecting "F" for favorable, "U" for unfavorable, and "None" for no effect (i.e., zero variance). Input all amounts as positive values. Round "rate per hour answers to 2 decimal places. Labor hours (a) Direct labor Indirect labor Uslities Supplies Equipment depreciation Factory administration Total expense $ 7,800 $ 81,650 $ 18,960 (4) * . Ray Company Production Department Flexible Budget Performance Report For the Month Ended August 31 Actual Results Spending Variances S 1.30 (4) (9) (4) $ 1.20 (4) $ $ 9,610 199,145 5,122 361,120 2,662 F 1,580 U 0 None Flexible Budget $ 197,005 20,043 4.574 Activity Variances 960 U 0 None Planning Budget 9,130 26,060 4.430arrow_forward

- Please do not give solution in image format thankuarrow_forwardHarderarrow_forwardAssume that sales quantity variance is $26,560 unfavourable, market share variance is $74,700 unfavourable. Which of the following statements is TRUE? A) Actual market size is lower than budgeted market size. B) Actual market size is higher than budgeted market size. C) Actual market share is higher than budgeted market share. D) None of these answers is correct.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education