FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

Note:-

- Do not provide handwritten solution. Maintain accuracy and quality in your answer. Take care of plagiarism.

- Answer completely.

- You will get up vote for sure.

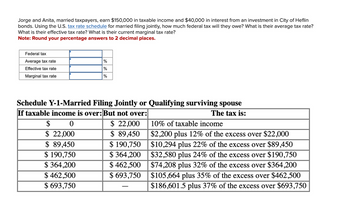

Transcribed Image Text:Jorge and Anita, married taxpayers, earn $150,000 in taxable income and $40,000 in interest from an investment in City of Heflin

bonds. Using the U.S. tax rate schedule for married filing jointly, how much federal tax will they owe? What is their average tax rate?

What is their effective tax rate? What is their current marginal tax rate?

Note: Round your percentage answers to 2 decimal places.

Federal tax

Average tax rate

Effective tax rate

Marginal tax rate

%

%

%

Schedule Y-1-Married Filing Jointly or Qualifying surviving spouse

If taxable income is over: But not over:

The tax is:

$ 22,000

$ 89,450

$ 190,750

$364,200

$462,500

$ 693,750

$ 0

$ 22,000

$ 89,450

$ 190,750

$364,200

$ 462,500

$ 693,750

10% of taxable income

$2,200 plus 12% of the excess over $22,000

$10,294 plus 22% of the excess over $89,450

$32,580 plus 24% of the excess over $190,750

$74,208 plus 32% of the excess over $364,200

$105,664 plus 35% of the excess over $462,500

$186,601.5 plus 37% of the excess over $693,750

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 3 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Auditors can help avoid litigation by implementing policies and procedures that ensure all work is fully documented Question 7 options: True Falsearrow_forwardPlease dont give plagiarised answers thnkuarrow_forwardDavid Savage asked you to write a memo presenting the issues and the risks associated withconsultants. Further, outline a set of procedures that could be used as a guide in selecting aconsultant.arrow_forward

- The legal environment has little impact on human resource management decision making. Question 22 options: True Falsearrow_forwardAssume that you accept the following ethical rule: “Failure to tell the whole truth is wrong.” In the textbook illustration about Santos’s problem with Ellis’s instructions, (a) what would this rule require Santosto do and (b) why is an unalterable rule such as this classified as an element of imperative ethical theory?arrow_forwarddiscuss how critical thinking skills will make you less likely to be influenced by arguments that are based on fallacies and faulty reasoning.arrow_forward

- Provide best Answer As per posible fastarrow_forwardCritically evaluate how the breach of ethics by auditors could contribute to expand the audit expectation gap. Your report should include/address the following concerns: 1. Introduce/analyze ethical aspect of auditors and audit expectation gap. 2. Critically examine how different threats to ethics enlarge the audit expectation gap. 3. Propose ways to minimize the threats to ethics and thus the expectation gap of audits. 4. Determine the current developments and future direction of ethical aspects of auditors, and explain how such developments contribute to safeguard the audit profession as a concluding remarks. Include a cover page, an executive summary, a table of contents and references. You may include an appendix if necessary.arrow_forwardKaren finds that many claim forms were rejected because important information was omitted. How might Karen suggest corrections for these omissions?arrow_forward

- What is risk of incorrect acceptance? A. The risk that the auditor concludes that a material misstatement exists when it does not exist. B. The risk that the auditor concludes that a material misstatement does not exist when it actually does not. C. The risk that the auditor concludes that a material misstatement does not exist when it does exist. D. The risk that the auditor concludes that a material misstatement exists when it actually does.arrow_forwardUrgent Please answer a soon as possible. Answer must be plagirism free What is the role of auditors and explain the importance of the role.arrow_forward1. Choose the ethical considerations that Amahle Khumalo should recognize in deciding how to proceed. Note: You may select more than one answer. Single click the box with the question mark to produce a check mark for a correct answer and double click the box with the question mark to empty the box for a wrong answer. Any boxes left with a question mark will be automatically graded as incorrect. Check my work is not available. Khumalo should exercise initiative and good judgment in providing management with information having a potentially adverse economic impact Khumalo should determine whether the controller's request violates her professional or personal standards or the company's code of ethics. ? Khumalo should protect proprietary information and should not violate the chain of command by discussing this matter with the controller's superiors ?Khumalo should not try to convince the controller regarding the probable failure of reworks.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education