FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

thumb_up100%

Transcribed Image Text:ady

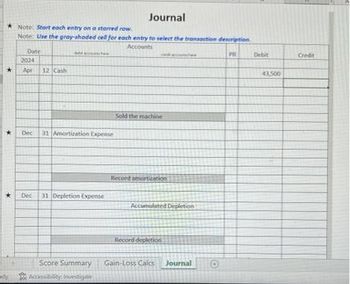

Journal

Note: Start each entry on a starred row.

Note: Use the gray-shaded cell for each entry to select the transaction description

Accounts

PR

Date

2024

Apr 12 Cash

Dec 31 Amortization Expense

Dec

31 Depletion Expense

Score Summary

Accessibility Investigate

Sold the machine

Record amortization

Accumulated Depletion

Record depletion

Gain-Loss Calcs Journal

Debit

43,500

Credit

Transcribed Image Text:A

8 C

D

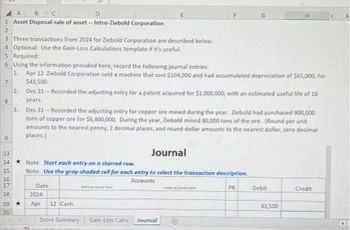

1 Asset Disposal-sale of asset--Intro-Ziebold Corporation

2

3 Three transactions from 2024 for Ziebold Corporation are described below.

4 Optional: Use the Gain-Loss Calculations template if it's useful.

5 Required:

6 Using the information provided here, record the following journal entries:

1. Apr 12 Ziebold Corporation sold a machine that cost $104,000 and had accumulated depreciation of $65,000, for

$43,500.

7

2. Dec 31 --Recorded the adjusting entry for a patent acquired for $1,000,000, with an estimated useful life of 16

years.

8

9

3.

Dec 31-Recorded the adjusting entry for copper ore mined during the year. Zebold had purchased 900,000

tons of copper are for $6,400,000. During the year, Ziebold mined 80,000 tons of the ore. (Round per unit

amounts to the nearest penny, 2 decimal places, and round dollar amounts to the nearest dollar, zero decimal

places.)

13

14

15

16

17

18

19 ★

20

Journal

Note: Start each entry on a starred row.

Note: Use the gray-shaded cell for each entry to select the transaction description

Accounts

PR

Date

2024

Apr 12 Cash

E

Score Summary

Gain-Loss Calcs

Journal

Debit

43,500

Credit

A

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- help please answer in text form with proper workings and explanation for each and every part and steps with concept and introduction no AI no copy paste remember answer must be in proper format with all workingarrow_forwardEdit View History Bookmarks Profiles Tab Window Help Question 5 - Proctoring Enable X + getproctorio.com/secured #lockdown octoring Enabled: Chapter 3 Required Homewor... D W 5 The trial balance for Canton Incorporated, listed the following account balances at December 31, 2024, the end of Canton Incorporated's fiscal year: cash, $32,000; accounts receivable, $27,000; inventory, $41,000; equipment (net), $96,000; accounts payable, $30,000; salaries payable, $13,000; interest payable, $9,000; notes payable (due in 20 months), $46,000; common stock, $82,000. Current assets Current liabilities ↑ Please calculate total current assets and total current liabilities that would appear in the year-end balance sheet of Canton Incorporated. #3 E с 54 $ R % G Search or type URL 5 T < Prev 5 of 5 Saved A 6 MacBook Pro Y & 7 Next * 00 8 + 9 O E 0 Help P | 1 50% * Save & Exit 0 + 11arrow_forwardAutoSave OFF Home Insert Draw Paste Page 47 of 95 Calibri B I U 20 Design V v 16916 words 50 ab X 2 V Layout X Α Α΄ A References Aa ▾ A Αν English (United States) Mailings = Review V V W= Packet Lecture-4 View 12/31 싫 V Accessibility: Investigate Tell me 30,000 V Estimating Uncollectible Accounts An estimate of bad debts is made at the end of the accounting period to match the cost of credit sales (bad debt expense) with the revenue credit sales allowed the company to record during the period. The estimate is incorporated in the company's books through an ADJUSTING ENTRY and the entry increases the allowance for uncollectible accounts and bad debt expense. Saved to my Mac ✓ Percent of Receivables Method (an allowance method) management estimates a percent of ending accounts receivable they expect to be uncollectible the ending balance of the Allowance for Uncollectible Accounts (AUA) is determined based on the estimate (% of uncollectible accounts x ending balance of A/R, "% of A/R").…arrow_forward

