FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

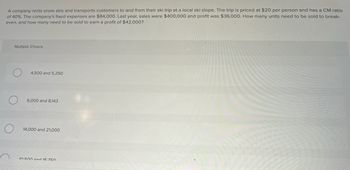

Transcribed Image Text:A company rents snow skis and transports customers to and from their ski trip at a local ski slope. The trip is priced at $20 per person and has a CM ratio

of 40%. The company's fixed expenses are $84,000. Last year, sales were $400,000 and profit was $36,000. How many units need to be sold to break-

even, and how many need to be sold to earn a profit of $42,000?

Multiple Choice

4,500 and 5,250

6,000 and 8,143

14,000 and 21,000

10 500 and 15 750

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Please help me fastarrow_forwardVinubhaiarrow_forwardA furniture company manufactures desks and chairs. Each desk requires 29 hours to manufacture and contributes $400 to profit, and each chair requires 19 hours to manufacture and contributes $250 to profit. Due to marketing restrictions, a total of 2000 hours are available. Use Solver to maximize the company’s profit. What is the maximum profit? How many desks and chairs should the company manufacture? Of the 2000 available hours, how many hours will be used?arrow_forward

- How many T-shirts must the company sell this year to break even?arrow_forwardDogarrow_forwardPosters.com is an Internet retailer of high-quality posters. The company has $750,000 in operating assets and fixed expenses of $156,000 per year. With this level of operating assets and fixed expenses, the company can support sales of up to $4,800,000 per year. The company's contribution margin ratio is 9%, which means an additional dollar of sales results in additional contribution margin, and net operating income, of 9 cents. Required: 1. Complete the following table showing the relation between sales and return on investment (ROI). 2. What happens to the company's return on investment (ROI) as sales increase? Complete this question by entering your answers in the tabs below. Required 1 Required 2 Complete the following table showing the relation between sales and return on investment (ROI). Note: Round your percentage answers to 2 decimal places. Sales Net Operating Income $ 4,300,000 $ 231,000 $ 4,400,000 $ 4,500,000 $ 4,600,000 $ 4,700,000 $ 4,800,000 Average Operating Assets $…arrow_forward

- Avocado Company sells guitars to Mexican restaurants. The guitars sell for $600, and the fixed monthly operating costs are as follows: Rent and utilities $4800 Wages and benefits to employees 2300 Other expenses 485 Avocado understand that for every dollar of sales, $0.65 went to cover fixed costs, and anything above that point was profit. What is the amount of revenue that Avocado should earn each month to break even? (Round your answer to the nearest dollar.) O $4285 O $4769 O $5515 O $10,243arrow_forwardRadar Company sells bikes for $490 each. The company currently sells 3.700 bikes per year and could make as many as 5,000 bikes per year. The bikes cost $275 each to make: $160 in variable costs per bike and $115 of fixed costs per bike. Radar received an offer from a potential customer who wants to buy 800 bikes for $440 each. Incremental fixed costs to make this order are $47,000. No other costs will change if this order is accepted. Compute Radar's additional income (ignore taxes) if it accepts this order. Contribution margin Incremental Amount per Unit Incremental Fixed Costs Incremental income (loss) from new business The company should Incremental Income from New Businessarrow_forwardOutback Outfitters sells recreational equipment. One of the company's products, a small camp stove, sells for $120 per unit. Variable expenses are $84 per stove, and fixed expenses associated with the stove total $ 154,800 per month. Required: What is the break - even point in unit sales and in dollar sales? If the variable expenses per stove increase as a percentage of the selling price, will it result in a higher or a lower break - even point? (Assume that the fixed expenses remain unchanged.) At present, the company is selling 17,000 stoves per month. The sales manager is convinced that a 10% reduction in the selling price would result in a 25% increase in monthly sales of stoves. Prepare two contribution format income statements, one under present operating conditions, and one as operations would appear after the proposed changes. Refer to the data in Required 3. How many stoves would have to be sold at the new selling price to attain a target profit of $77,000 per month? Complete…arrow_forward

- Posters.com is a small Internet retailer of high-quality posters. The company has $1,000,000 in operatingassets and fixed expenses of $150,000 per year. With this level of operating assets and fixed expenses, thecompany can support sales of up to $3,000,000 per year. The company’s contribution margin ratio is 25%,which means that an additional dollar of sales results in additional contribution margin, and net operatingincome, of 25 cents.Required:1. Complete the following table showing the relation between sales and return on investment (ROI).Net Operating AverageSales Income Operating Assets ROI$2,500,000 $475,000 $1,000,000 ?$2,600,000 $ ? $1,000,000 ?$2,700,000 $ ? $1,000,000 ?$2,800,000 $ ? $1,000,000 ?$2,900,000 $ ? $1,000,000 ?$3,000,000 $ ? $1,000,000 ?2. What happens to the company’s return on investment (ROI) as sales increase? Explain.arrow_forwardAnderson Inc. uses packing machines to prepare their product for shipping. One machine costs $136,000 and lasts about 5 years before it needs to be replaced. The operating cost per machine is $6,500 a year. Ignoring taxes, what is the equivalent annual cost of one packing machine if the required rate of return is 11%? Multiple Choice $49,904 $51,036 $44,298 $43,298 $50,776arrow_forwardOutback Outfitters sells recreational equipment. One of the company’s products, a small camp stove, sells for $90 per unit. Variable expenses are $63 per stove, and fixed expenses associated with the stove total $121,500 per month. Required: 1. What is the break-even point in unit sales and in dollar sales? 2. If the variable expenses per stove increase as a percentage of the selling price, will it result in a higher or a lower break-even point? (Assume that the fixed expenses remain unchanged.) 3. At present, the company is selling 11,000 stoves per month. The sales manager is convinced that a 10% reduction in the selling price would result in a 25% increase in monthly sales of stoves. Prepare two contribution format income statements, one under present operating conditions, and one as operations would appear after the proposed changes. 4. Refer to the data in Required 3. How many stoves would have to be sold at the new selling price to attain a target profit of $71,000 per month?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education