FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

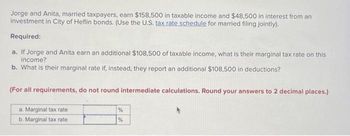

Transcribed Image Text:Jorge and Anita, married taxpayers, earn $158,500 in taxable income and $48,500 in interest from an investment in City of Heflin bonds. (Use the U.S. tax rate schedule for married filing jointly).

**Required:**

**a.** If Jorge and Anita earn an additional $108,500 of taxable income, what is their marginal tax rate on this income?

**b.** What is their marginal rate if, instead, they report an additional $108,500 in deductions?

*(For all requirements, do not round intermediate calculations. Round your answers to 2 decimal places.)*

| | |

|-------------------|------|

| a. Marginal tax rate | % |

| b. Marginal tax rate | % |

There is no graphical or diagrammatic element present in the text provided. The task primarily involves calculating and identifying marginal tax rates based on additional taxable income and deductions for a married couple filing jointly under the U.S. tax code.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Similar questions

- Nonearrow_forwardProblem 1-39 (LO 1-3) (Static) Jorge and Anita, married taxpayers, earn $150,000 in taxable income and $40,000 in interest from an investment in City of Heflin bonds. (Use the U.S. tax rate schedule for married filing jointly). Required: a. If Jorge and Anita earn an additional $100,000 of taxable income, what is their marginal tax rate on this income? b. What is their marginal rate if, instead, they report an additional $100,000 in deductions? (For all requirements, round your answers to 2 decimal places.) a. b. arginal tax rate. Marginal tax rate % %arrow_forwardAll of the following nondependent taxpayers are U.S. citizens. Which is/are required to file a 2023 income tax return? -Calvin (40), qualifying surviving spouse (QSS), $26,100 gross income. -Jen (68), single (S), $15,000 gross income, all from wages. -Sheldon (67) and Ruby (61), married filing jointly (MFJ), $28,500 gross income. -Zachery (38), head of household (HOH), $21,350 gross income. Choose Onearrow_forward

- DJ and Gwen paid $3,880 in qualifying expenses for their son, Nikko, who is a freshman attending the University of Colorado. DJ and Gwen have AGI of $170,000 and file a joint return. What is their allowable American opportunity tax credit? Multiple Choice O $2,470 O $1.235 O $3,880 $0.arrow_forwardkuk.3arrow_forwardMarc, a single taxpayer, earns $64,600 in taxable income and $5,460 in interest from an investment in city of Birmingham bonds. Using the US tax rate schedule for year 2021, what is his effective tax rate? (Round your final answer to two decimal places.) (Use tax rate schedule) Multiple Choice 20.75 percent 14.22 percent 15.49 percent 11.90 percent None of the choices are correctarrow_forward

- Jason is an Australian tax resident and for the financial year 2019-20, has taxable income of $ 61,000 and reportable super contribution of $ 3,500. Jason also has a Study and Training Support loan (HELP-HECS) from undertaking a University degree. What is Jason's compulsory rate of repayment on this loan?arrow_forwardChuck, a single taxpayer, earns $75,400 in taxable income and $10,400 in interest from an investment in City of Heflin bonds. (Use the U.S. tax rate schedule.) Required: a. If Chuck earns an additional $40,000 of taxable income, what is his marginal tax rate on this income? b. What is his marginal rate if, instead, he had $40,000 of additional deductions? Note: For all requirements, do not round intermediate calculations. Round percentage answers to 2 decimal places. a. Marginal tax rate b. Marginal tax rate % %arrow_forwardroblem 1-39 (LO 1-3) (Static) Jorge and Anita, married taxpayers, earn $150,000 in taxable income and $40,000 in interest from an investment in City of Heflin bonds. (Use the U.S. tax rate schedule for married filing jointly). Required: If Jorge and Anita earn an additional $100,000 of taxable income, what is their marginal tax rate on this income? What is their marginal rate if, instead, they report an additional $100,000 in deductions? (For all requirements, round your answers to 2 decimal places.)arrow_forward

- Jorge and Anita, married taxpayers, earn $169,200 in taxable income and $44,800 in interest from an investment in City of Heflin bonds. Using the U.S. tax rate schedule for married filing jointly, how much federal tax will they owe? What is their average tax rate? What is their effective tax rate? What is their current marginal tax rate? (Do not round intermediate calculations. Round your answers to 2 decimal places.) Federal tax Average tax rate Effective tax rate Marginal tax rate % % %arrow_forwardChuck, a single taxpayer, earns $77,200 in taxable income and $12,400 in interest from an investment in City of Heflin bonds. (Use the U.S. tax rate schedule.) Required: a. If Chuck earns an additional $40,000 of taxable income, what is his marginal tax rate on this income? b. What is his marginal rate if, instead, he had $40,000 of additional deductions? Note: For all requirements, do not round intermediate calculations. Round percentage answers to 2 decimal places. a. Marginal tax rate b. Marginal tax rate 53.58% 30.56 %arrow_forwardChuck, a single taxpayer, earns $80,200 in taxable income and $12,900 in interest from an investment in City of Heflin bonds. (Us the U.S tax rate schedule.) Required: a. How much federal tax will he owe? b. What is his average tax rate? c. What is his effective tax rate? d. What is his current marginal tax rate? Complete this question by entering your answers in the tabs below. Required A Required B Required C Required D How much federal tax will he owe? Note: Do not round intermediate calculations. Round "Federal tax" to nearest whole dollar amount. Federal taxarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education