ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

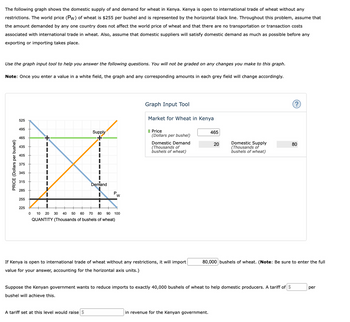

Transcribed Image Text:The following graph shows the domestic supply of and demand for wheat in Kenya. Kenya is open to international trade of wheat without any

restrictions. The world price (Pw) of wheat is $255 per bushel and is represented by the horizontal black line. Throughout this problem, assume that

the amount demanded by any one country does not affect the world price of wheat and that there are no transportation or transaction costs

associated with international trade in wheat. Also, assume that domestic suppliers will satisfy domestic demand as much as possible before any

exporting or importing takes place.

Use the graph input tool to help you answer the following questions. You will not be graded on any changes you make to this graph.

Note: Once you enter a value in a white field, the graph and any corresponding amounts in each grey field will change accordingly.

PRICE (Dollars per bushel)

525

495

465

435

405

375

345

315

285

255

225

1

Supply

Demand

W

0 10 20 30 40 50 60 70 80 90 100

QUANTITY (Thousands of bushels of wheat)

A tariff set at this level would raise $

Graph Input Tool

Market for Wheat in Kenya

Price

(Dollars per bushel)

Domestic Demand

(Thousands of

bushels of wheat)

If Kenya is open to international trade of wheat without any restrictions, it will import

value for your answer, accounting for the horizontal axis units.)

465

20

in revenue for the Kenyan government.

Domestic Supply

(Thousands of

bushels of wheat)

Suppose the Kenyan government wants to reduce imports to exactly 40,000 bushels of wheat to help domestic producers. A tariff of $

bushel will achieve this.

?

80,000 bushels of wheat. (Note: Be sure to enter the full

80

per

SAVE

AI-Generated Solution

info

AI-generated content may present inaccurate or offensive content that does not represent bartleby’s views.

Unlock instant AI solutions

Tap the button

to generate a solution

to generate a solution

Click the button to generate

a solution

a solution

Knowledge Booster

Similar questions

- The following table shows the demand, supply, and price of tulips in the Netherlands. If the world price of tulips is $1 and there are no trade restrictions, the Netherlands will: Table 19.2 Domestic Supply and Demand for Tulips in the Netherlands Demand Supply Q P($) Q P(S) 12,000 6,000 10,000 1 7,000 1 8,000 2 8,000 6,000 3 9,000 3. 4,000 4 10,000 O produce 9,000, consume 6,000, and export 6,000 tulips. O produce 7,000, consume 10,000, and export 3,000 tulips. O produce 10,000 and consume 10,000 tulips. hparrow_forwardThe following figure illustrates the tomato market for Mexico, assumed to be a "small" country that is unable t to affect the world price. Suppose the world price of tomato is given and constant at $100 per ton. SM is the domestic supply and DM is the domestic demand for Mexico. Now suppose the Mexican government provides production subsidy of $200 per ton to its tomato producers. SM (with subsidy) is Mexico's supply schedule with production subsidy. Price ($) 800 300 100 0 2 8 SM 20 SM (with subsidy) World price DM Tons of Tomatoes Refer to the figure above. As a result of the production subsidy, the deadweight loss to Mexico equals [Select]arrow_forwardNonearrow_forward

- Hand written solutions are strictly prohibitedarrow_forwardThe small nation of Capralia has an abundant stock of Pashmina goats, a breed that yields high‑quality cashmere. Capralia's authorities are still debating whether to open their economy to international trade. The international price of cashmere is $70,000 per metric ton, and the Capralian cashmere sells for $50,000 per metric ton.arrow_forwardThe following graph shows the domestic demand for and supply of oranges in Guatemala. The world price (Pw) of oranges is $550 per ton and is displayed as a horizontal black line. Throughout the question, assume that all countries under consideration are small, that is, the amount demanded by any one country does not affect the world price of oranges and that there are no transportation or transaction costs associated with International trade in oranges. Also, assume that domestic suppliers will satisfy domestic demand as much as possible before any exporting or importing takes place. PRICE (Dollars per ton) 820 790 760 730 700 670 640 610 580 550 520 0 Domestic Demand 1 Domestic Supply PW 30 60 90 120 150 180 210 240 270 300 QUANTITY (Tons of oranges) A tariff set at this level would raise (~.) ? If Guatemala is open to International trade In oranges without any restrictions, it will import Suppose the Guatemalan government wants to reduce imports to exactly 60 tons of oranges to help…arrow_forward

