FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

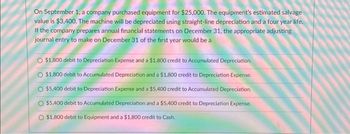

Transcribed Image Text:On September 1, a company purchased equipment for $25,000. The equipment's estimated salvage

value is $3,400. The machine will be depreciated using straight-line depreciation and a four year life.

If the company prepares annual financial statements on December 31, the appropriate adjusting

journal entry to make on December 31 of the first year would be a

O $1,800 debit to Depreciation Expense and a $1,800 credit to Accumulated Depreciation.

$1,800 debit to Accumulated Depreciation and a $1,800 credit to Depreciation Expense.

O $5,400 debit to Depreciation Expense and a $5,400 credit to Accumulated Depreciation.

$5,400 debit to Accumulated Depreciation and a $5,400 credit to Depreciation Expense.

$1,800 debit to Equipment and a $1,800 credit to Cash.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Chahal Company’s fiscal year-end is December 31. The company purchased a machine costing $129,000 on April 1, 2022. The machine is expected to be obsolete after five years (60 months), and thereafter no longer useful to the company. The estimated salvage value is $6,000. The company’s depreciation policy is to record depreciation for the portion of the year that the asset is in service. Compute depreciation expense for 2022 under the straight‑line depreciation method. (Round your answer to the nearest whole number. Do not include a $ sign in your answer.)arrow_forwardTake me to the text On July 1, 2023, Earth Corporation purchased factory equipment for $159,000. The equipment has a residual value of $7,000 and is to be depreciated over 8 years using the double- declining-balance method. Earth Corporation's year end is on September 30. Calculate the depreciation expense to be recorded for the fiscal years ending September 30, 2023, and September 30, 2024. Earth Corporation depreciates its assets based on the number of months it owned the asset during the year. Do not enter dollar signs or commas in the input boxes. Round your answers to the nearest whole number. 2023 Depreciation: $ 2024 Depreciation: $arrow_forwardBeck man Enterprise purchased a depreciable asset on October 1, Year 1 at the cost of $152,000. The asset is expected to have a salvage value of $16300 at the end of its five-year useful life. If the asset is depreciated on the double-declining-balance method, the assets book value on December 31,year 2 will be?arrow_forward

- On March 1, fixtures and equipment were purchased for $5,000 with a downpayment of $2,000 and a $3,000 note, payable in one year. Interest of 6% per year was due when the note was repaid. The estimated life of the fixtures and equipment is 9 years with no expected salvage value. [Note: Record the complete March 1 entry for the equipment purchase first, the complete March 31 depreciation adjusting entry second, and the complete March 31 interest adjusting entry third.] Account: Cash Dollar amount: -2000 Account: Fixtures and Equipment Dollar amount: 5000 Account: Notes Payable Dollar amount: 3000 Account: Fixtures and Equipment v Dollar amount: Account: Retained Earnings Dollar amount: Account: Interest Payable Dollar amount: Account: Retained Earnings Dollar amount: Account: Leave Blank Dollar amount:arrow_forwardRedhouse Corporation purchased a truck for $20,000 on January 1, 2023. The truck has an estimated salvage value of $5,000 and is expected to last five years. Redhouse Corporation prepares adjusting entries only at year-end. Which of the following is the necessary adjusting entry on December 31, 2023? (See your Chapter 3 notes, page 6) Debit Depreciation Expense—Trucks for $4,000, and credit Accumulated Depreciation—Trucks for $4,000. Debit Depreciation Expense—Trucks for $5,000, and credit Accumulated Depreciation—Trucks for $5,000. Debit Accumulated Depreciation—Trucks for $3,000, and credit Depreciation Expense—Trucks for $3,000. Debit Depreciation Expense—Trucks for $3,000, and credit Accumulated Depreciation—Trucks for $3,000. Debit Accumulated Depreciation—Trucks for $4,000, and credit Depreciation Expense—Trucks for $4,000. Debit Accumulated Depreciation—Trucks for $5,000, and credit Depreciation Expense—Trucks for $5,000.arrow_forwardCheers Delivery Company purchased a new delivery truck for $48,000 on April 1, 2019. The truck is expected to have a service life of 5 years or 120,000 miles and a residual value of $3,000. The truck was driven 10,000 miles in 2019 and 16,000 miles in 2020. Cheers computes depreciation expense to the nearest whole month. See attached questions.arrow_forward

- Lucky Lure Co. purchased a machine on October 1, 2018 for $125,000. It has a $15,000 residual value and a 10- year useful life. On July 1, 2020 the machine sold for $79,500. The company uses the double-declining-balance method of depreciation. The company fiscal year end is December 31. Instructions Prepare the journal entries for 2018 through 2020. Š A▾ B Iarrow_forwardA company purchased factory equipment for $88,000 on January 1. It is estimated that the equipment will have a $8000 salvage value at the end of its estimated 5-year useful life. If the company uses the straight-line method of depreciation, the balance is Accumulated depreciation at the end of the fifth year would bearrow_forwardPodey Company has a machine that originally cost $20,000, has accumulated depreciation of $14,000 at the beginning of the current year, and is being depreciated at $2,000 per year with the straight-line method. If the company sells the machine for $2,400 on September 30, it first records a depreciation expense of $500. $1,500. $3,600. $6,000.arrow_forward

- Vita Water purchased a used machine for $122,000 on January 2, 2020. It was repaired the next day at a cost of $9,625 and installed on a new platform that cost $1,775. The company predicted that the machine would be used for six years and would then have a $17,720 residual value. Depreciation was to be charged on a straight-line basis to the nearest whole month. A full year’s depreciation was recorded on December 31, 2020. On September 30, 2025, it was retired.Required:1. Prepare journal entries to record the purchase of the machine, the cost of repairing it, and the installation. Assume that cash was paid.1) Record the purchase of the machine 2) Record the capital repairs on the machine 3) Record installation of the machine 2. Prepare entries to record depreciation on the machine on December 31 of its first year and on September 30 in the year of its disposal. (Round intermediate calculations to the nearest whole dollar.) 1) Record the depreciation 2) Record the partical year's…arrow_forwardCheadle Company purchased a fleet of 20 delivery trucks for $8,000 each on January 2, 2019. It decided to use composite depreciation on a straight-line basis and calculated the depreciation from the following schedule: 1. Prepare the journal entries necessary to record the preceding events. 2. Assume that the company expected all the trucks to last 4 years and be retired for $1,600 each. Using group depreciation, prepare journal entries for all 6 years, assuming the company retired the trucks as shown by the latter schedule.arrow_forwardBlue Company purchases equipment on January 1, Year 1, at a cost of $600,000. The asset is expected to have a service life of 12 years and a salvage value of $54,000. Compute the amount of depreciation for each of Years 1 through 3 using the straight-line depreciation method. (Round answers to 0 decimal places, e.g. 5,125.) Depreciation for Year 1 $enter a dollar amount rounded to 0 decimal places Depreciation for Year 2 $enter a dollar amount rounded to 0 decimal places Depreciation for Year 3 $enter a dollar amount rounded to 0 decimal places Compute the amount of depreciation for each of Years 1 through 3 using the sum-of-the-years'-digits method. Depreciation for Year 1 $enter a dollar amount Depreciation for Year 2 $enter a dollar amount Depreciation for Year 3 $enter a dollar amount Part 3 Compute the amount of depreciation for each of Years 1 through 3 using the…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education