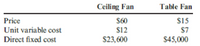

Vandenberg Inc., produces and sells two products; a celling fan and a table fan.Vandenberg plans to sell 30,000 ceiling fans and 70,000 table fans in the coming year.Product price and cost information includes;

Common fixed selling and ad,inistrative expenses total $85,000.

Required:

1. What is the sales mix estimated for the next year (calculated to the lowest whole number for each product)?

2. Using the sales mix from Requirement 1, form a package of ceiling fans and table fans.How many ceiling fans and table fans are sold at break-even?

3. Prepare a contribution-margin based income statement for Vandenberg,Inc.,based on the unit sales calculated in Requirement 2.

4. What if Vandenberg,Inc.,wanted to earn operating income equal to $14,000? calculate the number of ceiling fans and table fans that must be sold to earn this level of operating income.(hint;Remeber to form a package of ceiling fans and table fans based on the sales mix and to first calculate the number of packages to eearn an operating income of $14,000.)

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps with 2 images

- Please read the directive and questions carefully and answer the questions as follows. Use the correct rules available and formulas. Also explain in steps by steps .arrow_forwardCabin Creek Company is considering adding a new line of kitchen cabinets. The company's accountant provided the following estimated data for these cabinets: Annual sales Selling price per unit Variable manufacturing costs per unit Variable selling costs per unit Incremental fixed costs per year: Manufacturing Selling r Allocated common costs per year: Manufacturing Selling and administrative 800 units $ 3,570 $ 1,570 $ 420 $ 482,400 $ 62,000 $ 87,000 $ 119,000 If the kitchen cabinets are added as a new product line, the company expects that the contribution margin earned from selling its of products will decrease by $214,000 per year. Required: 1. What is the annual financial advantage (disadvantage) of adding the new line of kitchen cabinets? 2. What is the lowest selling price per unit that could be charged for the cabinets and still make it economically desirable for the company to add the new product line? Complete this question by entering your answers in the tabs below. Required…arrow_forwardThe Walton Toy Company manufactures a line of dolls and a sewing kit. Demand for the company’s products is increasing, and management requests assistance from you in determining an economical sales and production mix for the coming year. The company has provided the following data: Product DemandNext year(units) SellingPriceper Unit DirectMaterials DirectLabor Debbie 53,000 $ 19.00 $ 4.60 $ 4.40 Trish 45,000 $ 7.00 $ 1.40 $ 1.76 Sarah 38,000 $ 29.00 $ 6.89 $ 6.80 Mike 32,000 $ 13.00 $ 2.30 $ 5.20 Sewing kit 328,000 $ 8.30 $ 3.50 $ 1.36 The following additional information is available: The company’s plant has a capacity of 137,510 direct labor-hours per year on a single-shift basis. The company’s present employees and equipment can produce all five products. The direct labor rate of $8 per hour is expected to remain unchanged during the coming year. Fixed manufacturing costs total $550,000 per year. Variable overhead costs are $2 per direct labor-hour.…arrow_forward

- Heather Hudson makes stuffed teddy bears. Recent information for her business follows: Selling price per bear Total fixed costs per month Variable cost per bear $31.50 1,729.00 18.50 Required: If she sells 289 bears next month, determine the margin of safety in units, in sales dollars, and as a percentage of sales. Note: Round your intermediate calculations to the nearest whole number and round your "Percentage of Sales" answer to 2 decimal places. (i.e. 0.1234 should be entered as 12.34%. Round your "Margin of safety (Dollars)" answer to the nearest whole number.) Margin of safety (Units) Margin of safety (Dollars) Margin of safety percentage %arrow_forwardPlease answer part 4 and 5.arrow_forwardThe following operating information reports the results of Ayayai Company’s production and sale of 12,500 air-conditioned motorcycle helmets last year. Based on early market forecasts, Ayayai expects the same results this year. Sales $2,026,000 Variable manufacturing expenses 862,000 Fixed manufacturing expenses 279,000 Variable selling and administrative expenses 112,000 Fixed selling and administrative expenses 229,000 The American Motorcycle Club has offered to purchase 1,600 helmets at a price of $100 each. Ayayai has sufficient idle capacity to fill the order, which would not affect the company’s cost structure or regular sales.If Ayayai accepts this order, by how much will its income increase or decrease? Operating income will select an option decreaseincrease by $enter a dollar amount .arrow_forward

- Owearrow_forwardPLEASE TO PERFORM IN EXCEL AND SHOW FORMULAS Comercial El Suspiro, S.A., purchases 2'100,000 units per year of a component. The cost of each order is $25.00. The annual unit maintenance cost is 27% of its cost of $2.00. On a 360-day basis, calculate the reorder point, knowing that it takes 10.5 days for the supplier to put in the LAB company the goods, and the company sorts and stores them in 1.5 days, calculate the reorder point.arrow_forwardPlease help me. Thankyou.arrow_forward

- Feather Friends, Incorporated, distributes a high-quality wooden birdhouse that sells for $40 per unit. Variable expenses are $20.00 per unit, and fixed expenses total $200,000 per year. Its operating results for last year were as follows: Sales Variable expenses Contribution margin Fixed expenses Net operating income Required: Answer each question independently based on the original data: 1. What is the product's CM ratio? 2. Use the CM ratio to determine the break-even point in dollar sales. 3. Assume this year's unit sales and total sales increase by 59,000 units and $2,360,000, respectively. If the fixed expenses do not change, how much will net operating income increase? $ 1,000,000 500,000 500,000 200,000 $ 300,000 4-a. What is the degree of operating leverage based on last year's sales? 4-b. Assume the president expects this year's unit sales to increase by 19%. Using the degree of operating leverage from last year, what percentage increase in net operating income will the…arrow_forwardDellcom Inc. sells two products: a regular and a deluxe version. The owner would like to better understand the impact of the sales mix on the company's sales. The following information is available: Regular Deluxe Sales price per unit Variable cost per unit $38 $61 $15 $34 The company has total fixed costs of $384,615 for the year and they sell 9 Regular products for every 4 Deluxe product. The owner would like to know, given the sales mix, how many units of each product the company must sell per year to break even. The company must sell units of the Regular product. Enter the number of units given the current sales mix. The company must sell units of the Deluxe product. Enter the number of units given the current sales mix.arrow_forwardZulu sells its waterproof phone case for $100 per unit. Fixed costs total $177,000, and variable costs are $38 per unit. Compute the units that must be sold to get a target income of $210,500. Units to be sold to achieve targeted income Numerator: Denominator: Units to Achieve Target Units to achieve target %3Darrow_forward

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education