FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

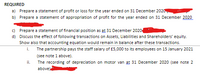

Transcribed Image Text:REQUIRED

a) Prepare a statement of profit or loss for the year ended on 31 December 2020

b) Prepare a statement of appropriation of profit for the year ended on 31 December 2020

c) Prepare a statement of financial position as at 31 December 2020

d) Discuss the effect of following transactions on Assets, Liabilities and Shareholders' equity.

Show also that accounting equation would remain in balance after these transactions.

i.

The partnership pays the staff salary of £5,000 to its employees on

January 2021

(see note 1 above).

The recording of depreciation on motor van at 31 December 2020 (see note 2

above)

ii.

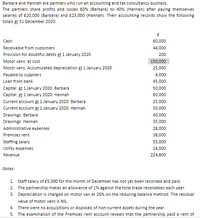

Transcribed Image Text:Barbara and Hannah are partners who run an accounting and tax consultancy business.

The partners share profits and losses 60% (Barbara) to 40% (Hannah) after paying themselves

salaries of £20,000 (Barbara) and £25,000 (Hannah). Their accounting records show the following

totals at 31 December 2020:

Cash

60,000

Receivable from customers

44,000

Provision for doubtful debts at 1 January 2020

200

Motor vans: at cost

150,000

Motor vans: Accumulated depreciation at 1 January 2020

25,000

Payable to suppliers

4,000

Loan from bank

45,000

Capital: at 1 January 2020: Barbara

50,000

Capital: at 1 January 2020: Hannah

60,000

Current account at 1 January 2020: Barbara

25,000

Current account at 1 January 2020: Hannah

30,000

Drawings: Barbara

Drawings: Hannah

40,000

35,000

Administrative expenses

28,000

Premises rent

38,000

Staffing salary

55,000

Utility expenses

14,000

Revenue

224,800

Notes:

1. Staff salary of £5,000 for the month of December has not yet been recorded and paid.

2. The partnership makes an allowance of 1% against the total trade receivables each year.

3. Depreciation is charged on motor van at 25% on the reducing balance method. The residual

value of motor vans is NIL.

4. There were no acquisitions or disposals of non-current assets during the year.

5. The examination of the Premises rent account reveals that the partnership paid a rent of

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Coburn (beginning capital, $60,000) and Webb (beginning capital $86,000) are partners. During 2022, the partnership earned net income of $74,000, and Coburn made drawings of $20,000 while Webb made drawings of $22,000.arrow_forwardPartnership A, B and C is a law firm. You have been engaged as accountant to prepare financial statements for the year ended Dec. 31, 2019 Partnerships profits are alllocated based fist on salaries,then on interest on opening capital balances then on fixed ratio. Salary allocation amount are A $100000 B $100000 C $160000 Opening capital balances A $70000 B $60000 C $70000 Interest rate is: 5% Fixed ratio is A 3 B 2 C 5 required Prepare year end adjusting entries Allocate partnership profit or loss to each partner Prepare adjusting entry and complete trial balnce Prepare income statement and statement of partners capital for the year ended Dec. 31, 2019 and a balance sheet for Dec.31arrow_forwardMrs. Shine was registered in Jamaica as a sole trader in 2015. To grow her practice Mrs. Shine decided to enter into a partnership agreement with Mr. Rain, thus the status of the business was changed in 2021. In 2022, the partnership income statement for Shine & Rain was as follows: Income Statement for the year ended 31 December 2022$ $Revenue 11,600,000ExpensesSalaries & Wages 7,600,000Employer NIS Contribution 1,400,000 Rent and Rates 2.400,000Interest 500,000Maintenance 120,000Depreciation 550,000Loss on Disposal of Vehicle 80,000Telephone 235,000Electricity 255,000General Expenses 700,000Donations 85,000Provision for Bad Debts 80,000Fines and Penalties 115,000Drawings 105,000 14,225,000Net Loss 2,625,000 Notes to the Income Statement1. $55,000 of the drawings relate to Mrs. Shine and $50,000 to Mr. Rain2. Gross Salary for Mrs. Shine was $250,000 per month, and $200,000 for Mr. Rain. Both partners worked in the business during the year. 3. The annual allowance was…arrow_forward

- The ledger of Tyler Lambert and Jayla Yost, attorneys-at-law, contains the following accounts and balances after adjustments have been recorded on December 31, 20Y3: Lambert and Yost Trial Balance December 31, 20Y3 Debit Balances Credit Balances Cash 34,000 Accounts Receivable 47,800 Supplies 2,000 Land 120,000 Building Accumulated Depreciation-Building Office Equipment Accumulated Depreciation-Office Equipment Accounts Payable Salaries Payable Tyler Lambert, Capital Tyler Lambert, Drawing Jayla Yost, Capital Jayla Yost, Drawing 157,500 67,200 63,600 21,700 27,900 5,100 135,000 50,000 88,000 60,000 Professional Fees 395,300 Salary Expense Depreciation Expense-Building 154,500 15,700 Property Tax Expense 12,000 Heating and Lighting Expense Supplies Expense Depreciation Expense-Office Equipment Miscellaneous Expense 8,500 6,000 5,000 3,600 740,200 740,200 The balance in Yost's capital account includes an additional investment of $10,000 made on April 10, 2OY3. (Continued)arrow_forwardRequired information [The following information applies to the questions displayed below.] Ries, Bax, and Thomas invested $80,000, $112,000, and $128,000, respectively, in a partnership. During its first calendar year, the firm earned $249,000. Required: Prepare the entry to close the firm's Income Summary account as of its December 31 year-end and to allocate the $249,000 net income under each of the following separate assumptions. 2. The partners agreed to share income and loss in the ratio of their beginning capital investments. Complete this question by entering your answers in the tabs below. Appropriation of profits Allocate $249,000 net income in the ratio of their beginning capital investments. Note: Do not round intermediate calculations. Supporting Computations General Journal Ries Bax Thomas Percentage of Total Equity X Income Summary Allocated Income to Capitalarrow_forwardShowing your workings, answer the following question. “Carnita and Cornwall are in partnership. The following is their trial balance as at 31 October 2020.” £ £ Capital Accounts: Carnita 400,000 Capital Accounts: Cornwall 500,000 Current Accounts: Carnita (at 1 November 2019) 164,000 Current Accounts: Cornwall (at 1 November 2019) 41,200 Drawings Accounts: Carnita 200,000 Drawings Accounts: Cornwall 160,000 Premises at cost 1,600,000 Vehicles at cost 520,000 Accumulated depreciation on vehicles at 31 October 2020 500,000 Debtors 464,200 Creditors 539,400 Stock at 31 October 2020 268,800 Bank 67,200 Bank loan at 5% 800,000 Net profit for the year 396,000 Accrued expenses 22,000 3,321,400 3,321,400 “You are given additional information as follows: i) Interest is charged on drawings, which has been calculated as: Carnita…arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education