FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

Transcribed Image Text:-

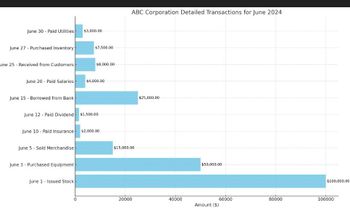

June 30 Paid Utilities

$3,000.00

June 27 - Purchased Inventory

une 25 - Received from Customers

$7,500,00

$8,000.00

June 20 - Paid Salaries

$4,000.00

June 15 - Borrowed from Bank

June 12 - Paid Dividend

$1,500.00

June 10 Paid Insurance

$2,000.00

June 5 - Sold Merchandise

June 3 - Purchased Equipment

June 1 Issued Stock

ABC Corporation Detailed Transactions for June 2024

$15,000.00

$25,000.00

$50,000.00

$100,000.00

0

20000

40000

60000

80000

100000

Amount ($)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- P. P. Bank loan payable-current portion P. 26,000 21,000 P. P. P. Bank loan payable-non-current portion 382,000 217,000 P. Common shares P. 196,000 89,000 Retained earnings 41,000 26,000 P. P. P. Total liabilities and shareholders' equity $695,000 $396.000 P. P. P. P. Additional information regarding 2021: P. P. 1. Net income was $52,000. P. P. P. 2. A gain of $9,000 was recorded on the disposal of a small parcel of land. No land was purchased during the year. A gain on the disposal of $39,000 was recorded when an old building was sold for $57,000 cash. A new building was purchased for $367.000 and depreciation expense on buildings for the year was $60,000. 3. P. P. P. P. Equipment costing $68.000 was purchased while a loss of $9,000 was recorded on equipment that was sold for $5,000. The equipment that was sold late in the year had accumulated depreciation of $11,000. 4. 5. The company took out $205,000 of new bank loans during the year. 6. Dividends were declared and paid and no…arrow_forwardComputing Financial Statement Measures The following pretax amounts are taken from the adjusted trial balance of Mastery Inc. on December 31, 2020, its annual year-end. Assume that the income tax rate for all items is 25%. The average number of common shares outstanding during the year was 20,000. Balance, retained earnings, December 31, 2019 $ 45,000 Sales revenue 300,000 Cost of goods sold 105,000 Selling expenses 36,000 Administrative expenses 34,000 Gain on sale of investments 10,000 Unrealized holding gain on debt investments, net of tax 4,250 Prior period adjustment, understatement of depreciation from prior period (2019) 20,000 Dividends declared and paid 16,000 Required Compute the following amounts for the year-end financial statements of 2020. Do not use negative signs with any of your answers. Round the per share amount to two decimal places. Item Amount a. Gross profit (2020). b. Operating income (2020). c. Net…arrow_forwardWhat is Ratio Corporation's Current Ratio at 12/31/2021? Question 2 options: 2.11 2.22 1.21 None of these optionsarrow_forward

- Balance Sheet Nicole Corporation's year-end 2019 balance sheet lists current assets of $753,000, fixed assets of $603,000, current liabilities of $542,000, and long-term debt of $697,000. What is Nicole's total stockholders' equity? Multiple Choice О о $117,000 $1,356,000 There is not enough information to calculate total stockholder's equity. $1,239,000arrow_forwardMr. X was an employee with the following information from his employment in 2020. Salaries and wages - $27,000 RRSP contribution in 2020 - $5,500 Membership dues paid by Mr. X - $500 Calculate Mr. X's the net employment income for 2020? Question 7 options: a) $21,500 b) $27,500 c) $21,000 d) $27,000arrow_forwardQuestion 66 Using Financial Statements for 2018-2019. Net asset value per share of preferred stock for 2019 is $685.71. TRUE OR FALSE?arrow_forward

- Accounts payable Accounts receivable Accumulated depreciation-buildings Additional paid-in capital in excess of par-common From treasury stock Allowance for doubtful accounts Bonds payable Buildings Cash Common stock ($1 par) Dividends payable (preferred stock-cash) Inventory Land SHEFFIELD CORPORATION Post-Closing Trial Balance December 31, 2025 Preferred stock ($50 par) Prepaid expenses Retained earnings Treasury stock (common at cost) Totals Authorized Issued Outstanding Common 585,000 195,000 Dr. 164,000 $513,000 1,489,000 203,000 579,000 392,000 42,000 181,000 $3,399,000 Preferred 66,000 11,000 Cr. $405,100 At December 31, 2025, Sheffield had the following number of common and preferred shares. 11,000 195,000 1,310,000 150,000 27,000 292,000 195,000 3,900 550,000 271,000 $3,399,000 The dividends on preferred stock are $4 cumulative. In addition, the preferred stock has a preference in liquidation of $50 per share. Prepare the stockholders' equity section of Sheffield's balance…arrow_forwardine following intormation pertains tO Alpha Computing at the ena of 2021: Assets $957,500 $452,500 $270,000 $330,000 Liabilities Net Income Common Stock Alpha Computing's Retained Earnings account had a zero balance at the beginning of 2021. What amount of dividends did the company declare 2021? Multiple Choice $96,000 $97,000 $98,000 $95.000arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education