FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

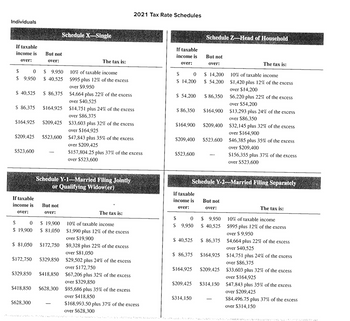

Transcribed Image Text:Individuals

If taxable

income is

over:

$

0

$ 9.950

$ 40,525 $ 86,375

$ 86,375 $164,925

$523,600

But not

over:

$164,925 $209,425

$209,425 $523,600

If taxable

income is

over:

$ 9.950

$ 40.525

$

0

$ 19,900

But not

$628,300

Schedule X-Single

over:

$ 19,900

$ 81,050

$ 81,050 $172,750

$172,750 $329,850

$329,850 $418,850

Schedule Y-1-Married Filing Jointly

or Qualifying Widow(er)

$418,850 $628,300

The tax is:

10% of taxable income

$995 plus 12% of the excess

over $9.950

$4,664 plus 22% of the excess

over $40.525

$14,751 plus 24% of the excess

over $86,375

$33,603 plus 32% of the excess

over $164,925

$47,843 plus 35% of the excess

over $209,425

$157,804.25 plus 37% of the excess

over $523,600

2021 Tax Rate Schedules

The tax is:

10% of taxable income

$1,990 plus 12% of the excess

over $19,900

$9,328 plus 22% of the excess

over $81,050

$29,502 plus 24% of the excess

over $172,750

$67,206 plus 32% of the excess

over $329,850

$95,686 plus 35% of the excess

over $418,850

$168.993.50 plus 37% of the excess

over $628,300

If taxable

income is

over:

$

0

$ 14,200

$ 54,200

$ 86,350

$523,600

If taxable

income is

over:

$6,220 plus 22% of the excess

over $54,200

$13,293 plus 24% of the excess

over $86,350

$164.900 $209,400 $32,145 plus 32% of the excess

over $164,900

$

$ 9,950

Schedule Z- Head of Household

$209,400 $523.600

$ 40,525

But not

$ 86,375

over:

$209,425

$ 14,200

$ 54,200

$314,150

$ 86,350

0 $ 9,950

$ 40,525

$164,900

Schedule Y-2-Married Filing Separately

But not

over:

$ 86,375

$164,925 $209,425

$164,925

The tax is:

10% of taxable income

$1,420 plus 12% of the excess

over $14,200

$314,150

$46,385 plus 35% of the excess

over $209,400

$156,355 plus 37% of the excess

over $523,600

The tax is:

10% of taxable income

$995 plus 12% of the excess

over $9.950

$4,664 plus 22% of the excess

over $40,525

$14,751 plus 24% of the excess

over $86,375

$33,603 plus 32% of the excess

over $164,925

$47,843 plus 35% of the excess

over $209,425

$84,496.75 plus 37% of the excess

over $314,150

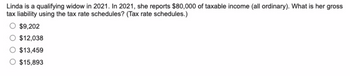

Transcribed Image Text:Linda is a qualifying widow in 2021. In 2021, she reports $80,000 of taxable income (all ordinary). What is her gross

tax liability using the tax rate schedules? (Tax rate schedules.)

