FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

thumb_up100%

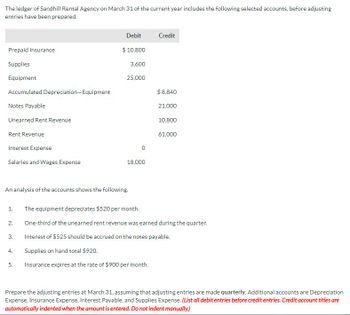

The ledger of Sandhill Rental Agency on March 31 of the current year includes the following selected accounts, before

Transcribed Image Text:The ledger of Sandhill Rental Agency on March 31 of the current year includes the following selected accounts, before adjusting

entries have been prepared.

Prepaid Insurance

Supplies

Equipment

Accumulated Depreciation-Equipment

Notes Payable

Unearned Rent Revenue

Rent Revenue

Interest Expense

Salaries and Wages Expense

1.

An analysis of the accounts shows the following.

2.

Debit

$ 10,800

3.

st

3,600

25,000

0

18,000

Credit

$ 8,840

The equipment depreciates $520 per month.

One-third of the unearned rent revenue was earned during the quarter.

Interest of $525 should be accrued on the notes payable.

Supplies on hand total $920.

5. Insurance expires at the rate of $900 per month.

21,000

10,800

61,000

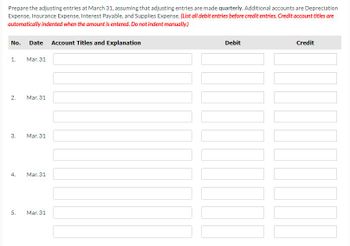

Prepare the adjusting entries at March 31, assuming that adjusting entries are made quarterly. Additional accounts are Depreciation

Expense, Insurance Expense, Interest Payable, and Supplies Expense. (List all debit entries before credit entries. Credit account titles are

automatically indented when the amount is entered. Do not indent manually.)

Transcribed Image Text:Prepare the adjusting entries at March 31, assuming that adjusting entries are made quarterly. Additional accounts are Depreciation

Expense, Insurance Expense, Interest Payable, and Supplies Expense. (List all debit entries before credit entries. Credit account titles are

automatically indented when the amount is entered. Do not indent manually.)

No. Date Account Titles and Explanation

1.

2.

3.

4.

5.

Mar. 31

Mar. 31

Mar. 31

Mar. 31

Mar. 31

Debit

Credit

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- At December 31, 2022, before any year-end adjustments, Blossom Company Prepaid Insurance account had a balance of $6840. It was determined that $3070 of the Prepaid Insurance had expired. The adjusted balance for Insurance Expense for the year would be: O $6840. O $3770. O $3070. O $3300.arrow_forwardThe balance in the prepaid insurance account, before adjustment at the end of the year, is $18,655. The year end is March 31. Journalize the March 31 adjusting entry required under each of the following alternatives for determining the amount of the adjustment: (a) the amount of insurance expired during the year is $15,945; (b) the amount of unexpired insurance applicable to future periods is $2,710. Refer to the Chart of Accounts for exact wording of account titles.arrow_forwardComplete the following adjusting entry for Mookie The Beagle Concierge.Interest on Mookie The Beagle Concierge’sLoan Payable to CK has been incurred, but not recorded or paid. The interest that has been 2019incurred is calculated as principal multiplied by the interest rate multi-plied by the time period ($1,000 × 6% × 1/12 = $5.00). Interest Expense of $5.00 must be recorded as an accrued expense and Accounts Payable,a liability, recorded for the amount that Mookie The Beagle Concierge is obligated to pay later. So an adjusting entry is needed to bring accounts up to date at January 31arrow_forward

