Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

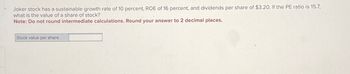

Transcribed Image Text:Joker stock has a sustainable growth rate of 10 percent, ROE of 16 percent, and dividends per share of $3.20. If the PE ratio is 15.7,

what is the value of a share of stock?

Note: Do not round intermediate calculations. Round your answer to 2 decimal places.

Stock value per share

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 1 steps

Knowledge Booster

Similar questions

- A stock has had the following year-end prices and dividends: Year 1 Price Dividend $ 43.41 2 48.39 $0.66 3 57.31 0.69 4 45.39 0.80 5 52.31 0.85 6 61.39 0.93 What are the arithmetic and geometric returns for the stock? (Do not round intermediate calculations. Round the final answers to 2 decimal places.)arrow_forwardRefer to Figure 2.8 and look at the listing for Hewlett Packard. Required: a. How many shares can you buy for $25,000? Note: Round down your answer to the nearest whole number. b. What would be your annual dividend income from those shares? Note: Round down your intermediate calculations to the nearest whole number. Do not leave the cell blank. Enter zero (0) if required. Round your answer to 2 decimal places. c. What must be Hewlett Packard's earnings per share? Note: Round your answer to 2 decimal places. d. What was the firm's closing price on the day before the listing? Note: Round your answer to 2 decimal places. a. Number of shares b. Annual dividend income c. Earnings per share d. Yesterday's closing price NAME Herbalife Nutrition SYMBOL CLOSE HLF Hershey HSY Hess Corporation HES Hewlett Packard HPE HD HMC HON Home Depot Honda Honneywell CHANGE 0051.45 -0.05 1.64 -3.52 0.25 2.17 0.13 3.69 177.57 80.39 14.01 319.22 32.54 227.22 VOLUME 0000434,355 658,253 2,143,509 9,448,992…arrow_forwardHow can I calculate geometric average in Excel?arrow_forward

- A stock has had the following year-end prices and dividends: Year 1 2355N 4 6 Price $ 64.63 71.50 77.30 63.57 73.71 82.75 Dividend Arithmetic average return Geometric average return $.66 .71 .77 .86 .93 What are the arithmetic and geometric returns for the stock? Note: Do not round intermediate calculations and enter your answers as a percent rounded to 2 decimal places, e.g., 32.16. % %arrow_forwardSuppose a stock had an initial price of $60 per share, paid a dividend of $.60 per share during the year, and had an ending share price of $72. Compute the percentage total return. (Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16.) Total Return:arrow_forwardSuppose a stock had an initial price of $84 per share, paid a dividend of $1.50 per share during the year, and had an ending share price of $71.50. a. Compute the percentage total return. (A negative answer should be indicated by a minus sign. Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16.) b. What was the dividend yield? (Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16.) c. What was the capital gains yield? (A negative answer should be indicated by a minus sign. Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16.)arrow_forward

- Share commom stock dividend is $1.00 , g=5.4 and required return is 11.4%, What is the stock price?arrow_forwardSuppose a stock had an initial price of $86 per share, paid a dividend of $1.80 per share during the year, and had an ending share price of $74. Compute the percentage total return, dividend yield, and capital gains yield. (A negative answer should be indicated by a minus sign. Do not round intermediate calculations and enter your answers as a percent rounded to 2 decimal places, e.g., 32.16.)arrow_forwardThe preferred stock of Denver Savings and Loan pays an annual dividend of $7.65. It has a required rate of return of 9 percent. Compute the price of the preferred stock. (Do not round intermediate calculations. Round your answer to 2 decimal places.)arrow_forward

- A small strip mining cola company is trying to decide whether it should purchase or lease a new clamshell. If purchased, the shell will cost $150,000 and is expected to have a $65,000 salvage value after 6 years. Alternatively, the company can lease a clamshell for $20,000 per year, but the lease payment will have to be made at the beginning of each year. If the clamshell is purchased, it will be leased to other strip-mining companies whenever possible, an activity that is expected to yield revenue of $12,000 per year. If the company’s MARR is 15% per year, should the clamshell be purchased or leased on the basis of future worth analysis. (Enter the FW value of the selected alternative with proper positive or negative sign)arrow_forwardYou are currently investigating a stock with per share earnings of $1.73. The current price of the stock is $119.99. If the expected growth rate of the firm is 12%, what is the stock's PEG ratio? Answer with two decimals.arrow_forwardA stock has had the following year-end prices and dividends: Year 1234 in 10 5 6 Price $64.68 71.55 77.35 63.62 73.81 83.25 Dividend Arithmetic average return. Geometric average return $.67 .72 .78 .87 .94 What are the arithmetic and geometric returns for the stock? Note: Do not round intermediate calculations and enter your answers as a percent rounded to 2 decimal places, e.g.. 32.16. % %arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education