$9,202

$12,038

$13,459

$15,893

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Similar questions

- Lacy is a single taxpayer. In 2022, her taxable income is $44,200. What is her tax liability in each of the following alternative situations? Use Tax Rate Schedule, Dividends and Capital Gains Tax Rates for reference. Note: Do not round intermediate calculations. Round your answer to 2 decimal places. Required: All of her income is salary from her employer. Her $44,200 of taxable income includes $1,200 of qualified dividends. Her $44,200 of taxable income includes $5,200 of qualified dividends.arrow_forwardSheila and Joe Wells are married with two dependent children. During 2021, they have gross income of $99,800, deductions for AGI of $3,500, itemized deductions of $10,000 and tax credits of $2,000. The Wells' had $6,000 withheld by their employer for federal income tax. They have a total tax of Blank 1 and an amount due/refund of Blank 2 (Use the tax table in Appendix D) Correct Answer Blank 1: 8149 Blank 2: 149arrow_forwardHenrich is a single taxpayer. In 2022, his taxable income is $488,500. What are his income tax and net investment income tax liability in each of the following alternative scenarios? Use Tax Rate Schedule, Dividends and Capital Gains Tax Rates for reference. Note: Do not round intermediate calculations. Leave no answer blank. Enter zero if applicable. Round your final answers to 2 decimal places. Required: His $488,500 of taxable income includes $56,000 of long-term capital gain that is taxed at preferential rates. Assume his modified AGI is $520,000. Henrich has $199,250 of taxable income, which includes $51,700 of long-term capital gain that is taxed at preferential rates. Assume his modified AGI is $218,500.arrow_forward

- Subject :- Accountarrow_forwardHenrich is a single taxpayer. In 2019, his taxable income is $456,500. What is his income tax and net investment income tax liability in each of the following alternative scenarios? Use Tax Rate Schedule, Dividends and Capital Gains Tax Rates, Estates and Trusts for reference. (Do not round intermediate calculations. Round your answers to 2 decimal places. Leave no answer blank. Enter zero if applicable.) Estates and Trusts If taxable income is over: But not over: The tax is: $ 0 $ 2,600 10% of taxable income $ 2,600 $ 9,300 $260 plus 24% of the excess over $2,600 $ 9,300 $12,750 $1,868 plus 35% of the excess over $9,300 $12,750 $3,075.50 plus 37% of the excess over $12,750 Tax Rates for Net Capital Gains and Qualified Dividends Rate* Taxable Income Married Filing Jointly Married Filing Separately Single Head of Household Trusts and Estates 0% $0 - $78,750 $0 - $39,375 $0 - $39,375 $0 - $52,750 $0 - $2,650 15% $78,751 - $488,850 $39,376…arrow_forwardRobert is a single taxpayer who has an AGI of $145,000 in 2020, his taxable income is $122,000. What is his federal tax liability in 2020? a.) $23,590.50 b.) $8,75400 c.) $29,280.00 d.) $18,719.00 e.) $23,454.50arrow_forward

- Hardevarrow_forwardA9arrow_forwardLacy is a single taxpayer. In 2021, her taxable income is $42,000. What is her tax liability in each of the following alternative situations? Use Tax Rate Schedule, Dividends and Capital Gains Tax Rates for reference. (Do not round intermediate calculations. Round your answer to 2 decimal places.) a. All of her income is salary from her employer.arrow_forward

- Saved Brooklyn files as a head of household for 2023. They claimed the standard deduction of $20,800 for regular tax purposes. Their regular taxable income was $99,000. What is Brooklyn's AMTI? AMTI Description Amountarrow_forwardSusan is single and had the following tax information for the current tax year: Pension income: $58,800 Social Security benefit: 18,700 Tax-exempt interest: 3,750 How much of her SSB must Susan include in her taxable income? (Round answer to O decimal places, e.g. 5,125.) Taxable SSBs $arrow_forwardJaylen and Zan are married, filing jointly. Their total adjusted gross income was $81,000 and they qualified for the standard deduction of $24,000. Use the following 2018 tax rate schedule to calculate their 2018 federal income tax. If your filing status is married, filing jointly or surviving spouses; and taxable income is more than: but not over: your tax is: $ 0 $19,050 10% OF the taxable income $19,050 $77,400 $1905 plus 12% of the excess over $19,050 $77,400 $165,000 $8907 plus 22% of the excess over $77,400 $165,000 $315,000 $28,179 plus 24% of the excess over $165,000 $315,000 $400,000 $64,179 plus 32% of the excess over $315,000 $400,000 $600,000 $91,379 plus 35% of the excess over $400,000 $600,000 _______ $161,379 plus 37% OF THE AMOUNT OVER $600,000 Jaylen and Zan's 2018 Federal income tax is: $(Round to the nearest dollar.)What is Jaylen and Zan's effective tax rate? [Tax paid divided by taxable income]%(Write as a percent, rounded to one decimal place.)arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education