FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

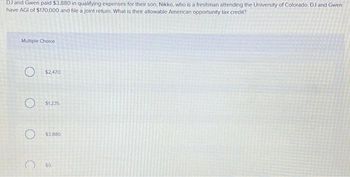

Transcribed Image Text:DJ and Gwen paid $3,880 in qualifying expenses for their son, Nikko, who is a freshman attending the University of Colorado. DJ and Gwen

have AGI of $170,000 and file a joint return. What is their allowable American opportunity tax credit?

Multiple Choice

O $2,470

O $1.235

O $3,880

$0.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Similar questions

- Problem 1-39 (LO 1-3) (Static) Jorge and Anita, married taxpayers, earn $150,000 in taxable income and $40,000 in interest from an investment in City of Heflin bonds. (Use the U.S. tax rate schedule for married filing jointly). Required: a. If Jorge and Anita earn an additional $100,000 of taxable income, what is their marginal tax rate on this income? b. What is their marginal rate if, instead, they report an additional $100,000 in deductions? (For all requirements, round your answers to 2 decimal places.) a. b. arginal tax rate. Marginal tax rate % %arrow_forwardUS Tax System 2021 Jessie is a single taxpayer and has taxable income of $195,000 for 2020. If Jessie anticipates a marginal tax rate of 12% in 2021, what income tax savings could he expect by accelerating $3,000 of deductible expenditures planned for 2021 in the 2020 tax year?arrow_forwardProblem 1-34 (LO 1-3) (Algo) Chuck, a single taxpayer, earns $75,200 in taxable income and $10,200 in interest from an investment in City of Heflin bonds. (Use the U.S tax rate schedule.) Required: a. How much federal tax will he owe? b. What is his average tax rate? c. What is his effective tax rate? d. What is his current marginal tax rate? Complete this question by entering your answers in the tabs below. Required A Required B Required C Answer is not complete. Federal tax Required D How much federal tax will he owe? Note: Do not round intermediate calculations. Round "Federal tax" to nearest whole dollar amount.arrow_forward

- Given the following tax structure, what minimum tax would need to be assessed on Shameika to make the tax progressive with respect to effective tax rates? (Round your final answer to nearest whole dollar amount.) Muni-Bond Total Tax Salary $ 10,000 $ 50,000 Тахраyer Interest $ 600 $ 10,000 $ 30,000 Mihwah Shameika ??? Minimum taxarrow_forwardSelf-Study Problem 1.7 What is the net effect of the EIP (economic impact payment) and RRC (recovery rebate credit) on each of the following taxpayers. The EIP is $1,400 for single taxpayers and $2,800 for married, filing jointly taxpayers. An additional $1,400 is allowed for each qualifying child. 1. Mirka and Liam are married and file jointly with AGI of $97,000 in 2021. In 2021 they received an EIP of $4,200 based on their filing status and having a dependent child at the end of 2020. 2. Phoebe was a dependent taxpayer in 2020 and had not filed a tax return. In 2021, she failed to request and did not receive an EIP, although she was no longer a dependent and had AGI of $28,000 as a single taxpayer. 3. Mahima received a $1,400 EIP in 2021. Due to the birth of her son in 2021, Mahima was classified as a head of household taxpayer with AGI of $47,000. 4. Jane and Marshall file jointly in 2021 and claim two dependents. They received a $5,600 EIP in 2021. Jane received a large bonus in…arrow_forwardSetting: Philippines 2021arrow_forward

- Return to question Given the following tax structure: Salary $ 40,500 Taxpayer Total Tax $ 2,349 Pedro 000 ES $ a. What is the minimum tax that Pedro should pay to make the tax structure vertically equitable with respect to the amount of tax paid? X Answer is complete but not entirely correct. $3,074 b. This would result in what type of tax rate structure? Answer is complete and correct. Tax rate structure Regressive 5:03 AM x> ツ 10/26/2021 61°F to search N4arrow_forwardAccounting Below are the 2021 tax brackets for single American taxpayers: Marginal Tax Rate For Single Individuals For Married Individuals Filing Joint Returns 10% $0 to $9,950 $0 to $19,900 12% $9,951 to $40,525 $19,901 to $81,050 22% $40,526 to $86,375 $81,051 to $172,750 24% $86,376 to $164,925 $172,751 to $329,850 32% $164,926 to $209,425 $329,851 to $418,850 35% $209,426 to $523,600 $418,851 to $628,300 37% $523,601 or more $628,301 or more a) Build this table in Excel. Have the user plug in their salary in a cell. In another cell, use a lookup function to determine and output the marginal tax rate, assuming the person is single. Note: the marginal tax rate is defined as the tax rate that applies to the last unit of the tax base. For example, if your income was $25,000, your marginal tax rate is 12%. Your lookup function should be flexible enough to output the correct answer for a multitude of different salaries. b) Do the same but this time assume the person is married filing…arrow_forward9. A Filipino citizen has P400,000 Philippine income and P300,000 foreign income. He paid P55,000 income taxes abroad. Compute the allowable tax credit for the income taxes paid abroad. с. Р 45, 000 d. P 55, 000 а. РО b. Р 40, 000 10. In the preceding problem, what is the tax credit if the taxpayer was a non-resident citizen or a resident alien? с. Р 45, 000 d. P 55, 000 а. РО b. P 40, 000arrow_forward

- 1. Mr. A, a Filipino citizen made the following gifts to his children for calendar year 2021: Phil. USA Canada Australia Net gift P500,000 P410,000 P300,000 P100,000 Donor's tax paid 30,000 P20,000P 5,000 Required: Compute the donor's to still due after tax credit.arrow_forwardUS Tax System Ellen, a single taxpayer, has $160,000 of taxable income plus $30,000 income from tax-exempt bonds. What is her effective tax rate?arrow_forwardMemanarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education