ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

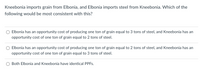

Transcribed Image Text:Kneebonia imports grain from Elbonia, and Elbonia imports steel from Kneebonia. Which of the

following would be most consistent with this?

Elbonia has an opportunity cost of producing one ton of grain equal to 3 tons of steel, and Kneebonia has an

opportunity cost of one ton of grain equal to 2 tons of steel.

Elbonia has an opportunity cost of producing one ton of grain equal to 2 tons of steel, and Kneebonia has an

opportunity cost of one ton of grain equal to 3 tons of steel.

Both Elbonia and Kneebonia have identical PPFS.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- Hand written solutions are strictly prohibitedarrow_forwardConsider a simplified example of two countries - Singapore and Indonesia - producing two goods – telecommunications equipment and electrical circuit apparatus. Using all its resources, Singapore can produce either 50 telecommunications equipment, or 100 electrical circuit apparatus. Using all its resources, Indonesia can produce either 1,000 telecommunications equipment, or 5,000 circuit apparatus. (a) Which country/countries has/have the absolute advantages and the comparative advantages in the production of telecommunications equipment, and of electrical circuit apparatus? Explain and show. (b) Consider the case of constant opportunity cost. What will be the resulting patterns of trade, terms-of-trade, and the aggregate production and consumption? Provide a diagram to illustrate, with telecommunications equipment on the y-axis. (c) It is found that contrary to the above, there is no complete specialisation in both Singapore and Indonesia. Instead, Singapore partially specialises in…arrow_forwardA small country imports salt. With free trade at the world price of $10 per pound, the country's national market is as follows: Domestic production: 100 million pounds per year Domestic consumption: 200 million pounds per year The country's government now decides to impose a $3 tariff per pound that limits salt imports to 40 million pounds per year. With the tariff in effect, the domestic production increases to 130 million pounds per year. Answer the following 3 questions according to this information. How much is the domestic producers gain or loss from the quota? How much is the domestic consumers' gain or loss after tariff? What is the government revenue from tariff?arrow_forward

- Suppose a large country A initially imposed a tariff on its imports and is now considering removing its tariff. Use a domestic-market graph to a) show the effect of country A’s tariff removal on the world’s price, country A’s import price, import quantity, consumer surplus, producer surplus, and government revenue. b) identify country A’s net welfare change as a result of its tariff removal. Is country A unambiguously better off? c) Use a different graph to show how foreign producers will be affected by country A’s tariff removal? d) What factor determines the level of optimal tariff for country A? Please make sure to graph fpr both parts "a" and "c"arrow_forwardQuestions 12-15 refer to the simple (free) trade model graph of country A on the right that shows what happens to welfare of consumers, producers, and total, when country A opens its border to trade. The domestic price and world price are Pp and Pw, respectively. The equilibrium quantity under autarky (no trade) is Qp. After trade, domestic producers supply Qa and (Qw Qa) is imported from the rest of the world. Domestic Supply (S) Price (in US $) ↑ G PD H Pw Export Supply K Domestic Demand (D) 12. What is the gain in consumers' surplus (CS) after free trade? [Select one] а. Н Qa QD Qw Quantity b. I+J с. Н+1+] d. H +I+J+ K 13. What is the gain in total welfare (CS+PS) after free trade? [Select one] а. Н b. I+J с. Н +1+] d. H +1+J+ K 14. Fill in the blanks: "Due to free trade, gain welfare and lose welfare, respectively. a. consumers, producers b. producers, government c. consumers, government d. government, producers 15. What is the minimum "area" of surplus that needs to be transferred…arrow_forwardSuppose that Portugal and Germany both produce rye and shoes. Portugal's opportunity cost of producing a pair of shoes is 4 bushels of rye while Germany's opportunity cost of producing a pair of shoes is 10 bushels of rye. By comparing the opportunity cost of producing shoes in the two countries, you can tell that has a comparative advantage in the production of shoes and has a comparative advantage in the production of rye. Suppose that Portugal and Germany consider trading shoes and rye with each other. Portugal can gain from specialization and trade as long as it receives more than of rye for each pair of shoes it exports to Germany. Similarly, Germany can gain from trade as long as it receives more than of shoes for each bushel of rye it exports to Portugal. Based on your answer to the last question, which of the following prices of trade (that is, price of shoes in terms of rye) would allow both Germany and Portugal to gain from trade? Check all…arrow_forward

