Concept explainers

Journalize the

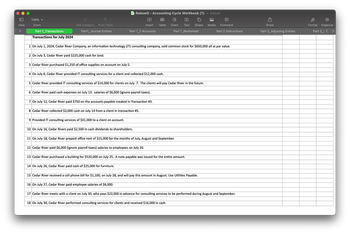

1. To record rent expense. (Three months of rent was prepaid earlier in the month.)

2. To record office supplies used. (A physical count revealed $625 of office supplies on hand at the end of the month.)

3. To record

4. To record depreciation on the building. (The building has a residual value of $24,000, and estimated useful life of 20 years. Use straight line depreciation.)

5. To record service revenue earned that was collected in advance. (Cedar River has earned $11,000 of the revenue that had been collected in advance.)

6. To accrue salaries expense. (Cedar River pays $6,000 every Friday for a five-day work week - Monday through Friday. July 31 is a Tuesday. Accrue two days of salaries.)

7. To accrue interest expense. (One month's interest on the Note Payable is $250.)

8. To accrue service revenue. (Revenue of $700 has been earned. The client will pay next month.)

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

- The cleaning equipment purchased for $8,050.00 on June 3 has a 6-year life and a salvage value of $850.00. Calculate and record the straight-line cleaning equipment depreciation expense for the month.arrow_forwardWillow Creek Company purchased and installed carpet in its new general offices on April 30 for a total cost of $18,000. The carpet is estimated to have a 15-year useful life and no residual value.a. Prepare the journal entry necessary for recording the purchase of the new carpet.b. Record the December 31 adjusting entry for the partial-year depreciation expense for the carpet, assuming that Willow Creek Company uses the straight-line method.arrow_forwardYour staff person has provided you with the following journal entry for January 20x1 depreciation. The monthly deprecation is supposed to be $100.00. What is wrong with this entry?arrow_forward

- Hi there, How do I write the journal entires for this question? Thanksarrow_forwardRead the following case and record the transactions and the corresponding adjustment entries: At Caribe Music, a company dedicated to the sale of music equipment, there have been the following transactions and adjustments in the past two years. The transactions are related to the use of the shipping equipment. The depreciation method was the double declining balance. First year Transacción February 6 A used delivery truck was purchased in cash for $35,000. July 7 $700 was paid in truck repairs. December 31 Records the depreciation of the truck for the calendar year. The truck had a lifespan of 3 years. The truck had a residual of $4,500. Second year January 8 A new truck was purchased in cash for $52,000. June 10 Maintenance and repairs were performed on the truck for $625. July 9 $300 was paid for repairs to the used truck that was purchased the first year. September 19 The truck that was purchased in the first year was sold for…arrow_forwardThe following transactions and adjusting entries were completed by Legacy Furniture Co. during a three-year period. All are related to the use of delivery equipment. The double-declining-balance method of depreciation is used. Year 1 Jan. 4. Purchased a used delivery truck for $27,200, paying cash. Nov. 2. Paid garage $630 for miscellaneous repairs to the truck. Dec. 31. Recorded depreciation on the truck for the year. The estimated useful life of the truck is four years, with a residual value of $5,005 for the truck. Year 2 Jan. 6. Purchased a new truck for $49,250, paying cash. Apr. 1. Sold the used truck for $14,670. (Record depreciation to date in Year 2 for the truck.) June 11. Paid garage $450 for miscellaneous repairs to the truck. Dec. 31. Record depreciation for the new truck. It has an estimated residual value of $8,950 and an estimated life of five years. Year 3 July 1. Purchased a new truck for $53,920, paying cash. Oct. 2. Sold the truck…arrow_forward

- The following transactions and adjusting entries were completed by Legacy Furniture Co. during a 3-year period. All are related to the use of delivery equipment. The double-declining-balance method of depreciation is used. Year 1 Jan. 4. Purchased a used delivery truck for $27,680, paying cash. Nov. 2. Paid garage $725 for miscellaneous repairs to the truck. Dec. 31. Recorded depreciation on the truck for the year. The estimated useful life of the truck is 4 years, with a residual value of $4,900 for the truck. Year 2 Jan. 6. Purchased a new truck for $49,850, paying cash. Apr. 1. Sold the used truck for $15,050. (Record depreciation to date in Year 2 for the truck.) June 11. Paid garage $450 for miscellaneous repairs to the truck. Dec. 31. Record depreciation for the new truck. It has an estimated residual value of $9,185 and an estimated life of 5 years. Year 3 July 1. Purchased a new truck for $53,640, paying cash. Oct. 2. Sold the truck purchased…arrow_forwardThe following transactions and adjusting entries were completed by Legacy Furniture Co. during a three-year period. All are related to the use of delivery equipment. The double-declining-balance method of depreciation is used. Year 1 Jan. 4 Purchased a used delivery truck for $15,360, paying cash. Nov. 2 Paid garage $240 for miscellaneous repairs to the truck. Dec. 31 Recorded depreciation on the truck for the year. The estimated useful life of the truck is 4 years, with a residual value of $3,200 for the truck. Year 2 Jan. 6 Purchased a new truck for $9,000, paying cash. Apr. 1 Sold the used truck purchased on Jan. 4 of Year 1 for $6,270. (Record depreciation to date in Year 2 for the truck.) June 11 Paid garage $260 for miscellaneous repairs to the truck. Dec. 31 Record depreciation for the new truck. It has an estimated residual value of $1,600 and an estimated life of 5 years. Year 3 July 1 Purchased a new truck for $88,000, paying cash. Oct. 2 Sold the truck purchased January 6,…arrow_forwardThe ledger of Hillsboro Rental Agency on March 31 of the current year includes the following selected accounts before adjusting entries have been prepared. Assume no adjusting entries were made in Januaray or February either. Prepaid Insurance Supplies Equipment Accumulated Depreciation- Equipment Notes Payable Unearned Rent Revenue Rent Revenue Interest Expense Salaries and Wages Expense Debit $ 3,600 3,053 26,200 -0- 15,330 Credit $ 8,921 20,600 7,500 54,170arrow_forward

- Wee Small Company has an asset that was just purchased. The cost of the asset was $72,000. The company has determined that the salvage is $2,000, and the life of the asset is five years. Depreciation is to be straight-line. Journalize the entry to record depreciation for the first month of the asset’s lifearrow_forwardplease answer all the parts of the questions within 30 minutes with explanations. make sure all the parts of the question are answered else i will give negative ratings.arrow_forward

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education