FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

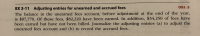

The balance in the urearned fees account, before adjustment at the end of the year, is $97,770. Of these fees, $82,220 have been earned. In addition, $34,250 of fees have been earned but have not been billed. Journalize the

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- The ledger of Sandhill Rental Agency on March 31 of the current year includes the following selected accounts, before adjusting entries have been prepared. ...Prepare the adjusting entries at March 31, assuming that adjusting enteries are made quarterly. Additional accounts are Depreciation Expense, Insurance Expense, Interest Payable, and Supplies Expense.arrow_forwardThe unearned rent account has a balance of $48,818. If $3,570 of the $48,818 is unearned at the end of the accounting period, the amount of the adjusting entry isarrow_forwardSheffield's Graphics has a December 31 year end. Sheffield's Graphics records adjusting entries on an annual basis. The following information is available.1. At the end of the year, the unadjusted balance in the Prepaid Insurance account was $2,950. Based on an analysis of the insurance policies, $2,550 had expired by year end.2. At the end of the year, the unadjusted balance in the Unearned Revenue account was $1,750. During the last week of December, $380 of the related services were performed.3. On July 1, 2024, Sheffield signed a one-year note payable for $9,000. The loan agreement stated that interest was 4%.4. Depreciation for the computer and printing equipment was $1,900 for the year.5. At the beginning of the year, Sheffield's had $700 of supplies on hand. During the year, $1,270 of supplies were purchased. A count at the end of the year indicated that $610 of supplies was left on December 31.6. Between December 28 and December 31 inclusive (4 days), three employees worked…arrow_forward

- Carla Vista Corporation has the following selected transactions during the year ended December 31, 2024: Jan. 1 Purchased a copyright for $117.480 cash. The copyright has a useful life of six years and a remaining legal life of 30 years. Mar. 1 Sept. 1 Dec. 31 Acquired a franchise with a contract period of nine years for $500,850; the expiration date is March 1, 2033, Paid cash of $38,820 and borrowed the remainder from the bank. Purchased a trademark with an indefinite life for $73,190 cash. As the purchase was being finalized, spent $33.150 cash in legal fees to successfully defend the trademark in court. Purchased an advertising agency for $640,000 cash. The agency's only assets reported on its statement of financial position immediately before the purchase were accounts receivable of $58,000, furniture of $170,000, and leasehold improvements of $320,000. Carla Vista hired an independent appraiser who estimated that the fair value of these assets was accounts receivable $58,000,…arrow_forwardPrepare the adjusting entries for the following situations:A. The supplies account balance on December 31, 2021 is $1,475. Actual supplies on hadat the end of the year was 350. Prepare the adjusting entry.B. Depreciation for the year is $7,200. Please prepare the adjusting entry.C. Fees earned but not yet billed totaled $23,750.D. Wages accrued but not paid at year end was $15,680.E. Unearned revenue had a balance of $6,900, at the end of the year you have earned$4,300. Please make the adjusting entry. 2. After the accounts have been adjusted at January 31, the end of the year, the followingbalances are taken from the ledger of Harrison's Dog Walking Service Company: Harrison Taylor, Capital $349,000Harrison Taylor, Drawing 6,000Fees Earned 124,600Wages Expense 29,000Rent Expense 43,000Supplies Expense 7,300Miscellaneous Expense 5,700arrow_forwardThe balance in the unearned fees account, before adjustment at the end of the year, is $14,310. Required: Journalize the adjusting entry required if the amount of unearned fees at the end of the year is $7,560. Refer to the Chart of Accounts for exact wording of account titles.arrow_forward

- The balance in the unearned fees account, before adjustment at the end of the year, is $13,010. Journalize the adjusting entry required if the amount of unearned fees at the end of the year is $4,110. If an amount box does not require an entry, leave it blank.arrow_forwardThe balance in the unearned fees account, before adjustment at the end of the year, is $96,470. Of these fees, $84,165 have been earned. In addition, $36,205 of fees have been earned but have not been billed. Journalize the December 31 adjusting entries (a) to adjust the unearned fees account and (b) to record the accrued fees. Refer to the chart of accounts for the exact wording of the account titles. CNOW journals do not use lines for journal explanations. Every line on a journal page is used for debit or credit entries. CNOW journals will automatically indent a credit entry when a credit amount is entered.arrow_forwardThe prepaid insurance account had a beginning balance of $3,755 and was debited for $6,755 of premiums paid during the year. Journalize the adjusting entry required at the end of the year, assuming the amount of unexpired insurance related to future periods is $2,640. Refer to the Chart of Accounts for exact wording of account titles.arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education