FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

thumb_up100%

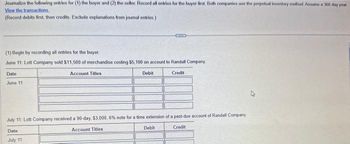

Transcribed Image Text:Journalize the following entries for (1) the buyer and (2) the seller. Record all entries for the buyer first. Both companies use the perpetual inventory method Assume a 360 day year

View the transactions.

(Record debits first, then credits. Exclude explanations from journal entries.)

(1) Begin by recording all entries for the buyer.

June 11: Lott Company sold $11,500 of merchandise costing $5,100 on account to Randall Company,

Account Titles

Debit

Credit

Date

June 111

July 11: Lott Company received a 90-day, $3,000, 6% note for a time extension of a past-due account of Randall Company

Account Titles

Debit

Credit

Date

July 11

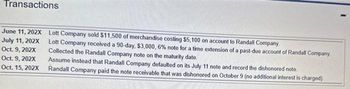

Transcribed Image Text:Transactions

June 11, 202X

July 11, 202X

Oct. 9, 202X

Oct. 9, 202X

Oct. 15, 202X

Lott Company sold $11,500 of merchandise costing $5,100 on account to Randall Company.

Lott Company received a 90-day, $3,000, 6% note for a time extension of a past-due account of Randall Company.

Collected the Randall Company note on the maturity date.

Assume instead that Randall Company defaulted on its July 11 note and record the dishonored note

Randall Company paid the note receivable that was dishonored on October 9 (no additional interest is charged).

1

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps with 4 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- John's Specialty Store uses a perpetual inventory system. The following are some inventory transactions for the month of May: 1. John's purchased merchandise on account for $5,500. Freight charges of $550 were paid in cash. 2. John's returned some of the merchandise purchased in (1). The cost of the merchandise was $850 and John's account was credited by the supplier. 3. Merchandise costing $3,050 was sold for $5,700 in cash. Required: Prepare the necessary journal entries to record these transactions. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.) Journal entry worksheet 1 2 3 4 5 Record the merchandise purchased on account for $5,500. Note: Enter debits before credits. Transaction General Journal Debit Credit 1a Record entry Clear entry View general journal 1b Record the payment of freight charges for $55o. 2. Record the return of merchandise purchased on account costing $850. 3a. Record the sale of merchandise for…arrow_forwardCheese Factory uses a perpetual inventory system. The following activities occurred during May: • May 2 - Cheese Factory purchased $45,000 worth of inventory, on credit terms 3/10 n/30. . May 5 - Cheese Factory returned $5,000 worth of that inventory to the supplier. • May 9 - Cheese Factory paid for the inventory, taking advantage of all available discounts. Required: Prepare the journal entries to record the transactions above using the gross method. Use the MSWord link for the table to write your journal entries. After you have written the journal entries on the table in the MSWord document provided, put your name below the table on the document, save the document and then upload it to this problem in the upload space provided at the bottom of this box.arrow_forwardJournalize the following transactions that occurred in March for Downton Company. Assume Downton uses the periodic inventory system. No explanations are needed. Identify each accounts payable and accounts receivable with the vendor or customer name. Downton estimates sales returns at the end of each month. (Record debits first, then credits. Exclude explanations from journal entries. Assume the company records sales at the net amount. Round all amounts to the nearest whole dollar.) More info Mar. 3 Mar. 4 Mar. 4 Mar. 6 Mar. 8 Mar. 9 Mar. 10 Mar. 12 Mar. 13 Mar. 15 Mar. 22 Mar. 23 Mar. 25 Mar. 29 Mar. 30 Purchased merchandise inventory on account from Sherry Wholesalers, $4,000. Terms 1/15, n/EOM, FOB shipping point. Paid freight bill of $90 on March 3 purchase. Purchase merchandise inventory for cash of $1,900. Returned $1,100 of inventory from March 3 purchase. Sold merchandise inventory to Hillis Company, $2,500, on account. Terms 1/15, n/35. Purchased merchandise inventory on…arrow_forward

- Sant Summa is a retailer that purchases merchandise inventory from Lee Co. Sant Summa record inventory purchases using the gross method and the perpetual inventory system. Sant Summa started the month of July with $2,000 in inventory. Required: Record the journal entries for the following transactions Calculate Sant Summa's Cost of Goods Available for Sale based on the above information. Calculate Sant Summa's Ending Inventory based on the above information. 2-Jul Purchased $5,200 of merchandise inventory from Lee Co. with credit terms 2/15, n60 and FOB shipping point. (Inventory cost Lee $4,000) 3-Jul Paid $350 for shipping charges for the May 2 purchase. 4-Jul Sant Summa returned $200 of damaged merchandise inventory to Lee Co. (inventory cost to Lee of $170) 13-Jul Paid the appropriate amount for the Lee Co. purchases of July 2, taking all discounts. (Lee…arrow_forwardThe following purchase transactions occurred during the last few days of Whilczel Company's business year, which ends October 31, or in the first few days after that date. A periodic inventory system is used. · An invoice for P6,000, terms FOB shipping point, was received and entered November 1. The invoice shows that the material was shipped October 29, but the receiving report indicates receipt of goods on November 3. · An invoice for P2,700, terms FOB destination, was received and entered November 2. The receiving report indicates that the goods were received October 29. · An invoice for P3,150, terms, FOB shipping point, was received October 15, but never entered. Attached to it is a receiving report indicating that the goods were received October 18. Across the face of the receiving report is the following notation: "Merchandise not of the same quality as ordered - returned for credit October 19". · An invoice for P3,600 terms FOB shipping…arrow_forwardOn October 5, your company buys and receives inventory costing $5,900, on terms 2/30, n/60. On October 20, your company pays the amount owed relating to the October 5 purchase.Prepare the journal entries needed on October 5 and 20, assuming the company uses a perpetual system and records purchase discounts using the gross method.arrow_forward

- Haresharrow_forwardTeal Mountain, Inc. uses a perpetual inventory system. Its beginning inventory consists of 200 units that cost $ 220 each. During August, the company purchased 255 units at $ 220 each, returned 4 units for credit, and sold 375 units at $ 340 each. Journalize the August transactions. (Credit account titles are automatically indented when the amount is entered. Do not indent manually.)arrow_forwardNixa Office Supply uses a perpetual inventory system. On September 12, Nixa Office Supply sold 26 calculators costing $23 for $31 each to Sura Book Store, terms n/30. Journalize the September 12 transaction for Nixa. (Credit account titles are automatically indented when amount is entered. Do not indent manually) Debit Credit Date Account Titles and Explanation Sept. 12 (To record credit sale) Sept. 12 (To record cost of merchandise sold)arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education