FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

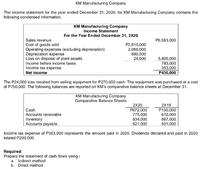

Transcribed Image Text:KM Manufacturing Company

The income statement for the year ended December 31, 2020, for KM Manufacturing Company contains the

following condensed information.

KM Manufacturing Company

Income Statement

For the Year Ended December 31, 2X20

Sales revenue

Cost of goods sold

Operating expenses (excluding depreciation)

Depreciation expense

Loss on disposal of plant assets

Income before income taxes

P6,583,000

P2,810,000

2,086,000

880,000

24,000

5,800,000

783,000

353,000

P430,000

Income tax expense

Net income

The P24,000 loss resulted from selling equipment for P270,000 cash. The equipment was purchased at a cost

of P750,000. The following balances are reported on KM's comparative balance sheets at December 31.

KM Manufacturing Company

Comparative Balance Sheets

2X20

2X19

Cash

Accounts receivable

Inventory

Accounts payable

P672,000

775,000

834,000

521,000

P130,000

610,000

867,000

501,000

Income tax expense of P353,000 represents the amount paid in 2020. Dividends declared and paid in 2020

totaled P200,000.

Required:

Prepare the statement of cash flows using i

a. Indirect method

b. Direct method

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 4 images

Knowledge Booster

Similar questions

- Excerpts from the annual report of XYZ Corporation follow: 2019 $675,138 $241,154 $64,150 $93,650 $25,100 2020 Cost of goods sold Inventory Net income $754,661 $219,686 $31,185 $68,685 $26,900 Retained earnings LIFO reserve Tax rate 20% 20% If XYZ used FIFO, its net income for fiscal 2020 would be O a. $34,165 O b. $30,375 O c. $32,625 d. $36,545arrow_forwardHere are comparative financial statement data for Bramble Company and Debra Company, two competitors. All data are as of December 31, 2022, and December 31, 2021. Net sales Cost of goods sold Operating expenses Interest expense Income tax expense Current assets Plant assets (net) Current liabilities Bramble Company 2022 $1,896,000 1.020,048 257,856 Return on assets 7,584 54,984 322,500 520,800 O 64,200 Plant assets (net) Current liabilities Long-term liabilities Common stock, $10 par Retained earnings 2021 Return on common stockholders' equity 520,800 64,200 Debra Company $561,000 297,330 79,662 3,927 6,171 $310,000 83,500 $78,000 500,300 139,800 123,000 75,600 29,600 108,400 498,000 172,700 2022 34,400 500,300 2021 498,000 146,300 Bramble Company 75,600 90,400 67.2 % % 139,800 34,400 28,400 122,500 Compute the 2022 return on assets and the return on common stockholders' equity ratios for both companies. (Round answers to 1 decimal place, eg. 12.1%) 38,000 123,000 Debra Company 29,600…arrow_forwardNASH'S LTD. Statement of Income For the year ended June 30, 2024 Sales revenue Cost of goods sold Gross profit Expenses Wages expense Depreciation expense Rent expense Income tax expense Operation income Gain on sale of equipment Net income Additional information: 1. $63,000 18,500 16,000 15,500 $400,000 210,000 190,000 113,000 77,000 5,000 $82,000 The following information is for Nash Ltd. for the year ended June 30, 2024. Assets Current assets: Cash NASH'S LTD. Statement of Financial Position As at June 30 Accounts receivable Inventory Total current assets Equipment Accumulated depreciation, equipment Land Liabilities and shareholders' equity Current liabilities Accounts payable Dividends payable Total current liabilities Bank loan payable Common shares Retained earnings 2024 $63,000 94,800 82,500 240,300 153,000 (33,500) 163,000 $522,800 $45,000 15,000 60,000 114,500 163,000 185,300 2023 $43,000 63,000 98,500 204,500 113,000 (29,000) 200,000 $488,500 $70,000 5,000 75,000 163,000…arrow_forward

- SUNLAND COMPANYIncome StatementsFor the Years Ended December 31 2022 2021 Net sales $2,178,400 $2,030,000 Cost of goods sold 1,207,000 1,187,080 Gross profit 971,400 842,920 Selling and administrative expenses 590,000 565,220 Income from operations 381,400 277,700 Other expenses and losses Interest expense 25,960 23,600 Income before income taxes 355,440 254,100 Income tax expense 106,632 76,230 Net income $ 248,808 $ 177,870 SUNLAND COMPANYBalance SheetsDecember 31 Assets 2022 2021 Current assets Cash $ 70,918 $ 75,756 Debt investments (short-term) 87,320 59,000 Accounts receivable 139,004 121,304 Inventory 148,680 136,290 Total current assets 445,922 392,350 Plant assets (net) 765,820 613,954 Total assets $1,211,742…arrow_forwardCochran corporation, Inc. has the following income statement: Cochran corporation, Inc. Income statement For the year ended December 31, 2021 net sales $240 Cost of goods sold $150 gross profit $90 Operating expenses $65 Net income $25 Using vertical analysis, what percentage is assigned to operating expenses? a. 27,1% b. 43.3% c. 72.2% d. 260.0%arrow_forwardThe following income statement and additional year-end information is provided. SONAD COMPANY Income Statement For Year Ended December 31 Sales $ 1,710,000 Cost of goods sold 837,900 Gross profit 872,100 Operating expenses Salaries expense $ 234,270 Depreciation expense 41,040 Rent expense 46,170 Amortization expenses—Patents 5,130 Utilities expense 18,810 345,420 526,680 Gain on sale of equipment 6,840 Net income $ 533,520 Accounts receivable $ 26,000 increase Accounts payable $ 15,650 decrease Inventory 27,075 increase Salaries payable 3,850 decrease Prepare the operating activities section of the statement of cash flows using the direct method. Note: Amounts to be deducted should be indicated with a minus sign.arrow_forward

