FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

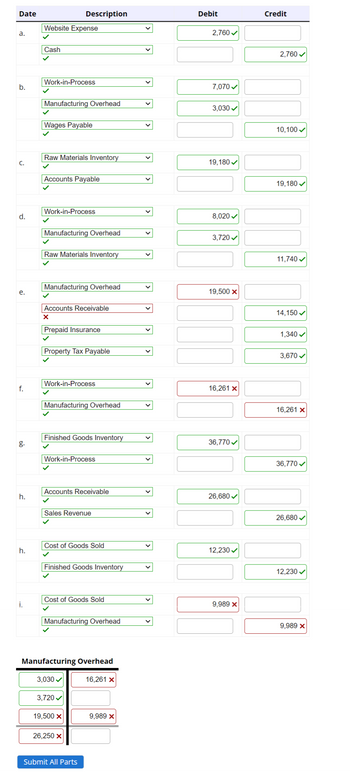

ournalize the following transactions for Becah's Bakery:

Becah's Bakery

| a. Incurred and paid Website expenses, $2,760. |

|---|

| b. Incurred manufacturing wages of $10,100, of which 70% was for direct labor and 30% of which was for indirect labor. |

| c. Purchased raw materials on account, $19,180. |

| d. Used in production: direct materials, $8,020; indirect materials $3,720. |

| e. Recorded manufacturing |

| f. Allocated manufacturing overhead to jobs, 230% of direct labor costs. |

| g. Completed production on |

| h. Sold inventory on account, $26,680; cost of goods sold, $12,230. |

| i. Adjusted for overallocated or underallocated overhead. |

Transcribed Image Text:Date

a.

b.

C.

d.

e.

f.

g.

h.

h.

Website Expense

Cash

Work-in-Process

Manufacturing Overhead

Wages Payable

Raw Materials Inventory

Accounts Payable

Work-in-Process

Description

Manufacturing Overhead

Raw Materials Inventory

Manufacturing Overhead

✓

Accounts Receivable

X

Prepaid Insurance

✓

Property Tax Payable

Work-in-Process

Manufacturing Overhead

Finished Goods Inventory

Work-in-Process

Accounts Receivable

Sales Revenue

Cost of Goods Sold

Finished Goods Inventory

Cost of Goods Sold

Manufacturing Overhead

Manufacturing Overhead

3,030✔

3,720✔

19,500 ×

26,250 X

Submit All Parts

16,261 X

9,989 X

V

Debit

2,760 ✓

7,070 ✓

3,030✔

19,180✔

8,020✔

3,720✔

19,500 ×

16,261 X

36,770✔

26,680✔

12,230✔

9,989 x

Credit

2,760 ✓

10,100✔

19, 180✔

11,740✔

14,150 ✓

1,340 ✓

3,670 ✓

16,261 X

36,770✔

26,680✔

12,230✔

9,989 x

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- ournalize the following transactions for Becah's Bakery: Becah's Bakery a. Incurred and paid Website expenses, $2,610. b. Incurred manufacturing wages of $10,900, of which 70% was for direct labor and 30% of which was for indirect labor. c. Purchased raw materials on account, $18,040. d. Used in production: direct materials, $7,970; indirect materials $3,630. e. Recorded manufacturing overhead: depreciation on plant, $14,190; plant insurance (previously paid), $1,440; plant property tax, $3,650 (credit Property Tax Payable). f. Allocated manufacturing overhead to jobs, 230% of direct labor costs. g. Completed production on jobs with costs of $35,580. h. Sold inventory on account, $25,980; cost of goods sold, $12,650. i. Adjusted for overallocated or underallocated overhead.arrow_forwardJournalize the following transactions for Becah's Bakery: Becah's Bakery a. Incurred and paid Website expenses, $2,650. b. Incurred manufacturing wages of $9,800, of which 80% was for direct labor and 20% of which was for indirect labor. c. Purchased raw materials on account, $18,930. d. Used in production: direct materials, $7,980; indirect materials $3,600. e. Recorded manufacturing overhead: depreciation on plant, $14,740; plant insurance (previously paid), $1,430; plant property tax, $3,630 (credit Property Tax Payable). f. Allocated manufacturing overhead to jobs, 230% of direct labor costs. g. Completed production on jobs with costs of $35,980. h. Sold inventory on account, $25,110; cost of goods sold, $12,240. i. Adjusted for overallocated or underallocated overhead.arrow_forwardJournalize the following transactions for Becah's Bakery:Becah's Bakery a. Incurred and paid Website expenses, $2,790. b. Incurred manufacturing wages of $10,600, of which 60% was for direct labor and 40% of which was for indirect labor. c. Purchased raw materials on account, $18,370. d. Used in production: direct materials, $8,040; indirect materials $3,650. e. Recorded manufacturing overhead: depreciation on plant, $14,410; plant insurance (previously paid), $1,370; plant property tax, $3,750 (credit Property Tax Payable). f. Allocated manufacturing overhead to jobs, 230% of direct labor costs. g. Completed production on jobs with costs of $36,960. h. Sold inventory on account, $25,690; cost of goods sold, $11,380. i. Adjusted for overallocated or underallocated overhead. Journal Date Description Debit Credit a. a. b. b. b. c. c. d. d. d. e. e.…arrow_forward

- The journal entry to record $1,500 of direct labor and $250 of indirect labor incurred will include debit(s) to the ________. A. Work−in−Process Inventory account for $1,500 and Manufacturing Overhead account for $250 B. Manufacturing Overhead account for $1,750 C. Finished Goods Inventory account for $1,750 D. Work−in−Process Inventory account for $1,500 and Finished Goods Inventory account forarrow_forwardA-Compute cost of goods manufactured. B- Compute cost of goods Sold. Complete both A and Barrow_forwardplease explain in stepsarrow_forward

- During July 20X1, Kali Co. purchased and issued the following materials and supplies. Purchases Issues from Storeroom Materials $ 62,000 Direct materials $ 52,000 Manufacturing supplies 4,200 Manufacturing supplies 3,700 Required: Give the entry in general journal form to record the cost of the materials purchasearrow_forwardPlease do not give solution in image format thankuarrow_forwardPlease help me with required 1 and required 2 and do not give solution in image format thankuarrow_forward

- Instructions: (a) Prepare the cost of goods manufactured schedule. (b) Compute the cost of goods sold.arrow_forwardUniq Works purchased raw materials amounting to $126,000 on account and $17,000 for cash, for a total purchase of $143,000. The materials will be used to manufacture upholstery for furniture manufacturers on a contract basis. Which of the following journal entries correctly records this transaction? OA. Finished Goods Inventory Accounts Payable B. Raw Materials Inventory Cash Accounts Payable OC. Work-in-Process Inventory Accounts Payable OD. Accounts Payable Cash- Raw Materials Inventory 143,000 143,000 143,000 126,000 17,000 143,000 17,000 126,000 143,000 143,000 1earrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education