Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

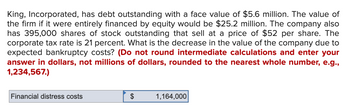

Transcribed Image Text:King, Incorporated, has debt outstanding with a face value of $5.6 million. The value of

the firm if it were entirely financed by equity would be $25.2 million. The company also

has 395,000 shares of stock outstanding that sell at a price of $52 per share. The

corporate tax rate is 21 percent. What is the decrease in the value of the company due to

expected bankruptcy costs? (Do not round intermediate calculations and enter your

answer in dollars, not millions of dollars, rounded to the nearest whole number, e.g.,

1,234,567.)

Financial distress costs

$

1,164,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Similar questions

- Sydney’s Shrimpboat's net capital spending was $350,000 this year. The firm also reduced its NWC by $250,000. Their interest expense was $75,000 and the firm net redeemed $20,000 in long term debt. The company does not pay a dividend and did not issue any stock, but did repurchase $50,000 of common stock. What was the firm’s OCF for the year? a. $ 95,000 b. $245,000 c. $275,000 d. $100,000 e. $145,000arrow_forwardSuppose Tefco Corp. has a value of $131 million if it continues to operate, but has outstanding debt of $160 million that is now due. If the firm declares bankruptcy, bankruptcy costs will equal $22 million, and the remaining $109 million will go to creditors. Instead of declaring bankruptcy, management proposes to exchange the firm's debt for a fraction of its equity in a workout. What is the minimum fraction of the firm's equity that management would need to offer to creditors for the workout to be successful? Tefco could offer its creditors% of the firm in a workout. (Round to one decimal place.) Carrow_forwardThe Morrit Corporation has $450,000 of debt outstanding, and it pays an interest rate of 11% annually. Morrit's annual sales are $3 million, its average tax rate is 25%, and its net profit margin on sales is 5%. If the company does not maintain a TIE ratio of at least 3 to 1, then its bank will refuse to renew the loan, and bankruptcy will result. What is Morrit's TIE ratio? Do not round intermediate calculations. Round your answer to two decimal places.arrow_forward

- Edwards Construction currently has debt outstanding with a market value of $116,000 and a cost of 12 percent. The company has EBIT of $13,920 that is expected to continue in perpetuity. Assume there are no taxes. a-1. What is the value of the company's equity? (Do not round intermediate calculations. Leave no cell blank - be certain to enter "0" wherever required.) a- What is the debt-to-value ratio? (Do not round intermediate calculations and round 2. your answer to the nearest whole number, e.g., 32.) b. What are the equity value and debt-to-value ratio if the company's growth rate is 5 percent? (Do not round intermediate calculations and round your "Debt-to- value" answer to 3 decimal places, e.g., 32.161.) c. What are the equity value and debt-to-value ratio if the company's growth rate is 8 percent? (Do not round intermediate calculations and round your "Debt-to- value" answer to 3 decimal places, e.g., 32.161.) Answer is complete but not entirely correct. a-1. Value of equity…arrow_forwardNeed helparrow_forwardFowler, Inc., has no debt outstanding and a total market value of $150,000. Earnings before interest and taxes, EBIT, are projected to be $28,000 if economic conditions are normal. If there is strong expansion in the economy, then EBIT will be 20 percent higher. If there is a recession, then EBIT will be 25 percent lower. The firm is considering a debt issue of $60,000 with an interest rate of 7 percent. The proceeds will be used to repurchase shares of stock. There are currently 10,000 shares outstanding. The firm has a tax rate 25 percent. Assume the stock price is constant under all scenarios. a-1. Calculate earnings per share (EPS) under each of the three economic scenarios before any debt is issued. (Do not round intermediate calculations and round your answers to 2 decimal places, e.g., 32.16.) a-2. Calculate the percentage changes in EPS when the economy expands or enters a recession. (A negative answer should be indicated by a minus sign. Do not round intermediate…arrow_forward

- Jordan, Corp., has debt outstanding with a market value of $3 million. The value of the firmwould be $X million if it were entirely financed by equity. The company also has 360,000shares of stock outstanding that sell at $50 per share. The corporate tax rate is 30 percent. Theexpected bankruptcy cost is 0.9 million. If there is no other market friction like agencycost/benefit, what is X?arrow_forwardBaker Industries’ net income is $26000, its interest expense is $5000, and its tax rate is 45%. Its notes payable equals $25000, long-term debt equals $70000, and common equity equals $260000. The firm finances with only debt and common equity, so it has no preferred stock. The data has been collected in the Microsoft Excel Online file below. Open the spreadsheet and perform the required analysis to answer the questions below. Open spreadsheet What are the firm’s ROE and ROIC? Round your answers to two decimal places. Do not round intermediate calculations.arrow_forwardPlease help me with this questionarrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education