- The following Income statement and additional year-end Information is provided. SONAD COMPANY Incone Statenent For Year Ended December 31 $ 1,823,e00 893, 270 Sales Cost of goods sold Gross profit Operating expenses Salaries expense Depreciation expense Rent expense Amortization expenses-Patents Utilities expense 929,730 $ 249,751 43,752 49, 221 5,469 20,053 368, 246 561,484 7,292 Gain on sale of equipment Net income $ 568,776 $ 31,5e0 increase Accounts payable 13,375 increase Salaries payable $ 13,950 decrease 4,800 decrease Accounts receivable Inventory Prepare the operating activitles section of the statement of cash flows using the direct method. (Amounts to be deducted should be Indicated with a minus sign.) Answer is not complete. Statement of Cash Flows (Partial) Cash flows from operating activities Amortization expenses-Patents Gain on sale of equipment Increase in Accounts receivable Increase in Inventory Decrease in Accounts payable Decrease in Salaries payable Net cash…arrow_forwardThe income statement of Sunland Company is shown below. Sunland Company Income Statement For the Year Ended December 31, 2025 Sales revenue $6,930,000 Cost of goods sold Beginning inventory $1,890,000 Purchases 4,410,000 Goods available for sale 6,300,000 Ending inventory 1,590,000 Cost of goods sold 4,710,000 Gross profit 2,220,000 Operating expenses 450,000 Selling expenses 450,000 Administrative expenses 700,000 1,150,000 Net income $1,070,000 1.Accounts receivable decreased $370,000 during the year.2. Prepaid expenses increased $160,000 during the year.3. Accounts payable to suppliers of merchandise decreased $290,000 during the year.4. Accrued expenses payable decreased $90,000 during the year.5. Administrative expenses include depreciation expense of $50,000.Prepare the operating activities section of the statement of cash flows using the direct method.arrow_forwardAt the fiscal year ended June 30, 2020, the following information is available for Shein Company: Cost of goods sold. . .$167,400 Sales returns and allowances... 4,000 Sales revenue. 243,200 Interest expense... 5,000 Operating expenses... 88,700 Shein's net income/(net loss) for the period is Select one: a. Net income of $21,900 O b. Net income of $11,900 O c. Net loss of $11,900 O d. Net loss of $21,900arrow_forward

- The following condensed income statements of the Jackson Holding Company are presented for the two years ended December 31, 2021 and 2020: 2021 2020 Sales revenue $ 15,000,000 $ 9,600,000 Cost of goods sold 9,200,000 6,000,000 Gross profit 5,800,000 3,600,000 Operating expenses 3,200,000 2,600,000 Operating income 2,600,000 1,000,000 Gain on sale of division 600,000 — 3,200,000 1,000,000 Income tax expense 800,000 250,000 Net income $ 2,400,000 $ 750,000 On October 15, 2021, Jackson entered into a tentative agreement to sell the assets of one of its divisions. The division qualifies as a component of an entity as defined by GAAP. The division was sold on December 31, 2021, for $5,000,000. Book value of the division’s assets was $4,400,000. The division’s contribution to Jackson’s operating income before-tax for each year was as follows: 2021 $400,000 2020 $300,000 Assume…arrow_forwardVery important please be correct thank youarrow_forwardCrane Ltd. reported the following for the fiscal year 2021: Sales Cost of goods sold Gross profit Operating expenses Depreciation expense Gain on sale of land Profit before income tax Income tax expense Profit Additional information: 1. 2. CRANE LTD. Income Statement Year Ended September 30, 2021 3. 4. 5. 6. $ 109,000 34,000 (44,000) $583,000 338,000 245,000 99,000 146,000 36,500 $109,500 Accounts receivable decreased by $16,300 during the year. Inventory increased by $7,800 during the year. Prepaid expenses decreased by $5,800 during the year. Accounts payable to suppliers increased by $11,300 during the year. Accrued expenses payable increased by $5,300 during the year. Income tax payable decreased by $7,100 during the year.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education