FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

Hi there,

How do I write the journal entires for this question?

Thanks

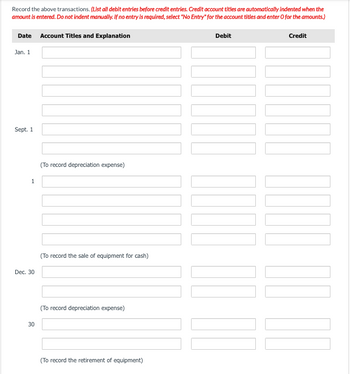

Transcribed Image Text:Record the above transactions. (List all debit entries before credit entries. Credit account titles are automatically indented when the

amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter O for the amounts.)

Date Account Titles and Explanation

Jan. 1

Sept. 1

1

Dec. 30

30

(To record depreciation expense)

(To record the sale of equipment for cash)

(To record depreciation expense)

(To record the retirement of equipment)

Debit

100000

Credit

[[

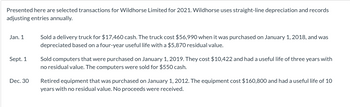

Transcribed Image Text:Presented here are selected transactions for Wildhorse Limited for 2021. Wildhorse uses straight-line depreciation and records

adjusting entries annually.

Jan. 1

Sept. 1

Dec. 30

Sold a delivery truck for $17,460 cash. The truck cost $56,990 when it was purchased on January 1, 2018, and was

depreciated based on a four-year useful life with a $5,870 residual value.

Sold computers that were purchased on January 1, 2019. They cost $10,422 and had a useful life of three years with

no residual value. The computers were sold for $550 cash.

Retired equipment that was purchased on January 1, 2012. The equipment cost $160,800 and had a useful life of 10

years with no residual value. No proceeds were received.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps with 4 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Which one is the correct answer?arrow_forwardHello i have attached two pictures. They are both used together to answer the question. The first picture is the information to use too answer the question plus the spreadsheet. The second attachment is the questions I HAVE DONE ALREADY PLEASE DO NOT ANSWER 1,2 or 3 as i have answered it already. I hope it is understandable and whoever answer this can please explain how they got the answers. I need the help I need help on question 4,5,6 4. Prepare a direct labor cost budget for march 5. Prepare a factory overhead cost budger for march 6. Prepare a cost of good sold budget for march. Work in process at the beginning of march is estimated to be $15,300, and work in process at the end of march is desire to be $14,800 please answer thesearrow_forwardfour email will be recorded when you submit this form Required Question A "balanced transaction" (DR=CR) is a guarantee that a transaction has been recorded 100% correctly. * O True False Back Next Page 6 of 25 Clea This formarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education