- Instructions 1 Record entry to write off the $15,000 receivable which is over 75 days outstanding 2 Calculate the desired credit balance in the Allowance for Doubtful Account using the chart above 3 Assuming prior to any adjusting entries the balance in the Allowance for Doubtful Accounts had a credit balance of $40,000, record the year ending adjusting entry for bad debts.arrow_forwardAccount Name Debit Amount Credit Amount Create a Journal Entry Gaston owns equipment that cost $90,000 with accumulated depreciation of $68,000. Gaston sells the equipment for $25,000. Prepare the journal entry to record the disposal of the equipment and enter it below.arrow_forwardPractice chpt 5 - Co X A ezto.mheducation.com/ext/map/index.html?_con=con&external browser=D0&launchUrl=https%253A%252F%252Fdcccd.blackboar ce chpt 5 A Saved At the end of 2021, Worthy Co's balance for Accounts Receivable is $24,000, while the company's total assets equal $1,540,000. In addition, the company expects to collect all of its receivables in 2022. In 2022, however, one customer owing $4,000 becomes a bad debt on March 14. Record the write off of this customer's account in 2022 using the direct write-off method. (If no entry is required for a particular transaction/event, select "No Journal Entry Required" in the first account field.) Rook View transaction list Journal entry worksheet Print erences Record the write off of this customer's account in 2022 using the direct write off method. Note: Enter debits before credits. Date General Journal Debit Credit March 14, 2022 Record entry Clear entry View general journal raw Type here to search Ps DII PrtScn Hom F3 F7 F8 近arrow_forward

- Journalize Bad Debts estimated to be $1,100. Edit View Insert Format Tools Table 12pt v Paragraph v BIUA O wordsarrow_forwardCornerstone Exercise 5-28 Aging Method On December 31, 2021, Khalid Inc. has the following balances for accounts receivable and allowance for doubtful accounts: Accounts Receivable Allowance for Doubtful Accounts (a credit balance) During 2022, Khalid had $18,500,000 of credit sales, collected $17.945,000 of accounts receivable, and wrote off $60,000 of accounts receivable as uncollectible. At year-end. Khalid performs an aging of its accounts receivable balance and estimates that $52,000 will be uncollectible. Required: 1. Calculate Khalid's preadjustment balance in accounts receivable on December 31, 2022. $1,280,000 44,000 2. Calculate Khalid's preadjustment balance in allowance for doubtful accounts on December 31, 2022. 3. Prepare the necessary adjusting entry for 2022. Dec. 31 (Record adjusting entry for bad debt expense estimate)arrow_forwardHome Insert Page Layout Formulas Data Review View Help - 10 - A A Insert v Σ Arial ab General EXDelete v BIU $- % 9 0 0 Conditional Format as Cell Sort & Formatting Table - Styles v Format v Filter oard Font Alignment Number Styles Cells Editing fr C D H. The following amounts summarize the financial position of Little Black Dog Inc. on May 31, 2021: В F G IJK L M N O P Q R S V W Assets Liabilities Shareholders' Equity %D Cash + Accounts Computers + + Supplies + Land Accounts + Note Salaries + Interest Common + Retained Receivable (net) Payable Payable Payable Payable Shares Earnings Balance 1820 700 70 8400 5600 2800 2590 During June 2021, the business completed these transactions: June 1: Received cash of $6300 and issued common shares. June 1: Bought two computers for a total of $5600 by paying $1400 down and signing a note payable for the rest. Interest of 5% to be paid with the note payable on June 1, 2022. The computers are expected to last 5 years. June 5: Performed services for…arrow_forwardFile Home Insert Draw Page Layout Formulas Data Review View Help Editing Arial V 10 Merge Currency ... B8 fx A 1. Amortization schedule 2. 3. Loan amount to be repaid (PV) $30,000.00 Interest rate (r) 4. Length of loan (in years) 8.00% 6. 7. a. Setting up amortization table Formula 8. Calculation of loan payment #N/A 6. Repayment of Principal 10 Year Beginning Balance Payment Interest Remaining Balance 11 1 12 13 3 14 15 b. Calculating % of Payment Representing Interest and Principal for Each Year Payment % Representing Payment % Representing Principal Check: Total = 16 Year Interest 100% 17 1 18 19 20 21 Formulas = A Sheet1 Calculation Mode: Automatic Workbook Statistics LL 2 3arrow_forwardurrent Attempt in Progress Pina Colada Corp had accounts receivable of $140.000 on January 1,2022. The only transactions that affected accounts receivable during 2022 were not credit sales of $4,950.000, cash collections of 54.850,000, and accounts written off of $50,000 ta) Compute the ending balance of accounts receivable Ending balance of accounts receivable Your answer is correct (b) P Textbook and Media. Yanis correct S 110000 Attempts 1 of Suned SUPEarrow_forwardarrow_back_iosarrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education