FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

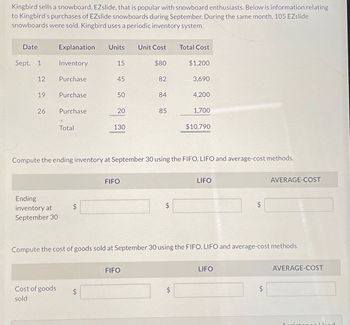

Transcribed Image Text:Kingbird sells a snowboard, EZslide, that is popular with snowboard enthusiasts. Below is information relating

to Kingbird's purchases of EZslide snowboards during September. During the same month, 105 EZslide

snowboards were sold. Kingbird uses a periodic inventory system.

Date

Explanation Units

Unit Cost

Total Cost

Sept. 1

Inventory

15

$80

$1,200

12

Purchase

45

82

3,690

19

Purchase

50

84

4,200

26

Purchase

20

85

1,700

Total

130

$10,790

Compute the ending inventory at September 30 using the FIFO, LIFO and average-cost methods.

Ending

inventory at

September 30

FIFO

LIFO

$

AVERAGE-COST

Compute the cost of goods sold at September 30 using the FIFO, LIFO and average-cost methods.

Cost of goods

sold

FIFO

LIFO

$

AVERAGE-COST

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Step 1: Definition of Inventory

VIEW Step 2: Calculation of cost of ending inventory and Cost of goods sold using FIFO

VIEW Step 3: Calculation of cost of ending inventory and Cost of goods sold using LIFO

VIEW Step 4: Calculation of cost of ending inventory and Cost of goods sold using average-cost method

VIEW Solution

VIEW Trending nowThis is a popular solution!

Step by stepSolved in 5 steps with 3 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- please answer within the format by providing formula the detailed workingPlease provide answer in text (Without image)Please provide answer in text (Without image)Please provide answer in text (Without image)arrow_forwardUramilabenarrow_forwardplease answer within the format by providing formula the detailed workingPlease provide answer in text (Without image)Please provide answer in text (Without image)Please provide answer in text (Without image)arrow_forward

- Buffalo Corp. sells a snowboard, EZslide, that is popular with snowboard enthusiasts. Below is information relating to Buffalo Corp.’s purchases of EZslide snowboards during September. During the same month, 103 EZslide snowboards were sold. Buffalo Corp. uses a periodic inventory system. Date Explanation Units Unit Cost Total Cost Sept. 1 Inventory 14 $110 $ 1,540 Sept. 12 Purchases 50 113 5,650 Sept. 19 Purchases 54 114 6,156 Sept. 26 Purchases 22 115 2,530 Totals 140 $15,876 (a) Compute the ending inventory at September 30 using the FIFO, LIFO and average-cost methods. (Round average cost per unit to 3 decimal places, e.g. 125.153 and final answers to 0 decimal places, e.g. 125.) FIFO LIFO AVERAGE-COST The ending inventory at September 30 $Enter a dollar amount $Enter a dollar amount $Enter a dollar amount (b) Compute the…arrow_forwardVaughn Boards sells a snowboard, Xpert, that is popular with snowboard enthusiasts. Information relating to Vaughn's purchases of Xpert snowboards during September is shown below. During the same month. 98 Xpert snowboards were sold. Vaughn's uses a periodic inventory system. Date Explanation Units Unit Cost Total Cost Sept. 1 Inventory 23 HK$970 HK$ 22,310 Sept. 12. Purchases 37 1,020 37,740 Sept. 19 Purchases 13 1.040 13,520 Sept. 26 Purchases 47 1,050 49.350 Totals 120 HK$122.920 (a) Compute the ending inventory at September 30 and cost of goods sold using the FIFO and average-cost methods. (Round per unit cost to 3 decimal places, eg. 15.125 and final answers to O decimal places, eg. 125) FIFO Average-Cost The ending inventory at September 30 HK$ HK$ Cost of goods sold HK$ HK$ (b) For both FIFO and average-cost, calculate the sum of ending inventory and cost of goods sold. (Round per unit cost to 3 decimal places, eg. 15.125 and final answers to O decimal places, eg 125) FIFO…arrow_forwardHans Inc. is a merchandising company that resells equestrian saddles. The company’s inventory data is as follows: Cost of Goods Available for Sale Jan. 1 Beginning Balance 3 units @ $200 = $600 Jan. 5 Purchase 2 units @ $400 = $800 Jan. 20 Purchase 3 units @ $500 = $1,500 Retail Sales of Goods Jan. 15 Sales 2 units @ $800 = $1,600 Jan. 31 Sales 1 units @ $1,000 = $1,000 For the January 15th sale, the company sold 1 unit that originally cost $200 and 1 unit that cost $400. For the January 31st sale, the 1 unit sold originally had a cost of $500. Using the Weighted Average method, the cost of goods sold for January would be: Answer formatting -when typing in your answer please include a dollar sign, a comma if necessary, use whole numbers, omit any periods, and make sure your response has no spaces. For example, $1,200arrow_forward

- Assume that J R Toys store purchased and sold a line of dolls during December as follows: (Click the icon to view the transactions.) JR Toys uses the perpetual inventory system. More info Dec. 1 Beginning merchandise inventory 8 Sale 14 Purchase 21 Sale 13 7 14 13 units @ $ 8 each units @ $18 each units @ $ 16 each units @ $ 18 each. - X Requirements 1. Compute the cost of goods sold, cost of ending merchandise inventory, and gross profit using the FIFO inventory costing method. 2. Compute the cost of goods sold, cost of ending merchandise inventory, and gross profit using the LIFO inventory costing method. 3. Which method results in a higher cost of goods sold? 4. Which method results in a higher cost of ending merchandise inventory? 5. Which method results in a higher gross profit?arrow_forwardREI sell snowboards. Assume the following information relates to REI's purchases of snowbourds during tegnember During the same month, 100 snowboards were sold REloses a periodic inventory system Dale Sept. 1 Sept. 12 Sept 19 Sept. 26 Explanation Unit Unit Cont Inventory 15 $110 Purchases 48 113 Purchases 33 114 Purchases 24 115 Totals 140 Compute the ending inventory at September 30 using FIFO LIFO, and average-cost. (Round average cost per 3 decimal places eg. 125.153 and final answers to 0 decimal places 125 Ending inventory at September 30 eTextbook and Media FIFO Your answer is incorrect Cost of goods sold 2775 FIFO $1.630 5,424 6042 3.760 $15.876 13654 LIFO Compute the cost of goods sold for the month using the FIFO, LIFO, and average-cost methock Mound average cost per unit to 3 decimal ploces, eg 125 153 end final enmers to 0 alecimal places, 1253 1344 UFD ETDA AVERAGE-COST $ 3402 AVERAGE-COST 130825arrow_forwardHans Inc. is a merchandising company that resells equestrian saddles. The company’s inventory data is as follows: Cost of Goods Available for Sale Jan. 1 Beginning Balance 3 units @ $200 = $600 Jan. 5 Purchase 2 units @ $400 = $800 Jan. 20 Purchase 3 units @ $500 = $1,500 Retail Sales of Goods Jan. 15 Sales 2 units @ $800 = $1,600 Jan. 31 Sales 1 units @ $1,000 = $1,000 For the January 15th sale, the company sold 1 unit that originally cost $200 and 1 unit that cost $400. For the January 31st sale, the 1 unit sold originally had a cost of $500. Using the LIFO method, the cost of goods sold for January would be: Answer formatting -when typing in your answer please include a dollar sign, a comma if necessary, use whole numbers, omit any periods, and make sure your response has no spaces. For example, $1,200arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education