- Fifteen transactions or events affecting Westmar, Inc., are as follows:a. Made a year-end adjusting entry to accrue interest on a note payable that has the interest ratestated separately from the principal amount.b. A liability classified for several years as long-term becomes due within the next 12 months. c. Recorded the regular weekly payroll, including payroll taxes, amounts withheld from employ-ees, and the issuance of paychecks. d. Earned an amount previously recorded as unearned revenue.e. Made arrangements to extend a bank loan due in 60 days for another 36 months.f. Made a monthly payment on a fully amortizing installment note payable. (Assume this note isclassified as a current liability.)g. Called bonds payable due in 10 years at a price below the carrying value of the liability in theaccounting records.h. Issued bonds payable at 101 on January 31, 2011. The bonds pay interest on January 31 andJuly 31.i. Recorded July 31, 2011, interest expense and made semiannual interest…arrow_forwardShow Attempt History Current Attempt in Progress M On July 1, 2022, Sheridan Company pays $18,500 to Wildhorse Co. for a 2-year insurance contract. Both companies have fiscal years ending December 31. (51)arrow_forwardWhich of the following is the proper adjusting entry, based on a prepaid insurance account balance before adjustment of $13,651 and unexpired insurance of $4,889, for the fiscal year ending on April 30?arrow_forward

- Adjusting entries for prepaid insurance Instructions Chart of Accounts Journal Instructions The balance in the prepaid insurance account, before adjustment at the end of the year, is $18,135. Journalize the March 31 adjusting entry required under each of the following alternatives for determining the amount of the adjustment: (a) the amount of insurance expired during the year is $15,480; (b) the amount of unexpired insurance applicable to future periods is $2,655. Refer to the chart of accounts for the exact wording of the account titles. CNOW journals do not use lines for journal explanations. Every line on a journal page is used for debit or credit entries. CNOW journals will automatically indent a credit entry when a credit amount is entered. Chart of Accounts CHART OF ACCOUNTS General Ledger ASSETS 11 Cash 12 Accounts Receivable 13 Supplies 14 Prepaid Insurance 15 Land 16 Equipment 17…arrow_forwardFor each of the following transactions below, prepare the journal entry (if one is required) to record the initial transaction and then prepare the adjusting entry, if any, required on September 30, the end of the fiscal year. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter 0 for the amounts.) (a) On September 1, paid rent on the track facility for three months, $210,000. (b) On September 1, sold season tickets for admission to the racetrack. The racing season is year-round with 25 racing days each month. Season ticket sales totaled $900,000. (c) On September 1, borrowed $350,000 from First National Bank by issuing a 9% note payable due in three months. (d) On September 5, programs for 20 racing days in September, 25 racing days in October, and 15 racing days in November were printed for $3,600. (e) The accountant for the concessions…arrow_forwardPrepare the December 31 year-end entry that companies record to adjust the Revenue and the Unearned Revenue accounts.arrow_forward

- Reviewing insurance policies revealed that a single policy was purchased on October 1st, for one year's coverage, in the amount of $1,200. There was no previous balance in the prepaid insurance account at that time. Based on the information provided: Make the December 31st adjusting journal entry to bring the balance to correct Insurance Expense?- Prepaid Insurance?- What is the remaining balance for the prepaid insurance on December 31st?arrow_forwardOn July 1, 2020, Wilson Co. pays $16,140 to Anderson Insurance Co. for a 3-year insurance policy. Both companies have fiscal years ending December 31. Journalize the entry on July 1 and the adjusting entry on December 31 for Anderson Insurance Co. Anderson uses the accounts Unearned Service Revenue and Service Revenue.arrow_forwardThe prepaid insurance account had a balance of $5,300 at the beginning of the year. The account was debited for $5,900 for premiums on policies purchased during the year. Journalize the adjusting entry required under each of the following alternatives for determining the amount of the adjustment: If an amount box does not require an entry, leave it blank. Question Content Area a. The amount of unexpired insurance applicable to future periods is $1,000. blank Insurance Expense Insurance Expense Prepaid Insurance-- answer Prepaid Insurance-- answer another question Selected account balances before adjustment for Intuit Realty at November 30, the end of the current year, follow: Debits Credits Accounts Receivable $73,830 Equipment 114,000 Accumulated Depreciation - Equipment $11,370 Prepaid Rent 9,300 Supplies 2,210 Wages Payable _ Unearned Fees 10,190 Fees Earned 431,170 Wages Expense…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education