- Country X has 100 units of labour and country Y has 200 units of labour. Both countries produce computers and televisions. The unit labour requirements are given in the table below: Computers Televisions Country X 50 Country Y 100 Assume that free trade exists and that the relative price is such that both countries specialize completely in the industry in which they have a comparative advantage (neither country produces both goods). The supply of computers relative to televisions will be Select one: a. 0.02 (or 1/50) O b. 0.013 (or 1/75) c. 0.01 (or 1/100) d. impossible to determine without knowing the relative price of computers in terms of televisionsarrow_forwardSuppose the United States and Mexico both produce hamburgers and tacos. The combinations of the two goods that each country can produce in one day are presented in the table below. United States Mexico Hamburgers (in tons) Tacos (in tons) Hamburgers (in tons) Tacos (in tons) 162 135 90 108 18 90 180 54 36 45 270 54 Which country has an absolute advantage in producing tacos? The United States Which country has a comparative advantage in producing tacos? Mexico Suppose the United States is currently producing 180 tons of hamburgers and 54 tons of tacos and Mexico is currently producing 36 tons of hamburgers and 45 tons of tacos. If the United States and Mexico each specialize in producing only one good (the good for which each has a comparative advantage), then a total of additional ton(s) of hamburgers can be produced for the two countries combined (enter a numeric response using an integer)arrow_forwardThe following hypothetical production possibilities tables for China and Canada. Assume that, before specialization and trade, the optimal product mix for China is alternative D and for Canada is alternative S.arrow_forward

- 3. Two areas, Europe and America, can produce only goods A and B, under constant costs as indicated below. What will be the result of free trade between the two areas? In Europe In America 1 unit of good A 2 hours of labor 3 hours of labor 1 unit of good B 4 hours of labor 5 hours of labor a. Europe will export A and B to America. b. Europe will import A and export B. c. Europe will import B and export A. d. Europe will import A and B from America. e. No trade will take place.arrow_forwardIf Bangladesh is open to international trade of wheat without any restrictions, it will import the full value for your answer, accounting for the horizontal axis units.) Suppose the Bangladeshi government wants to reduce imports to exactly 200,000 bushels of wheat to help domestic producers. A tariff of S per bushel will achieve this. A tariff set at this level would raise $ bushels of wheat. (Note: Be sure to enter in revenue for the Bangladeshi government.arrow_forwardConsider two countries, Home and Foreign. In the figure below, the import demand ("IDHome") curve depicts Home's demand for Foreign's flash drives, and the import supply curve ("ISForeign") depicts Foreign's supply of flash drives to Home. Assume Home is a "large" country that levies a tariff against Foreign imports of flash drives, thereby shifting the relevant supply curve from ISForeign to ISForeign +t. For the following questions, please refer to the figure below. P $30 28 26 24 22 20 18 16 15-- 14 12 10 8 6 4 2 0 2 4 ISForeign +t 6 8 10 12 14 16 18 20 22 22 24 26 28 ISForeign IDHome 30 Q With free trade, Home's consumer surplus equals $112.50 and Foreign's producer surplus equals $112.50. With a tariff of $ 12 per flash drive, Home's consumer surplus equals $72, Foreign's producer surplus equals $ 36, Home's tariff revenue equals $72, and Home's deadweight loss equals $45. Of the Home's tariff revenue, $36 comes from Foreign's producers, and the rest comes from Home's consumers.…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education