FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

Transcribed Image Text:pok

sk

int

ences

=

aw

11

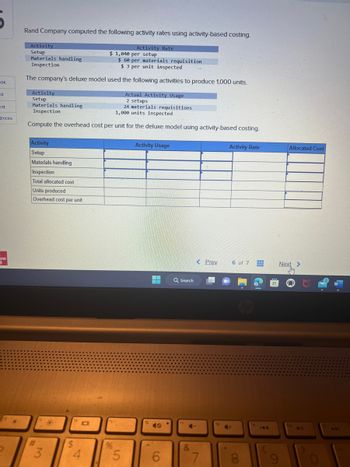

Rand Company computed the following activity rates using activity-based costing.

Activity

Setup

Materials handling

Inspection

$ 60 per materials requisition

$3 per unit inspected

The company's deluxe model used the following activities to produce 1,000 units.

Activity

Setup

Materials handling

Inspection

Actual Activity Usage

2 setups

24 materials requisitions

1,000 units inspected

Compute the overhead cost per unit for the deluxe model using activity-based costing.

Activity

Setup

Materials handling

Inspection

Total allocated cost

Units produced

Overhead cost per unit

#

2 3

*

$

10

$ 1,040 per setup

4

Activity Rate

%

5

Activity Usage

6

Q Search

17

C-

&

< Prev

7

Activity Rate

6 of 7

4+

8

Allocated Cost

Next >

DA

441

Expert Solution

arrow_forward

Step 1

Overheads are the indirect cost incurred to produce the goods or services. The overheads are not directly related to the production but these overheads are necessary to be incurred to run the business. The overheads can be allocated using the activity-based costing method.

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Beginning work in process (40% complete) Direct materials. Conversion cost Total cost of beginning work in process Number of units started Number of units completed and transferred to finished goods Ending work in process (75% complete) Current period costs Direct materials Conversion cost Total current period costs a. Reconcile the number of physical units worked on during the period. b. Calculate the number of equivalent units. Required: 1. Using FIFO method of process costing, complete each of the following steps: c. Calculate the cost per equivalent unit. d. Reconcile the total cost of work in process. Complete this question by entering your answers in the tabs below. Req 1A Req 1B Req 1C Units Req 1D ? 35,900 34,300 21,350 Costs $ 1,331,500 620,800 $ 1,952,300 $ 2,397,400 1,261,500 $ 3,658,900 Using FIFO method of process costing, reconcile the total cost of work in process. Note: Use Equivalent Units rounded to the nearest whole unit and Cost per Equivalent Unit rounded to 5…arrow_forwardComparing ABC and Plantwide Overhead Cost Assignments Wellington Chocolate Company uses activity-based costing (ABC). The controller identified two activities and their budgeted costs: Setting up equipment $396,000 Other overheard $1,240,000 Setting up equipment is based on setup hours, and other overhead is based on oven hours.Wellington produces two products, Fudge and Cookies. Information on each product is as follows: Fudge Cookies Units produced 8,000 445,000 Setup hours 7,200 1,800 Oven hours 1,000 7,000 Required: Round your answers to the nearest whole dollar, unless otherwise directed. 1. Calculate the activity rate for (a) setting up equipment and (b) other overhead. a. Setting up equipment $ per setup hour b. Other overhead $ per oven hour 2. How much total overhead is assigned to Fudge using ABC?$ 3. What is the unit overhead assigned to Fudge using ABC? Round to the nearest cent.$per unit 4. Now, ignoring the ABC…arrow_forwardISQUID Corp. has provided the following data from its activity-based costing system: Activity Cost Pool Inspection Processing Orders Assembly Total Activity 1,410 inspection hours 1,600 orders Total Cost P82,767 P60,896 P436,240 28,000 machine hours The Company makes 230 units of product of WD40 a year, requiring a total of 480 machine-hour, 50 orders, and 30 inspection-hours per year. The product's direct materials costs are P12.70 er unit and its direct labor cost is P45.93 per units. The product sells for P126.60 per unit. Using activity-based costing system, compute the product margin of WD40 per unit.arrow_forward

- Hi-T Company uses the weighted average method of process costing. Information for the company’s first production process follows. All direct materials are added at the beginning of this process, and conversion costs are added uniformly throughout the process. Units Direct Materials Conversion Percent Complete Percent Complete Beginning work in process inventory 6,000 100% 80% Completed and transferred out 27,000 Ending work in process inventory 11,000 100% 40% Beginning work in process Direct materials $ 60,000 Conversion 78,460 $ 138,460 Costs added this period Direct materials 415,000 Conversion 358,000 773,000 Total costs to account for $ 911,460 a. Compute the equivalent units of production for both direct materials and conversion.b. Compute the cost per equivalent unit for both direct materials and conversion.c. Assign costs to the department’s output—specifically, to the units transferred out and to the units in ending work…arrow_forward1. X Company uses activity-based costing for Product B and Product D. The total estimated overhead cost for the parts administration activity pool was $550,000 and the expected activity was 2000 part types. If Product D requires 1200 part types, the amount of overhead allocated to product D for parts administration would be: a) $275,000 b) $300,000 c) $330,000 d) $345,000arrow_forwardCarla Vista Industries has three activity cost pools and two products. It expects to produce 2,700 units of Product SZ09 and 1,400 of Product NZ16. Having identified its activity cost pools and the cost drivers for each pool, Carla Vista accumulated the following data relative to those activity cost pools and cost drivers. question: Assign the overhead cost to the two products: SZ09$? and NZ16$?arrow_forward

- please provide answer of this questionarrow_forwardLens Care Incorporated (LCI) manufactures specialized equipment for polishing optical lenses. There are two models - one mainly used for fine eyewear (F-32) and another for lenses used in binoculars, cameras, and similar equipment (B-13).The manufacturing cost of each unit is calculated using activity-based costing, using the following manufacturing cost pools: Cost Pools Allocation Base Costing Rate Materials handling Number of parts $ 2.50 per part Manufacturing supervision Hours of machine time $ 14.81 per hour Assembly Number of parts $ 3.35 per part Machine setup Each setup $ 56.55 per setup Inspection and testing Logged hours $ 45.55 per hour Packaging Logged hours $ 19.55 per hour LCI currently sells the B-13 model for $2,000 and the F-32 model for $1,500. Manufacturing costs and activity usage for the two products are as follows: B-13 F-32 Direct materials $ 164.55 $ 75.64 Number of parts 161 121 Machine hours 7.95 4.21 Inspection time…arrow_forwardPaparo Corporation has provided the following data from its activity-based costing system: Activity Cost Pool Total Cost $ 888,300 Assembly Processing orders $ 60,560 Inspection $ 101,572 Data concerning the company's product Q79Y appear below: Annual unit production and sales Annual machine-hours Annual number of orders Annual inspection hours Direct materials cost Direct labor cost Multiple Choice Total Activity 54,000 machine-hours 1,600 orders: 1,340 inspection-hours O $144.43 per unit 600 1,040 70 45 According to the activity-based costing system, the average cost of product Q79Y is closest to: (Round your intermediate calculations to 2 decimal places.) $49.00 per unit $ 41.13 per unitarrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education