FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

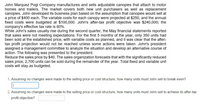

Transcribed Image Text:John Marquez Pogi Company manufactures and sells adjustable canopies that attach to motor

homes and trailers. The market covers both new unit purchasers as well as replacement

canopies. John developed its business plan based on the assumption that canopies would sell at

a price of $400 each. The variable costs for each canopy were projected at $250, and the annual

fixed costs were budgeted at $100,000. John's after-tax profit objective was $240,000; the

company's effective tax rate is 60%.

While John's sales usually rise during the second quarter, the May financial statements reported

that sales were not meeting expectations. For the first 5 months of the year, only 350 units had

been sold at the established price, with variable costs as planned, and it was clear that the after-

tax profit projection would not be reached unless some actions were taken. John's president

assigned a management committee to analyze the situation and develop an alternative course of

action. The following was presented to the president.

Reduce the sales price by $40. The sales organization forecasts that with the significantly reduced

sales price, 2,700 units can be sold during the remainder of the year. Total fixed and variable unit

costs will stay as budgeted.

1. Assuming no changes were made to the selling price or cost structure, how many units must John sell to break even?

2. Assuming no changes were made to the selling price or cost structure, how many units must John sell to achieve its after-tax

profit objective?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- The company produces and sells athletic shoes for children. The costs associated with each pair of shoes are estimated to be $14 of variable costs and $5 of fixed costs. The shoes normally sell for $35 per pair. A local children’s athletic league has offered to buy 100 pairs of shoes for $19 each. The company has excess capacity. How much additional revenue would be earned if they accept the offer?arrow_forwardA company rents snow skis and transports customers to and from their ski trip at a local ski slope. The trip is priced at $20 per person and has a CM ratio of 40%. The company's fixed expenses are $84,000. Last year, sales were $400,000 and profit was $36,000. How many units need to be sold to break- even, and how many need to be sold to earn a profit of $42,000? Multiple Choice 4,500 and 5,250 6,000 and 8,143 14,000 and 21,000 10 500 and 15 750arrow_forwardLucid Images Ltd manufactures premium high definition televisions. The firm’s fixed costs are$4,000,000 per year. The variable cost of each TV is $2,000, and the TVs are sold for $3,000 each. Thecompany sold 5,000 TVs during the previous year. (In the following requirements, ignore income taxes)Required:Treat each of the requirements as independent situations:a) Calculate the break-even point in units.b) What will the new break-even point be if fixed costs increase by 10 per cent? c) What was the company’s net profit for the previous year? (4 marks)d) The sales manager believes that a reduction in the sales price to $2,500 will result in orders for 1,200 more TVs each year. What will the break-even point be if the price is changed?arrow_forward

- Deluxe Homes is a residential Home Builder. Based on their current production of 300 homes per year, they currently make a profit of $20,000 per unit, based on the following costs per unit: Direct labor $ 20,000 Direct materials 200,000 Variable overhead 30,000 Fixed overhead 40,000 Variable selling costs 10,000 Fixed selling costs 10,000 Total costs per unit $310,000 Required Each of these are separate situations: A. Prepare an income statement based on the information provided. B. What is the profit and cost per unit if production is increased to 400 homes per year, and there is an increase of $1.50 million in total fixed overhead costs?arrow_forwardSteps Inc sells step aerobic class equipment. The equipment sells for $15 / unit. The variable cost is $10 per unit and fixed costs are $1,750,000. What are number of units the company must sell if the company wants to achieve a target profit of $400,000arrow_forwardVandenberg, Inc., produces and sells two products: a ceiling fan and a table fan. Vandenberg plans to sell 40,000 ceiling fans and 60,000 table fans in the coming year. Product price and cost information includes: Ceiling Fan Table Fan Price $54 $12 Unit variable cost $11 $9 Direct fixed cost $20,800 $41,000 Common fixed selling and administrative expenses total $84,000. Required: 1. What is the sales mix estimated for next year (calculated to the lowest whole number for each product)?Sales mix of ceiling fans to table fans = _______ : __________ 2. Using the sales mix from Requirement 1, form a package of ceiling fans and table fans. How many ceiling fans and table fans are sold at break-even? Round your intermediate calculations and final answers to the nearest whole number. Break-even ceiling fans ______ Break-even table fans _______ 3. Prepare a contribution-margin-based income statement for Vandenberg, Inc., based on the unit sales…arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education