FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

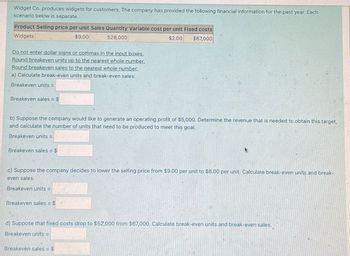

Transcribed Image Text:Widget Co. produces widgets for customers. The company has provided the following financial information for the past year. Each

scenario below is separate.

Product Selling price per unit Sales Quantity Variable cost per unit Fixed costs

Widgets

$9.00

528,000

$2.00 $67,000

Do not enter dollar signs or commas in the input boxes.

Round breakeven units up to the nearest whole number.

Round breakeven sales to the nearest whole number.

a) Calculate break-even units and break-even sales.

Breakeven units =

Breakeven sales = $

b) Suppose the company would like to generate an operating profit of $5,000. Determine the revenue that is needed to obtain this target,

and calculate the number of units that need to be produced to meet this goal.

Breakeven units =

Breakeven sales = $

c) Suppose the company decides to lower the selling price from $9.00 per unit to $8.00 per unit. Calculate break-even units and break-

even sales.

Breakeven units =

Breakeven sales = $

d) Suppose that fixed costs drop to $52,000 from $67,000. Calculate break-even units and break-even sales.

Breakeven units =

Breakeven sales = $

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Step 1: Basic Introduction

VIEW Step 2: a Calculation of Breakeven units and Breakeven sales

VIEW Step 3: b Calculation of Sales needed to earn operating profit of 5000

VIEW Step 4: c. Calculation of Breakeven units and Sales if Selling price per unit is 8

VIEW Step 5: d. Calculation of Breakeven units and breakeven sales if Fixed Cost is 52000

VIEW Solution

VIEW Trending nowThis is a popular solution!

Step by stepSolved in 6 steps

Knowledge Booster

Similar questions

- Coco Corp. manufactures boxes of chocolate candies. Its basic cost and profit information is summarized below: • Selling price per box: $12 • Variable cost per box: $6 • Fixed cost per year: $33,000 The company has the capacity to manufacture up to 100,000 boxes of its candy per year. a) Determine the net income at a volume of 30% of capacity. b) Determine the sales volume in dollars to generate a net income of $60,000. c) Determine the break-even point in units if the selling price is increased by 10%.arrow_forwardLin Corporation has a single product whose selling price is $130 per unit and whose variable expense is $65 per unit. The company’s monthly fixed expense is $32,150. Lin Corporation has a single product whose selling price is $130 per unit and whose variable expense is $65 per unit. The company’s monthly fixed expense is $32,150. Required: 1. Calculate the unit sales needed to attain a target profit of $2,300. (Do not round intermediate calculations.) 2. Calculate the dollar sales needed to attain a target profit of $8,900. (Round your intermediate calculations to the nearest whole numbarrow_forwardCarla Vista Company produces a molded briefcase that is distributed to luggage stores. The following operating data for the current year has been accumulated for planning purposes. Sales price Variable cost of goods sold Variable selling expenses Variable administrative expenses Annual fixed expenses Overhead Selling expenses Administrative expenses (a) $80 * Your answer is incorrect. 21.20 24 Break even units $9,400,000 Carla Vista can produce 1.5 million cases a year. The projected net income for the coming year is expected to be $2,100,000. Carla Vista is subject to a 40% income tax rate. 6 1,550,000 During the planning sessions, Carla Vista's managers have been reviewing costs and expenses. They estimate that the company's variable cost of goods sold will increase 20% in the coming year and that fixed administrative expenses will increase by $120,000. All other costs and expenses are expected to remain the same. 3,250,000 Carla Vista Company's managers are considering expanding the…arrow_forward

