FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

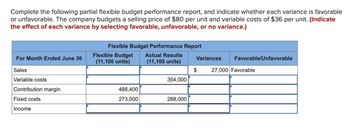

Transcribed Image Text:Complete the following partial flexible budget performance report, and indicate whether each variance is favorable

or unfavorable. The company budgets a selling price of $80 per unit and variable costs of $36 per unit. (Indicate

the effect of each variance by selecting favorable, unfavorable, or no variance.)

Flexible Budget Performance Report

Flexible Budget

For Month Ended June 30

(11,100 units)

Sales

Variable costs

Contribution margin

Fixed costs

Income

Actual Results

Variances

Favorable/Unfavorable

(11,100 units)

$

27,000 Favorable

354,000

488,400

273,000

288,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Clementine Company makes skateboards. They prepare master and flexible budgets and then perform variance analysis after the budget plan period elapses. Their data is as follows: Budget Actual Selling price per $99 $96 unit Variable cost per $57 $41 unit Quantity sold 1,030 1,007 What is the Clementine's flexible budget variance for VARIABLE COSTS? If the variance is unfavorable put a minus sign in front of your answer. Enter your answer without commas or decimals.arrow_forwardPrepare a Flexible Budget Performance Report Required: Using Exhibit 9–8 as your guide, prepare a flexible budget performance report that shows the company’s revenue and spending variance and activity variances for august. Exhibit 9–8 Performance Report Combining Activity Variances with Revenue and Spending Variancesarrow_forwardThe following is data collected by Bees Co. for the month of June Static budget data: Sales Variable costs 11,000 units $38/unit $27 per unit $23,100 Total fixed costs Actuel results: 619 Sales Variable costs Total fixed costs 12,000 units $37/unit $28 per unit $22,100 Required: Prepare the flexible budgets and show the flexible budget variances by completing the table given below. Indicate the effect of each varionce by selecting "F for favourable, "U" for unfavourable, and "None" for no effect (i.e., zero voriance). Flexible Favourable Unfavourable Static Flexible Budget Variance Actual Budget Budget Sales (units) Revenue ($) Variable expenses (S) Fixed expenses (5) Income (S) 11,000 418,000 297,000 23.100 97,100 (Clck to select) (Cick to select) v (Cick to select) (Click to select)arrow_forward

- Complete the flexible budget variance analysis by filling in the blanks in the partial flexible budget performance report for 10,000 travel locks for Gavin, Inc.arrow_forwardRay Company provided the following excerpts from its Production Department's flexible budget performance report. Required: Complete the Production Department's Flexible Budget Performance Report. (Indicate the effect of each variance by selecting "F" for favorable, "U" for unfavorable, and "None" for no effect (i.e., zero variance). Input all amounts as positive values. Round "rate per hour" answers to 2 decimal places.) Ray Company Production Department Flexible Budget Performance Report For the Month Ended August 31 Actual Results Spending Variances Flexible Budget Activity Variances Planning Budget Labor-hours (q) 9,510 9,030 Direct labor (q) $ 150,445 $ 147,405 Indirect labor + S 1.20 (a) Utilities $ 5,800 + (q) 2.938 F 1,480 U 18.862 480 U 15,830 Supplies + (a) 4,982 4,474 4,330 $ Equipment depreciation 0 None 0❘ None 79.150 $ Factory administration 18,760 + $ 1.20 (q) Total expense $ 297,293arrow_forwardRay Company provided the following excerpts from its Production Department's flexible budget performance report. (Round "rate per hour" answers to 2 decimal places. Indicate the effect of each variance by selecting "F" for favorable, "U" for unfavorable, and "None" for no effect (i.e., zero variance). Input all amounts as positive values.) Required: Complete the Production Department's Flexible Budget Performance Report. Labor-hours (q) Direct labor Indirect labor Utilities Supplies Equipment depreciation Factory administration Total expense ( ( ($ 7,000 ( ( ( $ 79,650 $ 18,800 q) ) + + + + Ray Company Production Department Flexible Budget Performance Report For the Month Ended August 31 Spending Variances $ 1.40 q) q) q) $ 1.40 q) Actual Results 9,530 $ 159,305 5,010 $ 313,459 2,206 F 1,500 U 0 None Flexible Budget $ 157,245 20,812 4,494 Activity Variances 576 U 0 None Planning Budget 9,050 17,860 4,350arrow_forward

