FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

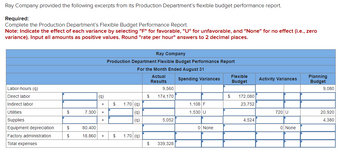

Transcribed Image Text:Ray Company provided the following excerpts from its Production Department's flexible budget performance report.

Required:

Complete the Production Department's Flexible Budget Performance Report.

Note: Indicate the effect of each variance by selecting "F" for favorable, "U" for unfavorable, and "None" for no effect (i.e., zero

variance). Input all amounts as positive values. Round "rate per hour" answers to 2 decimal places.

Labor-hours (q)

Direct labor

Indirect labor

Utilities

Supplies

Equipment depreciation

Factory administration

Total expenses

$

$

$

7,300

(9)

+

+

+

80,400

18.860 +

Ray Company

Production Department Flexible Budget Performance Report

For the Month Ended August 31

Actual

Results

$

$

1.70 (q)

(9)

(9)

1.70 (9)

$

$

9,560

174,170

5,052

339,328

Spending Variances

1,108 F

1,530 U

0 None

Flexible

Budget

$ 172,080

23,752

4,524

Activity Variances

720 U

0 None

Planning

Budget

9,080

20,920

4,380

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- sarrow_forwardAirQual Test Corporation provides on-site air quality testing services. The company has provided the following cost formulas and actual results for the month of February: Variable Fixed Component per Month Component per Job $ 277 Actual Total for February $ 27,720 $ 8,350 $ 8,370 Revenue Technician wages $ 8,500 Mobile lab operating expenses $ 4,900 $ 33 Office expenses $ 2,400 $2 $ 2,470 Advertising expenses $ 1,600 $ 1,670 Insurance $ 2,850 $ 2,850 Miscellaneous expenses $ 960 $ 1 $ 375 The company uses the number of jobs as its measure of activity. For example, mobile lab operating expenses should be $4,900 plus $33 per job, and the actual mobile lab operating expenses for February were $8,370. The company expected to work 110 jobs in February, but actually worked 120 jobs. Required: Prepare a flexible budget performance report showing AirQual Test Corporation's revenue and spending variances and activity variances for February. (Indicate the effect of each variance by selecting "F"…arrow_forward! Required information [The following information applies to the questions displayed below.] Phoenix Company reports the following fixed budget. It is based on an expected production and sales volume of 15,300 units. Sales Costs Direct materials Direct labor Sales staff commissions Depreciation-Machinery Supervisory salaries. Shipping Sales staff salaries (fixed annual amount) Administrative salaries Depreciation-Office equipment Income PHOENIX COMPANY Fixed Budget For Year Ended December 31 Sales (18,300 units) Costs Income Direct materials Direct labor Sales staff commissions Depreciation-Machinery Phoenix Company reports the following actual results. Actual sales were 18,300 units. Supervisory salaries Shipping Sales staff salaries (fixed annual amount) Administrative salaries Depreciation-Office equipment $ 3,060,000 979,200 229,500 76,500 300,000 200,000 229,500 250,000 450, 300 192,000 $ 153,000 $ 3,705,750 $ 1,185,840 281,820 82,350 300,000 214,000 266, 265 267,000 458,300…arrow_forward

- Jj.170.arrow_forwardss.arrow_forwardRay Company provided the following excerpts from its Production Department's flexible budget performance report. Required: Complete the Production Department's Flexible Budget Performance Report. (Indicate the effect of each variance by selecting "F" for favorable, "U" for unfavorable, and "None" for no effect (i.e., zero variance). Input all amounts as positive values. Round "rate per hour" answers to 2 decimal places.) Labor-hours (q) Direct labor Indirect labor Utilities Supplies Equipment depreciation Factory administration Total expense $ 6,500 78,400 $ 18,700 (q) + + + + Ray Company Production Department Flexible Budget Performance Report For the Month Ended August 31 Actual Results $ 1.50 (9) (q) (q) GA 1.90 (q) 9,480 $ 134,730 SA 4,940 288,088 Spending Variances 1,780 F 1,450 U 0 None Flexible Budget $ 132,720 21,640 4,444 Activity Variances 336 U 0 None Planning Budget 9,000 12,800 4,300arrow_forward

- Oriole Industries has the following actual and master budget information for its two product lines: Volume in Units Unit Contribution Margin Sales quantity variance Gadgets Sales quantity variance Gizmos Actual Results Total sales quantity variance Gadgets Gizmos 1,150 1,870 $6 $9 Compute the Sales Quantity Variances for the Gadgets, Gizmos, and in Total. (Round intermediate calculations to 4 decimal places, eg. 2.3337 and final answers to O decimal places, e.g. 2,555.) $ $ tA Master Budget $ Gadgets 1,350 $5 Gizmos 1,770 $10 >arrow_forwardAAarrow_forwardRay Company provided the following excerpts from its Production Department's flexible budget performance report. Required: Complete the Production Department's Flexible Budget Performance Report. (Indicate the effect of each variance by selecting "F" for favorable, "U" for unfavorable, and "None" for no effect (i.e., zero variance). Input all amounts as positive values. Round "rate per hour" answers to 2 decimal places.) Labor-hours (q) Direct labor Indirect labor Utilities Supplies Equipment depreciation Factory administration. Total expense $ 7,100 $ 79,900 $ 18,820 (q) + + + + Ray Company Production Department Flexible Budget Performance Report For the Month Ended August 31 Actual Results $ 1.50 (q) (9) (9) $ 1.50 (q) 9,540 $164,250 5,024 $ 322,066 Spending Variances 1,840 F 1,510 U 0 None Flexible Budget $ 162,180 21,790 4,504 Activity Variances 624 U 0 None Planning Budget 9,060 18,878 4,360arrow_forward

- Ray Company provided the following excerpts from its Production Department’s flexible budget performance report. (Round "rate per hour" answers to 2 decimal places. Indicate the effect of each variance by selecting "F" for favorable, "U" for unfavorable, and "None" for no effect (i.e., zero variance). Input all amounts as positive values.) Required: Complete the Production Department’s Flexible Budget Performance Report.arrow_forwardRay Company provided the following excerpts from its Production Department's flexible budget performance report. Required: Complete the Production Department's Flexible Budget Performance Report. Note: Indicate the effect of each variance by selecting "F" for favorable, "U" for unfavorable, and "None" for no effect (i.e., zero variance). Input all amounts as positive values. Round "rate per hour answers to 2 decimal places. Labor hours (a) Direct labor Indirect labor Uslities Supplies Equipment depreciation Factory administration Total expense $ 7,800 $ 81,650 $ 18,960 (4) * . Ray Company Production Department Flexible Budget Performance Report For the Month Ended August 31 Actual Results Spending Variances S 1.30 (4) (9) (4) $ 1.20 (4) $ $ 9,610 199,145 5,122 361,120 2,662 F 1,580 U 0 None Flexible Budget $ 197,005 20,043 4.574 Activity Variances 960 U 0 None Planning Budget 9,130 26,060 4.430arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education