- Mauro Products distributes a single product, a woven basket whose selling price is $26 per unit and whose variable expense is $22 per unit. The company's monthly fixed expense is $5,600. Required: 1. Calculate the company's break-even point in unit sales. 2. Calculate the company's break-even point in dollar sales. (Do not round intermediate calculations.) 3. If the company's fixed expenses increase by $600, what would become the new break-even point in unit sales? In dollar sales? (Do not round intermediate calculations.)arrow_forwardWarner clothing is considering the introudciton fo a new baseball cap for sales by local vendors. The comapny has collected the following price and cost characteristics. A. What number must Warner sell per month to break even? B. What number must Warner sell per month to make an operating profit of $30,000?arrow_forwardLin Corporation has a single product whose selling price is $140 per unit and whose variable expense is $70 per unit. The company’s monthly fixed expense is $31,600. Required: 1. Calculate the unit sales needed to attain a target profit of $8,300. (Do not round intermediate calculations.) 2. Calculate the dollar sales needed to attain a target profit of $10,000. (Round your intermediate calculations to the nearest whole number.)arrow_forward

- Ullie Medical Supply is a retailer of home medical equipment. Last year, Ullie's sales revenues totaled $6,600,000. Total expenses were $2,300,000. Of this amount, approximately $1,320,000 were variable, while the remainder were fixed. Since Ullie's offers thousands of different products, its managers prefer to calculate the breakeven point in terms of sales dollars rather than units. 4.(PLEASE SOLVE THIS QUESTION) Ullie's top management is deciding whether to embark on a $180,000 advertising campaign. The marketing firm has projected annual sales volume to increase by 18% as a result of this campaign. Assuming that the projections are correct, what effect would this advertising campaign have on the company's annual operating income? What effect would this advertising campaign have on Ullie's annual operating income? The effect would be (INCREASE/DECREASE) operating income ofarrow_forwardMaple Enterprises sells a single product with a selling price of $80 and variable costs per unit of $32. The company's monthly fixed expenses are $28,800. A. What is the company's break-even point in units? Break-even units fill in the blank 48108800dffc040_1 units B. What is the company's break-even point in dollars? Break-even dollars $fill in the blank 48108800dffc040_2 C. Construct a contribution margin income statement for the month of September when they will sell 800 units. Use a minus sign for a net loss if present. Income Statement $fill in the blank 74e529089f92058_2 fill in the blank 74e529089f92058_4 $fill in the blank 74e529089f92058_6 fill in the blank 74e529089f92058_8 $fill in the blank 74e529089f92058_10 D. How many units will Maple need to sell in order to reach a target profit of $48,000? New break-even units fill in the blank 946f62fa600f077_1 units E. What dollar sales will Maple need in order to reach a…arrow_forwardMaple Enterprises sells a single product with a selling price of $94 and variable costs per unit of $32. The company’s monthly fixed expenses are $15,846. What dollar sales will Maple need in order to reach a target profit of $22,657? Round to the nearest whole dollar, no decimals.arrow_forward

- Lin Corporation has a single product whose selling price is $134 per unit and whose variable expense is $67 per unit. The company's monthly fixed expense is $32,300. Required: 1. Calculate the unit sales needed to attain a target profit of $7,900. (Do not round intermediate calculations.) 2. Calculate the dollar sales needed to attain a target profit of $8,600. (Round your intermediate calculations to the nearest whole number.) 1. Units sales to attain target profit units 2. Dollar sales to attain target profitarrow_forwardMauro Products distributes a single product, a woven basket whose selling price is $14 per unit and whose variable expense is $10 per unit. The company's monthly fixed expense is $6,800. Required: 1. Calculate the company's break-even point in unit sales. 2. Calculate the company's break-even point in dollar sales. (Do not round intermediate calculations.) 3. If the company's fixed expenses increase by $600, what would become the new break-even point in unit sales? In dollar sales? (Do not round intermediate calculations.) 1. Break-even point in unit sales 2. Break-even point in dollar sales baskets 3. Break-even point in unit sales baskets 3. Break-even point in dollar salesarrow_forwardVishnuarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education