Cornerstones of Cost Management (Cornerstones Series)

4th Edition

ISBN: 9781305970663

Author: Don R. Hansen, Maryanne M. Mowen

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

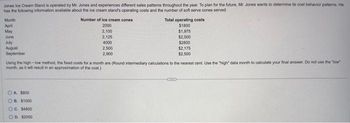

Transcribed Image Text:Jones

Ice Cream Stand is operated by Mr. Jones and experiences different sales patterns throughout the year. To plan for the future, Mr. Jones wants to determine its cost behavior patterns. He

has the following information available about the ice cream stand's operating costs and the number of soft serve cones served.

Month

April

May

June

July

August

September

Number of ice cream cones

2000

2,100

OA $800

OB $1000

OC. $4800

OD. $2000

2,125

4000

2,500

2,900

Total operating costs

$1800

$1,975

$2,000

$2800

$2,175

$2,500

Using the high-low method, the fixed costs for a month are (Round intermediary calculations to the nearest cent. Use the "high" data month to calculate your final answer. Do not use the "low"

month, as it will result in an approximation of the cost.)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Jean and Tom Perritz own and manage Happy Home Helpers, Inc. (HHH), a house-cleaning service. Each cleaning (cleaning one house one time) takes a team of three house cleaners about 1.5 hours. On average, HHH completes about 15,000 cleanings per year. The following total costs are associated with the total cleanings: Required: 1. Calculate the prime cost per cleaning. 2. Calculate the conversion cost per cleaning. 3. Calculate the total variable cost per cleaning. 4. Calculate the total service cost per cleaning. 5. What if rent on the office that Jean and Tom use to run HHH increased by 1,500? Explain the impact on the following: a. Prime cost per cleaning b. Conversion cost per cleaning c. Total variable cost per cleaning d. Total service cost per cleaningarrow_forwardPlease help me. Thankyou.arrow_forwardSlarlet Beauty manufactures and sells a face cream lo small specialy stores in the greater Los Angeles area. It presents the monthly operating income stalement shown here to George Diaz, a polenial investor in the business. Help Mr. Diaz understand Starlet Beauty's cost structure. E(Click the icon to view the operating income stalement.) Read the equirements. Data Table Requirement 1. Recast the income statement to emphasize contribution margin. Starlet Cosmetics Operating Income Statement, June 2017 Starlet Beauty Operating Income Statement, June 2017 10,000 Units sold Revenues 200,000 Cost of goods sold Variable manufacturing costs 80,000 32,900 Fixed manufacturing costs 112,900 Total Gross margin 87,100 Operating costs Variable marketing costs 48,000 17.500 Fixed marketing and administrative costs 65,500 Total operating costs 21,600 Operating income Print Done Choose from any list or enter any number in the input fields and then click Check Answer.arrow_forward

- Tasty Treats is a snow cone stand near the local park. To plan for the future, it wants to determine its cost behavior patterns. It has the following information available about its operating costs and the number of snow cones served Month January February March. April May June Number of snow cones 6,400 7,000 6,200 6,900 7,600 7,250 Total operating costs $5,830 $6,400 $5,840 $6,330 $6,820 $6,575 Using the high-low method, the monthly operating costs, if Tasty Treats sells 8,000 snow cones in a month, are:arrow_forwardStable Paper Delivery has decided to analyze the profitability of five new customers. It buys recycled paper at $12 per case and sells to retail customers at a list price of $14.80 per case. Data pertaining to the five customers are: E (Click the icon to view the data.) Stable Paper Delivery's five activities and their cost drivers are as follows: E (Click the icon to view the activities and cost drivers.) Read the requirements. Requirement 1. Compute the customer-level operating income of each of the five retail Begin by calculating each customer's gross margin. Then calculate the operating incom minus sign for operating losses.) Requirements 1 2 1. Compute the customer-level operating income of each of the five retail customers now being examined (1, 2, 3, 4, and 5). Comment on the results. 2. What insights do managers gain by reporting both the list selling price and the actual selling price for each customer? 3. What factors should managers consider in deciding whether to drop one…arrow_forwardA Prepare a schedule to show the differential costs per cookie (Enter your answers to 2 decimal places. Select option "higher" or "lower", keeping Status Quo as the base. Select "none" if there is no effect.) B. Should Mel continue to buy the cookies?arrow_forward

- Please provide answer with detailed working, please answer in text form, without imagearrow_forwardRecalculate the customer-level operating income using the number of written orders but at their actual $8 cost per order instead of $15 (except for DC, whose actual cost is $15 per order). How will KC Corporation evaluate customer-level operating cost performance this period?arrow_forwardDesk company has a product that it currently sells in the market for $80 per unit. Does develop a new feature that if added to the 16 product will allow desk to receive a price of $95 per unit.arrow_forward

- Please provide answer in text (Without image) and show calculationarrow_forwarda. What impact would accepting this special order have on operating profit? b. From an operating profit perspective for April, should Maria accept the order?arrow_forwardSheryl Company operates a factory in which pickled olives are prepared and packaged. Of course, in making her product, Sheryl must purchase a lot of olives. Sheryl has purchased her olives from the same supplier for 15 years. For the purpose of doing a cost-volume-profit analysis, what kind of cost is Sheryl’s cost of purchasing olives? Variable Fixed Indirect Period Administrativearrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,Principles of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,Principles of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Cornerstones of Cost Management (Cornerstones Ser...

Accounting

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Cengage Learning

Principles of Cost Accounting

Accounting

ISBN:9781305087408

Author:Edward J. Vanderbeck, Maria R. Mitchell

Publisher:Cengage Learning

Managerial Accounting

Accounting

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:South-Western College Pub

Financial And Managerial Accounting

Accounting

ISBN:9781337902663

Author:WARREN, Carl S.

Publisher:Cengage Learning,

Principles of Accounting Volume 2

Accounting

ISBN:9781947172609

Author:OpenStax

Publisher:OpenStax College