FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

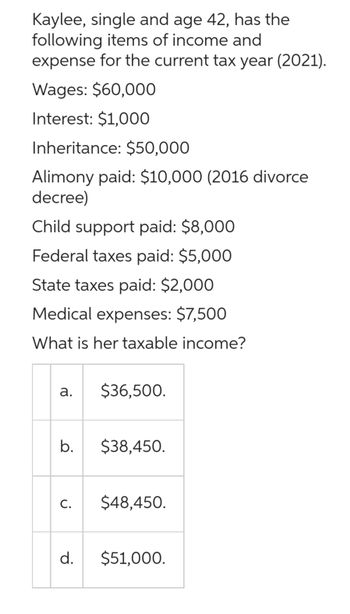

Transcribed Image Text:Kaylee, single and age 42, has the

following items of income and

expense for the current tax year (2021).

Wages: $60,000

Interest: $1,000

Inheritance: $50,000

Alimony paid: $10,000 (2016 divorce

decree)

Child support paid: $8,000

Federal taxes paid: $5,000

State taxes paid: $2,000

Medical expenses: $7,500

What is her taxable income?

a.

b.

C.

d.

$36,500.

$38,450.

$48,450.

$51,000.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- krystal is single. Last year, she earned $35,800 wages. Additional tax information for the year is as follows.. Interest earned $136, capital gains from sale of stock $1850. alimony paid $6,100, contributions to IRA retirement fund $ 2800; Real estate taxes $1600, mortgage interest paid $5100. The following table gives the standard deduction for various statuses.arrow_forwardYanni, who is single, provides you with the following information for 2021: Salary State income taxes Mortgage interest expense on principal residence Charitable contributions. 2,564 Interest income 1,923 Click here to access the exemption table. If required, round your answers to the nearest dollar. Compute the following: a. Yanni's taxable income: b. Yanni's AMT base: $128,200 12,820 11,538 c. Yanni's tentative minimum tax: X Incorrectarrow_forwardBetty operates a beauty salon as a sole proprietorship. Betty also owns and rents an apartment building. In 2021, Betty had the following income and expenses. You may assume that Betty will owe $2,624 in self-employment tax on her salon income, with $1,312 representing the employer portion of the self-employment tax. You may also assume that her divorce from Rocky was finalized in 2016. Interest income $ 14,975 Salon sales and revenue 88,760 Salaries paid to beauticians 46,550 Beauty salon supplies 23,640 Alimony paid to her ex-husband, Rocky 7,200 Rental revenue from apartment building 35,540 Depreciation on apartment building 14,100 Real estate taxes paid on apartment building 12,060 Real estate taxes paid on personal residence 6,937 Contributions to charity 5,029 a. Determine Betty's AGI. (Amounts to be deducted should be indicated by a minus sign.)arrow_forward

- In 2021, Patricia (age 10) received $7,880 from a corporate bond. Patricia lives with her parents and she is claimed as a dependent in their tax return. Assuming her parent's marginal tax rate is 24%, what is Patricia's gross tax liability? 2021 Tax Rate Schedules.pdf O $0. $110. O $1473. O $999.arrow_forwardSharon Jones is single. During 2022, she had gross income of $159,800, deductions for AGI of $5,500, itemized deductions of $14,000 and tax credits of $2,000. Sharon had $22,000 withheld by their employer for federal income tax. She has a tax (due/refund) rounded to the nearest whole dollar of $.arrow_forwardMario, a single taxpayer with two dependent children, has the following items of income and expense during 2020: Gross receipts from business $144,000 Business expenses 180,000 Net capital gain 22,000 Interest income 3,000 Itemized deductions (state taxes, residence interest, and contributions) 24,000 a. Determine Mario's taxable income or loss for 2020. Adjusted gross income Less: itemized deductions Less: Deduction for qualified business income Loss b. Indicate which items are adjustments to taxable income or loss when computing an NOL. Business receipts Business Expenses Net capital gain Interest income Itemized deductions c. Determine Mario's NOL for 2020. Mario's NOL is ?arrow_forward

- Chris and Heather are engaged and plan to get married. During 2023, Chris is a full-time student and earns $9,400 from a part-time job. With this income, student loans, savings, and nontaxable scholarships, he is self-supporting. For the year, Heather is employed and has wages of $72,600. Click here to access the standard deduction table to use. Click here to access the Tax Rate Schedules. If an amount is zero, enter, "0". Do not round your intermediate computations. Round your final answer to the nearest whole dollar. a. Compute the following: Gross income and AGI Standard deduction (single) Taxable income Income tax Chris Filing Single Heather Filing Singlearrow_forwardAlice is single and self-employed in 2022. Her net business profit on her Schedule C for the year is $166,000. What are her self-employment tax liability and additional Medicare tax liability for 2022?arrow_forwardA surviving spouse with one dependent child has a gross income of 68,170 per year. If 3,000 is withheld from the taxpayers wages for federal income taxes, what is the amount of the taxpayers refund or tax due?arrow_forward

- Chris and Heather are engaged and plan to get married. During 2020, Chris is a full-time student and earns $8,500 from a part-time job. With this income, student loans, savings, and nontaxable scholarships, he is self-supporting. For the year, Heather is employed and has wages of $83,600. Click here to access the standard deduction table to use. Click here to access the Tax Rate Schedules. If an amount is zero, enter, "0". Do not round your intermediate computations. Round your final answer to nearest whole dollar.a. Compute the following: ChrisFiling Single HeatherFiling Single Gross income and AGI 8,500 83,600 Standard deduction 12,400 12,400 Taxable income 0 71,200 Income tax 0 11,454 b. Assume that Chris and Heather get married in 2020 and file a joint return. What is their taxable income and income tax? Round your final answer to nearest whole dollar. MarriedFiling Jointly Gross income and AGI 92,100 Standard deduction…arrow_forwardCalculate the 2020 tax liability and the tax or refund due for each situation. Round your answers to the nearest dollar. a. Mark is single with no dependents and has a taxable income of $62,600. He has $9,500 withheld from his salary for the year. b. Harry and Linda are married and have taxable income of $62,600. Harry has $5,270 withheld from his salary. Linda makes estimated tax payments totaling $2,600. c. Aspra is single. His 20-year-old son, Calvin, lives with him throughout the year. Calvin pays for less than one-half of his support and his earned income for the year is $2,980. Aspra pays all costs of maintaining the household. His taxable income is $62,600. Aspra’s withholdings total $8,300. d. Randy and Raina are married. Because of marital discord, they are not living together at the end of the year, although they are not legally separated or divorced. Randy's taxable income is $25,500, and Raina's is $62,600. Randy makes…arrow_forwardChris and Heather are engaged and plan to get married. During 2023, Chris is a full-time student and earns $7,600 from a part-time job. With this income, student loans, savings, and nontaxable scholarships, he is self-supporting. For the year, Heather is employed and has wages of $79,200. Click here to access the standard deduction table to use. Click here to access the Tax Rate Schedules. If an amount is zero, enter, "0". Do not round your intermediate computations. Round your final answer to the nearest whole dollar.a. Compute the following: ChrisFiling Single HeatherFiling Single Gross income and AGI $fill in the blank 488588fb1f91034_1 $fill in the blank 488588fb1f91034_2 Standard deduction (single) fill in the blank 488588fb1f91034_3 fill in the blank 488588fb1f91034_4 Taxable income $fill in the blank 488588fb1f91034_5 $fill in the blank 488588fb1f91034_6 Income tax $fill in the blank 488588fb1f91034_7 $fill in the blank 488588fb1f91034_8…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education