FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

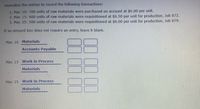

Transcribed Image Text:Journalize the entries to record the following transactions:

1. Mar. 10: 700 units of raw materials were purchased on account at $6.00 per unit.

2. Mar. 15: 600 units of raw materials were requisitioned at $6.50 per unit for production, Job 872.

3. Mar. 25: 500 units of raw materials were requisitioned at $6.00 per unit for production, Job 879.

If an amount box does not require an entry, leave it blank.

Mar. 10 Materials

Accounts Payable

Mar. 15 Work in Process

Materials

Mar, 25 Work in Process

Materials

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Journalize the following transactions for Becah's Bakery: Becah's Bakery a. Incurred and paid Website expenses, $2,820. b. Incurred manufacturing wages of $10,600, of which 70% was for direct labor and 30% of which was for indirect labor. c. Purchased raw materials on account, $19,430. d. Used in production: direct materials, $8,070; indirect materials $3,800. e. Recorded manufacturing overhead: depreciation on plant, $14,140; plant insurance (previously paid), $1,410; plant property tax, $3,900 (credit Property Tax Payable). f. Allocated manufacturing overhead to jobs, 230% of direct labor costs. g. Completed production on jobs with costs of $36,650. h. Sold inventory on account, $26,780; cost of goods sold, $12,620. i. Adjusted for overallocated or underallocated overhead.arrow_forwardb. Materials requisitioned, $680,000, of which $75,800 was for general factory use. Entry Description Debit Credit b. Work in Process fill in the blank 6 fill in the blank 7 Factory Overhead fill in the blank 9 fill in the blank 10 Materials fill in the blank 12 fill in the blank 13 c. Factory labor used, $756,000, of which $182,000 was indirect. Entry Description Debit Credit c. Work in Process fill in the blank 15 fill in the blank 16 Factory Overhead fill in the blank 18 fill in the blank 19 Wages Payable fill in the blank 21 fill in the blank 22arrow_forward[The following information applies to the questions displayed below.]Information on Kwon Manufacturing’s activities for its first month of operations follows: Purchased $101,700 of raw materials on credit. Materials requisitions show the following materials used for the month. Job 201 $ 49,900 Job 202 25,300 Total direct materials 75,200 Indirect materials 10,320 Total materials used $ 85,520 Time tickets show the following labor used for the month. Job 201 $ 40,900 Job 202 14,300 Total direct labor 55,200 Indirect labor 25,900 Total labor used $ 81,100 Applied overhead to Job 201 and to Job 202 using a predetermined overhead rate is 80% of direct materials cost. Transferred Job 201 to Finished Goods Inventory. (1) Sold Job 201 for $168,860 on credit. (2) Record cost of goods sold for Job 201. Incurred the following actual other overhead costs for the month. Depreciation of factory equipment $ 33,700 Rent on factory building (payable)…arrow_forward

- Journalize the following transactions for Becah's Bakery: Becah's Bakery a. Incurred and paid Website expenses, $2,650. b. Incurred manufacturing wages of $9,800, of which 80% was for direct labor and 20% of which was for indirect labor. c. Purchased raw materials on account, $18,930. d. Used in production: direct materials, $7,980; indirect materials $3,600. e. Recorded manufacturing overhead: depreciation on plant, $14,740; plant insurance (previously paid), $1,430; plant property tax, $3,630 (credit Property Tax Payable). f. Allocated manufacturing overhead to jobs, 230% of direct labor costs. g. Completed production on jobs with costs of $35,980. h. Sold inventory on account, $25,110; cost of goods sold, $12,240. i. Adjusted for overallocated or underallocated overhead.arrow_forwarddon't give answer in image formatarrow_forwardJournalize the following transactions for Becah's Bakery:Becah's Bakery a. Incurred and paid Website expenses, $2,790. b. Incurred manufacturing wages of $10,600, of which 60% was for direct labor and 40% of which was for indirect labor. c. Purchased raw materials on account, $18,370. d. Used in production: direct materials, $8,040; indirect materials $3,650. e. Recorded manufacturing overhead: depreciation on plant, $14,410; plant insurance (previously paid), $1,370; plant property tax, $3,750 (credit Property Tax Payable). f. Allocated manufacturing overhead to jobs, 230% of direct labor costs. g. Completed production on jobs with costs of $36,960. h. Sold inventory on account, $25,690; cost of goods sold, $11,380. i. Adjusted for overallocated or underallocated overhead. Journal Date Description Debit Credit a. a. b. b. b. c. c. d. d. d. e. e.…arrow_forward

- Record the journal entries for the following transactions: March 10: 600 units of raw materials were purchased on account at $6.00 per unit. March 15: 500 units of raw materials were requisitioned at $6.50 per unit for production, Job 872. March 25: 400 units of raw materials were requisitioned at $6.00 per unit for production, Job 879. March 10 fill in the blank 2 fill in the blank 4 March 15 fill in the blank 6 fill in the blank 8 March 25 fill in the blank 10 fill in the blank 12arrow_forwardSterling's records show the work in process inventory had a beginning balance of $5,000 and an ending balance of $4,000. How much direct labor was incurred if the records also show: Materials used $1,600 Overhead applied 400 Cost of goods manufactured 7,700 $fill in the blank 1arrow_forwardOn May 7, Lockmiller Company purchased on account 12,000 units of materials at $6 per unit. During May, raw materials were requisitioned for production as follows: 8,400 units for Job 275 at $6 per unit and 2,150 units for Job 310 at $4 per unit. Required: Journalize the entry on May 7 to record the purchase and on May 31 to record the requisition from the materials storeroom. Refer to the chart of accounts for the exact wording of the account titles. CNOW journals do not use lines for journal explanations. Every line on a journal page is used for debit or credit entries. CNOW journals will automatically indent a credit entry when a credit amount is entered. Chart of Accounts CHART OF ACCOUNTS Lockmiller Company General Ledger ASSETS 110 Cash 121 Accounts Receivable 125 Notes Receivable 126 Interest Receivable 131 Materials 132 Work in Process 133 Factory Overhead 134 Finished Goods 141 Supplies 142 Prepaid Insurance…arrow_forward

- Record the amount in each account affected by the transactions/adjustments below. Note: These are not complete journal entries not all rows will have more than one entry and they will not balance like previous transactions. Beginning Inventory Purchased $10,000 of raw materials Transferred $13,000 direct materials to factory for production. Production required $7,200 of direct labor. Applied overhead at $2 per each dollar of direct Completed work on production costing $32,120. Sold products that cost $17,530 to produce for $35,000 in sales. Actual overhead totaled $16,000. Ending Balances Raw Materials $12,500 Work In Process $3,600 Finished Goods Cost of Goods Sold $5,980 Sales $0 $0 $12,500 $3,600 $5,980 $0 $0arrow_forwardFortune Company had beginning raw materials inventory of $9,900. During the period, the company purchased $55,500 of raw materials on account. If the ending balance in raw materials was $6,900, the amount of raw materials transferred to work in process is: Multiple Choice $52,500. $58,500. $55,500. $62,400.arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education