FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

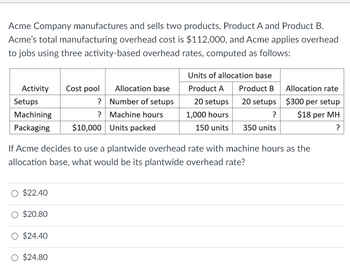

Transcribed Image Text:Acme Company manufactures and sells two products, Product A and Product B.

Acme's total manufacturing overhead cost is $112,000, and Acme applies overhead

to jobs using three activity-based overhead rates, computed as follows:

Activity

Setups

Machining

Packaging

$22.40

$20.80

Cost pool Allocation base

Number of setups

Machine hours

$24.40

$24.80

?

?

$10,000 Units packed

Units of allocation base

Product A

20 setups

1,000 hours

150 units

Product B

20 setups

?

350 units

If Acme decides to use a plantwide overhead rate with machine hours as the

allocation base, what would be its plantwide overhead rate?

Allocation rate

$300 per setup

$18 per MH

?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Rex Industries has identified three different activities as cost drivers: machine setups, machine hours, and inspections. The overhead and estimated usage are: Compute the overhead rate for each activity. Round your answers to two decimal places. Overhead Overhead Annual Rate per Activity per Activity Usage Activity Machine Setups $157,850 4,100 $ Machine Hours 324,622 14,114 2$ Inspections 119,000 3,400arrow_forwardMultiple Choice $9,907.97 $89,171.73 $5,173.02 $136.51arrow_forwardBlue Ridge Marketing Inc. manufactures two products, A and B. Presently, the company uses a single plantwide factory overhead rate for allocating overhead to products. However, management is considering moving to a multiple department rate system for allocating overhead. The following table presents information about estimated overhead and direct labor hours. Overhead DirectLabor Hours (dlh) Product A B Painting Dept. $459,138 11,800 dlh 16 dlh 2 dlh Finishing Dept. 56,203 4,900 6 20 Totals $515,341 16,700 dlh 22 dlh 22 dlh The overhead from both production departments allocated to each unit of Product B if Blue Ridge Marketing Inc. uses the multiple production department factory overhead rate method isarrow_forward

- naion manufactures two models of office chairs, a standard and a deluxe model. The following activity and cost information has been compiled: Number of Number of Number of Product Setups Components Direct Labor Hours 16 Standard 265 Deluxe 34 14 245 Overhead costs $50,000 $58.900 Nrter of setups and number of components are identified as activity- cost drivers for overhead. Assuming an activity - based costing system is used, what is the total amount of overhead costs assigned to the standard modela OA $54,600 OB $77 400 OC. S54,450 O0 $31.500 O Time Remaining: 02:58:03 Nextarrow_forwardAngler Industries produces a product which goes through two operations, Assembly and Finishing, before it is ready to be shipped. Next year's expected costs and activities are shown below. Direct labor hours Machine hours Overhead costs Multiple Choice O $15.60. O Assume that the Assembly Department allocates overhead based on machine hours, and the Finishing Department allocates overhead based on direct labor hours. How much total overhead will be assigned to a product that requires 1 direct labor hour and 3.4 machine hours in the Assembly Department, and 4.0 direct labor hours and 0.6 machine hours in the Finishing Department? $3.40 Assembly 190,000 DLH 390,000 MH $16.10. $ 390,000 Finishing) 149,000 DLH: 95,550 MH $ 581,100arrow_forwardBoswell Company manufactures two products, Regular and Supreme. Boswell's overhead costs consist of machining. $2400000; and assembling. $1200000. Information on the two products is: Direct labor hours Machine hours Number of parts Regular Supreme 10000 15000 30000 90000 160000 Ⓒ$2568000 $1440000. $2160000. $1032000. 10000 Overhead applied to Regular using activity-based costing isarrow_forward

- Aileen Co manufactures two components, L and M. Both components are manufactured on the machine ZX. The following cost information per unit of L and M is available: Direct material Direct labour Variable overhead Fixed overhead Total cost L M ($) ($) 12 18 25 15 8 7 6 46 10 55 Component L requires three hours on machine ZX and component M requires five hours. Manufacturing requirements show a need for 1,500 units of each component per week. The maximum number of machine ZX hours available per week is 10,000. An external supplier has offered to supply Aileen Co with the components for a price of $57 per component L and $55 per component M. Identify, by clicking on the relevant boxes in the table below, whether each of the following statements are true or false. would be cheaper for Aileen Co to produce all the components in-house if the hours on machine ZX were available Aileen Co should purchase 400 units of component M from the external supplier TRUE TRUE FALSE FALSEarrow_forwardDoles Corporation uses the following activity rates from its activity-based costing to assign overhead costs to products. Activity Cost Pools Setting up batches Processing customer orders Assembling products Data concerning two products appear below: Number of batches Number of customer orders Number of assembly hours Total overhead cost Activity Rate $69.22 per batch $26.28 per customer order $ 12.11 per assembly hour Product K52W 65 45 418 Required: How much overhead cost would be assigned to each of the two products using the company's activity-based costing system? (Round your intermediate calculations and final answers to 2 decimal places.) Product K52W Product X94T Product X94T 52 30 161arrow_forwardTolerin Company uses the FIFO method in its process costing system. Data for the Assembly Department for May appear below: Materials $41,280 Overhead $ 66,150 7,000 8,000 Cost added during May Equivalent units of production Required: Compute the cost per equivalent unit for materials, for labour, for overhead, and in total. (Round your answers to 2 decimal places.) Cost per equivalent unit Materials Labour $ 26,460 7,000 Labour Overhead $ Total 0:00 Next >arrow_forward

- Blue Ridge Marketing Inc. manufactures two products, A and B. Presently, the company uses a single plantwide factory overhead rate for allocating overhead to products. However, management is considering moving to a multiple department rate system for allocating overhead. The following table presents information about estimated overhead and direct labor hours. Overhead Direct LaborHours (dlh) Product A B Painting Dept. $248,000 10,000 dlh 16 dlh 4 dlh Finishing Dept. 72,000 10,000 4 16 Totals $320,000 20,000 dlh 20 dlh 20 dlh Using a single plantwide rate, determine the overhead rate per unit for Blue Ridge Marketing Inc.'s Product B.arrow_forwardRequlred Informatlon Greenwood Company manufactures two products-13,000 units of Product Y and 5,000 units of Product Z. The company uses a plantwide overhead rate based on direct labor-hours. It is considering implementing an activity-based costing (ABC) system that allocates all of its manufacturing overhead to four cost pools. The following additional information is available for the company as a whole and for Products Y and Z: Estimated Overhead Activity Cost Pool Machining Machine setups Production design General factory Activity Measure Machine-hours Number of setups Number of products Direct labor-hours Expected Activity 12, 000 МHs 220 setups 2 products 12,000 DLHS Cost $ 242,400 $ 114,400 $ 86,000 $ 302,400 Activity Measure! Machining Number of setups Number of products Direct labor-hours, Product Y 8,200 40 1. 8,200 Product Z 3,800 180 3,800 3. What is the activity rate for the Machining activity cost pool? (Round your answer to2 declmal places.) Activity rate per MH 15…arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education