- Blue Industries has a Flexible Budget Variance of $474, favorable and a Sales Activity Variance of $274, unfavorable. What is the Master Budget Variance for Blue Industries? Master budget variance tAarrow_forwardVulcan Flyovers offers scenic overflights of Mount Saint Helens. Data concerning the company's operations in July appear below: Vulcan Flyovers Operating Data For the Month Ended July 31 Flights (q) Revenue ($350.00q) Expenses: Wages and salaries ($3,200 + $88.00q) Fuel ($32.00g) Airport fees ($830 + $34.00q) Aircraft depreciation ($10.00q) Office expenses ($230 + $1.00q) Total expenses Net operating income Actual Results 54 $ 16,300 7,916 1,894 2,546 540 452 13,348 $ 2,952 Flexible Planning Budget Budget 54 $ 18,900 7,952 1,728 2,666 540 284 13,170 $ 5,730 52 $ 18, 200 7,776 1,664 2,598 520 282 12,840 $5,360 The company measures its activity in terms of flights. Customers can buy individual tickets for overflights or hire an entire plane at a discount.arrow_forwardComplete the following partial flexible budget performance report, and indicate whether each variance is favorable or unfavorable. The company budgets a selling price of $80 per unit and variable costs of $35 per unit. Note: Indicate the effect of each variance by selecting favorable, unfavorable, or no variance. For Month Ended June 30 Sales Variable costs Contribution margin Fixed costs Income Flexible Budget Performance Report Flexible Budget Actual Results (11,300 units) (11,300 units) 508,500 275,000 356,000 290,000 Variances Favorable or Unfavorable 31,000 Favorable $arrow_forward

- Antuan Company set the following standard costs per unit for its product. $ 12.00 Direct materials (3.0 pounds @ $4.00 per pound) Direct labor (1.8 hours @ $12.00 per hour) Overhead (1.8 hours @ $18.50 per hour). 21.60 33.30 Standard cost per unit $ 66.90 The standard overhead rate ($18.50 per direct labor hour) is based on a predicted activity level of 75% of the factory's capacity of 20,000 units per month. Following are the company's budgeted overhead costs per month at the 75% capacity level. Overhead Budget (75% Capacity) Variable overhead costs Indirect materials $ 15,000 Indirect labor 75,000 Power 15,000 Maintenance 30,000 135,000 Total variable overhead costs Fixed overhead costs 24,000 Depreciation-Building Depreciation-Machinery 70,000 Taxes and insurance 16,000 Supervisory salaries. 254,500 Total fixed overhead costs 364,500 Total overhead costs $ 499,500 The company incurred the following actual costs when it operated at 75% of capacity in October. Direct materials (46,000…arrow_forwardWilson Manufacturing has provided you with the following variances for the month of March: Direct materials price variance Direct materials quantity variance Direct labor rate variance Direct labor efficiency variance Required: $3,230 Favorable (4,700) Unfavorable (3,900) Unfavorable (9,500) Unfavorable a. Calculate the direct materials spending variance. Note: Indicate the effect of variance by selecting "Favorable", "Unfavorable", or "None" for no effect (i.e., zero variance). b. Calculate the direct labor spending variance Note: Indicate the effect of variance by selecting "Favorable", "Unfavorable", or "None" for no effect (i.e., zero variance). a. Direct materials spending variance b. Direct labor spending variancearrow_forwardComplete the following partial flexible budget performance report, and indicate whether each variance is favorable or unfavo The company budgets a selling price of $81 per unit and variable costs of $35 per unit. (Indicate the effect of each variance selecting favorable, unfavorable, or no variance.) For Month Ended June 30 Sales Variable costs Contribution margin Fixed costs Income Flexible Budget Performance Report Flexible Budget Actual Results (11,400 units) (11,400 units) 524,400 276,000 357,000 291,000 Variances Favorable/Unfavorable $ 21,600 Favorablearrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education