FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

thumb_up100%

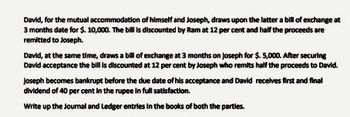

Transcribed Image Text:David, for the mutual accommodation of himself and Joseph, draws upon the latter a bill of exchange at

3 months date for $. 10,000. The bill is discounted by Ram at 12 per cent and half the proceeds are

remitted to Joseph.

David, at the same time, draws a bill of exchange at 3 months on joseph for $. 5,000. After securing

David acceptance the bill is discounted at 12 per cent by Joseph who remits half the proceeds to David.

joseph becomes bankrupt before the due date of his acceptance and David receives first and final

dividend of 40 per cent in the rupee in full satisfaction.

Write up the Journal and Ledger entries in the books of both the parties.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 4 steps with 4 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- the early part of 2021, the partners of HughJacobs, and Thomas sought assistance from a local accountant. They had begun a new business in 2020 but had never used an accountant's services Hugh and Jacobs began the partnership by contributing $150,000 and $100,000 in cash, respectivelyHugh was to work occasionally at the business, and Jacobs was to be employed full-time. They decided that year-end profits and losses should be assigned as follows: Each partner was to be allocated 10 percent interest computed on the beginning capital balances for the period A compensation allowance of $5,000 was to go to Hugh with a $25,000 amount assigned to Jacobs Any remaining income would be split on a 4:6 basis to Hugh and Jacobs, respectively 2020, revenues totaled $175,000, and expenses were $146,000 (not including the partnerscompensation allowance)Hugh withdrew cash of $9,000 during the year, and Jacobs took out $14,000. In addition, the business paid $7,500 for repairs made to Hugh's home and…arrow_forwardA married couple has a net short-term capital loss of $2,000 and a net long-term capital loss of $3,000 for the year. If the couple has no other gains or losses, what, if anything, carries over to the next year? 1) $2,000 short-term capital loss 2) $2,000 long-term capital loss 3) $2,000 short-term capital loss; $3,000 long-term capital loss 4) $500 short-term capital loss; $1,500 long-term capital loss 5) The couple has no capital loss carryoverarrow_forwardM, N and O are partners sharing profits in the ratio of 2: 2: 2. N dies on 30th Jun 2020 due to ill health. The company profits for the last 3 years was OMR 20,000, OMR 20,000 and OMR 20,000. Calculate the profit share of N? O a. None of the options are correct O b. OMR 3333.33 O c. OMR 20,000 d. OMR 10,000arrow_forward

- Assume Darrin transfers ownership of the life insurance policy on his life to an Irrevocable Life Insurance Trust (ILIT) and retains the right to borrow against the policy. Assume Darrin dies five years later. Which of the following is correct regarding the treatment of the proceeds of the life insurance policy? O The proceeds will always be included in Darrin's federal gross estate. The proceeds will be included in Darrin's federal gross estate if he has any outstanding loans against the life insurance policy. O The proceeds will be included in Darrin's federal gross estate if Darrin continued paying the policy premiums after the life insurance policy was transferred to the ILIT. O The proceeds will never be included in Darrin's federal gross estate.arrow_forwardChoose the response that correctly completes the following sentence about canceled debt. When the debt is held jointly by both spouses: If they are married filing jointly, a single insolvency worksheet can be completed showing all of their liabilities and assets. They must file married filing jointly in order to receive the greatest reduction of canceled debt income. Each spouse will be responsible for a prorated amount of the canceled debt based on their income, and they will each complete an insolvency worksheet with their individual liabilities and assets. They must file married filing separately in order to receive the greatest reduction of canceled debt income.arrow_forwardT. Thomas withdraws from his partnership with five other partners and takes cash equal to his capital balance, in the amount of $25,000. The journal entry to reflect this transaction would include which of the following? (Check all that apply.) Multiple select question. Credit to Cash Debit to T. Thomas, Capital Credit to T. Thomas, Capital Debit to Casharrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education