Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

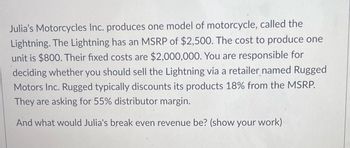

Transcribed Image Text:Julia's Motorcycles Inc. produces one model of motorcycle, called the

Lightning. The Lightning has an MSRP of $2,500. The cost to produce one

unit is $800. Their fixed costs are $2,000,000. You are responsible for

deciding whether you should sell the Lightning via a retailer named Rugged

Motors Inc. Rugged typically discounts its products 18% from the MSRP.

They are asking for 55% distributor margin.

And what would Julia's break even revenue be? (show your work)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Rolf's Golf store sells golf balls for $32 per dozen. The store's overhead expenses are 30% of cost and the owners require a profit of 19% of cost. a. How much does Rolf's Golf store buy the golf balls for? b. What is the price needed to cover all the costs and expenses? c. What is the highest rate of markdown at which the store will still break even? d. What markdown rate would price the golf balls at cost? Anna sells a certain pair of earrings at her store for $46.40 per pair. Her overhead expenses are $6.00 per pair and she makes 55.00% operating profit on selling price.Round to the nearest cent. a. What is her amount of markup per pair of earrings? b. How much does it cost her to purchase each pair of earrings?arrow_forwardFish Finder Company manufactures sonars for fishing boats. Model 100 sells for $400. They produce and sell 6,000 units per year. Cost data are as follows: $25 $65 $15 $280,000 An offer has come in for a one-time sale of 300 units at a special price of $130 per unit. The marketing manager says. that the sale will not affect the company's regular sales activities, and that it will not require any variable selling and administrative costs. The production manager says that there is plenty of excess capacity and the sale will not impact fixed costs in any way. What is the effect this deal on operating income? Direct Materials Direct Labor Variable manufacturing overhead Fixed manufacturing overhead increases by $7,500 increases by $2,100 O increases by $400 decreases by $7,500 per unit per unit per unit per yeararrow_forwardTupper Inc. and Victory Inc. are two small clothing companies that are considering leasing a dyeing machine together. The companies estimated that in order to meet production, Tupper needs the machine for 950 hours and Victory needs it for 700 hours. If each company rents the machine on its own, the fee will be $85 per hour of usage. If they rent the machine together, the fee will decrease to $80 per hour of usage. Read the requirements. Requirement 1. Calculate Tupper's and Victory's respective share of fees under the stand-alone cost-allocation method. (Do not round intermediary calculations. Only round the amount you input in the cell to the nearest dollar.) Stand-alone Tupper Victoryarrow_forward

- Diamond Boot Factory normally sells its specialty boots for $23 a pair. An offer to buy 105 boots for $16 per pair was made by an organization hosting a national event in Norfolk. The variable cost per boot is $8, and special stitching will add another $3 per pair to the cost. Determine the differential income or loss per pair of boots from selling to the organization.$ Should Diamond Boot Factory accept or reject the special offer?arrow_forwardMonica is a manufacturer of handcrafted wooden signs. The variable cost of each wooden sign Monica produces is $40. Monica sells her wooden signs to a wholesaler at a 50% margin, who then sells the wooden signs to the retailer at an undisclosed markup (%). The retailer then adds a 30% margin and sells the product to the consumer at $160. Based on this information, what is the markup (%) of the wholesaler? 40% 20% 60 50%arrow_forwardDiamond Boot Factory normally sells its specialty boots for $35 a pair. An offer to buy 125 boots for $31 per pair was made by an organization hosting a national event in Norfolk. The variable cost per boot is $12, and special stitching will add another $2 per pair to the cost. Determine the differential income or loss per pair of boots from selling to the organizatioarrow_forward

- Henry Sweet Company currently makes 6-inch candy sticks that it sells for $0.20 each. Henry can make 12-inch candy sticks out of two 6-inch candy sticks by melting them together, which costs an additional $0.03 per 12-inch stick. Henry can sell the 12-inch sticks for $0.45. Henry has enough capacity to make 10,000 6-inch candy sticks per month, and enough demand to sell all of the candy sticks it can manufacture, whether 6- inch or 12-inch. Should Henry sell 6-inch or 12-inch candy sticks, and how much additional profit will its decision bring in per month? Multiple Choice O O Sell 6-inch sticks, additional $100 Sell 6-inch sticks, additional $250 Sell 12-inch sticks, additional $100 Sell 12-inch sticks, additional $250arrow_forwardMiller Books is considering publishing a book about meditation. The fixed costs to publish the book is estimated at $160,000. Variable material costs are estimated at $6 per book. Demand over the life of the textbook is estimated at 4,000 copies. Miller books anticipates that they can sell the books for $46 per unit. a) Write an expression for total revenue b) Write an expression for total cost c) Write an expression for total profit d) Find the break-even point e) Recommend a strategy if Miller will not be able to sell more than 3,500 copies.arrow_forwardRoe manufactures and sells cloth facial masks. Per unit direct material and direct labor costs are $1 and $2 respectively. Other than these costs, Roe pays $1,000 for rent, $1,500 for the floor manager's salary, and recognizes $300 depreciation on the equipment every month. Roe sells each mask at $10. If Roe sells 500 masks, what would be Roe's total revenue and total costs? Group of answer choices Total revenue: 5,000; Total costs: 1,500 Total revenue: 5,000; Total costs: 4,300 Total revenue: 3,500; Total costs: 1,500 Total revenue: 3,500; Total costs: 2,800arrow_forward

- Tim's Bicycle Shop sells 21-speed bicycles. For purposes of a cost-volume-profit analysis, the shop owner has divided sales into two categories, as follows: product type high quality medium quality price invoice cost 840 620 sales commission sales price 1850 920 100 40 Three-quarters of the shop's sales are medium-quality bikes. The shop's annual fixed expenses are $270,400. (In the following requirements, ignore income taxes.) a. What is the shop's break-even sales volume in dollars? Assume a constant sales mix. b. How many bicycles of each type must be sold to earn a target net income of $126,750? Assume a constant sales mix.arrow_forwardSnow Now sells snowboards. Snow Now knows that the most people will pay for the snowboards is $129.99. Snow Now is convinced that it needs a 45% markup based on cost. The most that Snow Now can pay to its supplier for the snowboards is: A. $88.65 B. $98.65 C. $96.65 D. None of these E. $87.65arrow_forwardCrane, Inc., sells two types of water pitchers, plastic and glass. Plastic pitchers cost the company $30 and are sold for $40. Glass pitchers cost $26 and are sold for $47. All other costs are fixed at $280,800 per year. Current sales plans call for 14,000 plastic pitchers and 28,000 glass pitchers to be sold in the coming year. Crane, Inc., has just received a sales catalog from a new supplier that is offering plastic pitchers for $28. What would be the new contribution margin per unit if managers switched to the new supplier? What would be the new breakeven point if managers switched to the new supplier? (Use contribution margin per unit to calculate breakeven units. Round answers to 0 decimal places, e.g. 25,000.)arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education