- The small nation of Capralia has an abundant stock of Pashmina goats, a breed that yields high-quality cashmere. Capralia's authorities are still debating whether to open their economy to international trade. The international price of cashmere is $70,000 per metric ton, and the Capralian cashmere sells for $50,000 per metric ton. Place the consumer surplus triangle (CS) and the producer surplus triangle (PS) to correctly depict consumer and producer surplus if Capralia chooses to open its borders to the international cashmere trade. 100 Price ($/metric ton) 90 80 70 60 50 40 30 20 Capralia's Domestic Cashmere Market 10 0 0 6 domestic supply domestic quilibrium domestic demand 30 42 36 18 24 12 Quantity (thousands of metric tons). 48 54 60 CS APS ENGarrow_forwardA small country imports salt. With free trade at the world price of $10 per pound, the country's national market is as follows: Domestic production: 100 million pounds per year Domestic consumption: 200 million pounds per year The country's government now decides to impose a $3 tariff per pound that limits salt imports to 40 million pounds per year. With the tariff in effect, the domestic production increases to 130 million pounds per year. Answer the following 3 questions according to this information. How much is the domestic producers gain or loss from the quota? How much is the domestic consumers' gain or loss after tariff? What is the government revenue from tariff?arrow_forwardPrice of Clothing Market for Clothing in Vietnam Domestic Demand Quantity of Clothing Domestic Supply World Price A Consumer Surplus Producer Surplusarrow_forward

- Topic 3 Assignment The following graph shows the domestic supply of and demand for maize in Bangladesh. Bangladesh is open to international trade of maize without any restrictions. The world price (Pw) of maize is $245 per ton and is represented by the horizontal black line. Throughout this problem, assume that the amount demanded by any one country does not affect the world price of maize and that there are no transportation or transaction costs associated with international trade in maize. Also, assume that domestic suppliers will satisfy domestic demand as much as possible before any exporting or importing takes place. Use the graph input tool to help you answer the following questions. You will not be graded on any changes you make to this graph. Note: Once you enter a value in a white field, the graph and any corresponding amounts in each grey field will change accordingly. 470 Supply 420 305 X I I Demand I PRICE (Dollars perton) 445 245 720 D P W 40 80 120 150 200 240 280 320 350…arrow_forwardThe United States imports a lot of cars, despite having its own auto industry. Each of the following statements are arguments some people could make for restricting imports of cars into the United States. For each statement, identify the threat to the U.S. industry that the argument is trying to counter, and identify the opportunities that would be given up if the argument wins. SELECT THE CORRECT ANSWER a. “Foreign manufacturers are offloading their cheap cars onto the U.S. market. We should stop this so that consumers have access to higher-quality U.S. cars.” -National security requires that strategically important goods be produced domestically. -Protection can help infant industries develop. -Foreign competition may lead to job losses. -Anti-dumping laws prevent unfair competition. -Trade should not enable foreign firms to skirt U.S. regulations. b. “We must foster the innovation of small car companies, like Tesla. Allowing foreign electric vehicle manufacturers…arrow_forwardVietnam has a policy of free trade in motorcycles which are sold in world markets at a price of 10,000 per motorcycle. Under free trade, Vietnam produces 100,000 motorcycles and imports 100,000 motorcycles. To provide some protection to the domestic industry, Vietnam imposes an import tariff of $1500 per motorcycle. With this tariff in place, production in Vietnam rises by 5,000 motorcycles and consumption drops by the same amount. Calculate the effects of the tariff on: a. Consumer Surplus b. Producer Surplus c. Government Revenues d. Overall Welfare e. If the tariff imposed by the Vietnamese had led to small reduction in world prices of, say, 250 dollars, how, qualitatively, would the welfare calculations (a), (b), (c) and (d) above change?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education