FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

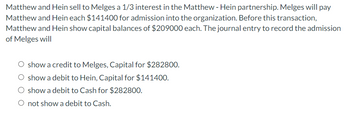

Transcribed Image Text:Matthew and Hein sell to Melges a 1/3 interest in the Matthew - Hein partnership. Melges will pay

Matthew and Hein each $141400 for admission into the organization. Before this transaction,

Matthew and Hein show capital balances of $209000 each. The journal entry to record the admission

of Melges will

O show a credit to Melges, Capital for $282800.

O show a debit to Hein, Capital for $141400.

show a debit to Cash for $282800.

O not show a debit to Cash.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Similar questions

- On October 1, 2020, Mary Graham organized a computer service company called Echo Systems. Echo is organized as a sole proprietorship and will provide consulting services, computer system installations, and custom program development. Graham has adopted the calendar year for reporting, and expects to prepare the company's first set of financial statements as of December 31, 2020. The initial chart of accounts for the accounting system includes these items: Account Number 101 106 126 128 131 163 167 201 Account Name Cash Accounts Receivable Computer Supplies Prepaid Insurance Prepaid Rent Office Equipment Computer Equipment Accounts Payable PART A: CHECK FIGURES: 4. Total Dr.= $159,450; Profit= $8,920; Total assets = $145,720 Oct. Required 1. Set up balance column accounts based on the chart of accounts provided. 2. Prepare journal entries to record each of the following October transactions. 3. Post the October entries. Account Number 301 302 403 623 655 676 684 699 4. Prepare a trial…arrow_forwardMr Gugu and Lethu are members of Gugulethu CC. The bookkeeper attempted to prepare the financial statements of the entity however, he lacked the technical knowhow of the task. The following information is extracted from the workings of the bookkeeper and relates to the close cooperation on 28 February 2021, the end of the financial year: R Vehicles 780 000 Land and buildings 1 210 000 Long-term loan 520 000 Inventory (1 March 2020) 52 000 Trade receivables control 150 000 Trade payables control 84 790 Purchases 761 000 Purchases returns 5 100 Settlement discount granted 2 800 Freight on sales 12 300 Interest on long-term loan 43 875 Sales returns 2 300 Insurance expense 48 000 Settlement discount received 850 Allowance for credit…arrow_forwardJournalize the following: 1. On the books & records of Company A: On May 2nd, Company A received $100 of interest income from the bank earned in April. If the books are on an accrual basis, record the entry in April and in May when cash was received April May 2. On the books & records of Company A: In January, Company A purchased Investment in XYZ for $100. Payment was made in cash. In March, Company A sold Investment in XYZ for $150. Payment was received in cash. 3. On the books & records of Company A: On April 1st, Company A paid $1,200 for insurance expense that covers the year 4/1/17-3/31/18. Record 4/1/17 entry for payment of $1,200 Record 4/30/17 journal entry 4. There are 2 parallel funds, Fund A and Fund B. Together, the funds will make an investment of $100k, with a 65/35 split. The investment will be paid in cash, however, Fund B does not currently have any cash so Fund…arrow_forward

- The company takes out a $1,000,000 loan from the bank. Provide the journal entry that would be necessary to record the transaction.arrow_forwardMOH applied to WIP amounted to $20,000. A Journal Entry to record this transaction would be: Select one: O a. Debit WIP by $20,000; Credit - MOH by $20,000 O b. Debit MOH by $20,000; Credit - WIP by $20,000 Oc. Debit - MOH Applied by $20,000; Credit - MOH Actual by $20,000 O d. Debit - MOH Actual by $20,000; Credit - MOH Applied by $20,000arrow_forwardThe owner deposited P280,000 in the name of his business. Dinections: Record the transactions directly into the T-accounts. The transactions are independent from one another. Write your answers on a separate sheet of paper. is Owner's Withdrawals Professional Fees Cash ACCounts Receivable Office Equipment Office Furniture Accounts Payable Owner's Capital Salaries Expense Rent Expense Utilities Expense Miscellaneous Expense a. urchased a 4-in-1 equipment from Limay Equipment for P4,950, paying P1 000 in cash and the balance on account. c. He bought chairs and tables for the office for P12,300 cash. d. He purchased furniture from Orion Company for P2,750 in cash. * he received and paid the telephone bilu from Ph Telecom amounting to P1,030. 15arrow_forward

- The following information is available for the R. KandamilCompany before closing the accounts. After all of the closingentries are made, what will be the balance in the R.Kandamil, Capital account? Total revenues . . . $300,000Total expenses . . 195,000R. Kandamil, Capital . . . . . . $100,000R. Kandamil, Withdrawals . . 45,000 a. $360,000 d. $150,000b. $250,000 e. $60,000c. $160,000arrow_forwardGroro Co. bills a client $62,000 for services provided and agrees to accept the following three items in full payment: (1) $10,000 cash, (2) equipment worth $80,000, and (3) to assume responsibility for a $28,000 note payable related to the equipment. For this transaction, (a) analyze the transaction using the accounting equation, (b) record the transaction in journal entry form, and (c) post the entry using T-accounts to represent ledger accounts. Use the following (partial) chart of accounts—account numbers in parentheses: Cash (101); Supplies (124); Equipment (167); Accounts Payable (201); Note Payable (245); Owner, Capital (301); and Revenue (404).arrow_forwardOn June 1, 2022 Bedu, Budi, and Bobi were three friends who wanted to form a new firm which would be named as 3B. Bedu would deposit Cash $2,250, Budi would give Equipment $1,150, and Bobi would give Vehicle $3,350. The correct record for this transaction is Select one: O a. Equipment $1,150 on Credit b. Cash $2,250 on Credit O c. Capital of Bedu $1,150 on Credit O d. Capital of Bobi $3,350 on Creditarrow_forward

- The following business transactions of Mrs.Amal, a sole trader. April 2021 (1) Capital invested as cash RO 90,000 to start up the business (5) Paid RO 50000 in cash to Purchase Factory (7) Purchase of goods on credit for RO 30000 and 20500 on cash from Royal trading (8) Sale of RO 34000 on credit to Suhail trading and for cash RO 24000 (9) Paid RO 28000 liability to the Royal trading (11) Paid advertisement of RO 12000 (17) Paid salaries of RO 3500 (16) Withdraw of RO 300 for personal use (28) Collection of accounts receivable RO 23000 from Suhail trading You required to: Prepare Journal entries b. Post ledger accounts c. Trail balances а.arrow_forwardThe post-closing trial balances of two proprietorships on January 1,2022, are presented below. Sorensen Company Lucas Company Dr. Cr. Dr. Cr. Cash $17,000 $14,400 Accounts receivable 21,000 31,000 Allowance for doubtful accounts $3,600 $5,300 Inventory 32,000 22,100 Equipment 54,000 35,000 Accumulated depreciation-equipment 28,800 13,200 Notes payable 21,600 18,000 Accounts payable 26,400 37,200 Sorensen, capital 43,600 Lucas, capital 28,800 $124.000 $124,000 $102,500 $102.500 Sorensen and Lucas decide to form a partnership, Blossom Company, with the following agreed upon valuations for noncash assets. Sorensen and Lucas decide to form a partnership, Blossom Company, with the following agreed upon valuations for noncash assets. Sorensen Lucas Company Company Accounts receivable $21,000 $31.000 Allowance for doubtful accounts 5,400 4,800 Inventory 33,600 24,000 Equipment 30,000 18,000 All cash will be transferred to the partnership, and the partnership will assume all the liabilities of…arrow_forwarda. P3,440,900 b. P3,250,000 C. P3,146,900 D. P3,059,100arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education