FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

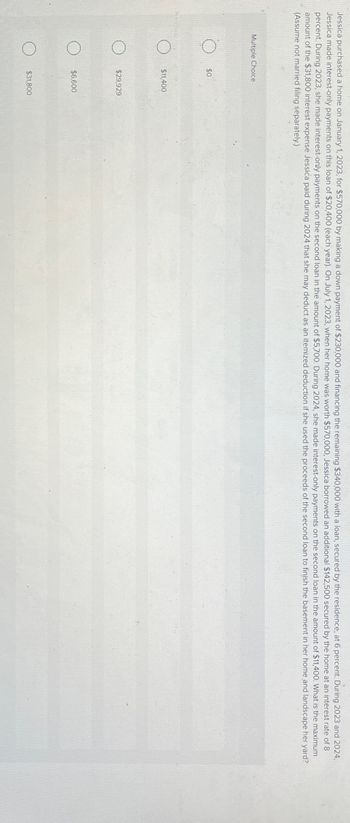

Transcribed Image Text:Jessica purchased a home on January 1, 2023, for $570,000 by making a down payment of $230,000 and financing the remaining $340,000 with a loan, secured by the residence, at 6 percent. During 2023 and 2024,

Jessica made interest-only payments on this loan of $20,400 (each year). On July 1, 2023, when her home was worth $570,000, Jessica borrowed an additional $142,500 secured by the home at an interest rate of 8

percent. During 2023, she made interest-only payments on the second loan in the amount of $5,700. During 2024, she made interest-only payments on the second loan in the amount of $11,400. What is the maximum

amount of the $31,800 interest expense Jessica paid during 2024 that she may deduct as an itemized deduction if she used the proceeds of the second loan to finish the basement in her home and landscape her yard?

(Assume not married filing separately.)

Multiple Choice

$0

$11,400

$29,929

$6,600

$31,800

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Amanda purchased a home for $520,000 in 2016. She paid $104,000 cash and borrowed the remaining $416,000. This is Amanda's only residence. Assume that in year 2021 when the home had appreciated to $780,000 and the remaining mortgage was $312,000, interest rates declined and Amanda refinanced her home. She borrowed $520,000 at the time of the refinancing, paid off the first mortgage, and used the remainder for purposes unrelated to the home. What is her total amount of her amount of acquisition indebtedness for purposes of determining the deduction for home mortgage interest? (Assume not married filing separately.)arrow_forwardJudy recently purchased her first home for $220,000. She made a down payment of $20,000, and financed the balance over 15 years, at 6% interest. If Judy's first payment is due on October 1 of this year, approximately how much interest will she pay inthis year? $2,073.47. $1,979.76 $3,288.63. $5,885.09.arrow_forwardKenneth is expected to receive an inheritance of about $250,000 from his grandmother's estate in a few months' time. He is eyeing to buy a 1-bedder condominium so that he can stay on his own. The price of the property is $1,000,000. He is offered a 30-year mortgage loan of $750,000 at an interest rate of 1.3%. (1) Compute the monthly instalment of the mortgage loan. (ii) Analyse and discuss how the Mortgage Servicing Ratio (MSR) and Total Debt Service Ratio (TDSR) will impact his plan to purchase the $1m condo.arrow_forward

- Tamar owns a condominium near Cocoa Beach in Florida. In 2023, she incurs the following expenses in connection with her condo: $ 650 950 5,200 1,190 1,030 1,000 10,700 Insurance Advertising expense Mortgage interest Property taxes Repairs & maintenance Utilities Depreciation During the year, Tamar rented out the condo for 97 days, receiving $34,500 of gross income. She personally used the condo for 57 days during her vacation. Tamar's itemized deduction for nonrental taxes is less than $10,000 by more than the property taxes allocated to the rental use of the property. Assume Tamar uses the Tax Court method of allocating expenses to rental use of the property. Assume 365 days in the current year. Note: Do not round apportionment ratio. Round all other dollar values to the nearest whole dollar amount. Required: a. What is the total amount of for AGI (rental) deductions Tamar may deduct in the current year related to the condo (assuming she itemizes deductions before considering…arrow_forwardThis year, Major Healy paid $34,500 of interest on a mortgage on his home (he borrowed $690,000 to buy the residence in 2015; $790,000 original purchase price and value at purchase), $5,250 of interest on a $105,000 home equity loan on his home (loan proceeds were used to buy antique cars), and $7,000 of interest on a mortgage on his vacation home (borrowed $140,000 to purchase the home in 2010; home purchased for $350,000). Major Healy's AGI is $220,000. How much interest expense can Major Healy deduct as an itemized deduction? Interest Deductiblearrow_forwardJim and Joan Miller are borrowing $120,000 at 6.5% per annum compounded monthly for 30 years (360 months) to purchase a home. Their monthly payment is determined to be $758.48. A recursive formula for their balance after each monthly payment has been made. A determination of Jim and Joan's balance after the first payment. Don't forget the interest affecting their payment create a table showing their balance after each monthly payment. Determine when the balance will be below $75,000. Determine when the balance will be paid off. Determine the interest expense when the loan is paid.(find the total paid, and subtract 120,000 from it).arrow_forward

- Amanda purchased a home for $860,000 in 2016. She paid $172,000 cash and borrowed the remaining $688,000. This is Amanda's only residence. Assume that in year 2021 when the home had appreciated to $1,290,000 and the remaining mortgage was $516,000, interest rates declined and Amanda refinanced her home. She borrowed $860,000 at the time of the refinancing, paid off the first mortgage, and used the remainder for purposes unrelated to the home. What is her total amount of her amount of acquisition indebtedness for purposes of determining the deduction for home mortgage interest? (Assume not married filing separately.) Multiple Choice ___ $516,000. ___ $645,000. ___ $860,000. ___ $946,000.arrow_forwardTamar owns a condominium near Cocoa Beach in Florida. In 2023, she incurs the following expenses in connection with her condo: Insurance Advertising expense Mortgage interest Property taxes Repairs & maintenance $ 1,000 500 3,500 900 650 Utilities Depreciation 950 8,500 During the year, Tamar rented out the condo for 75 days, receiving $10,000 of gross income. She personally used the condo for 35 days during her vacation. Tamar's itemized deduction for nonrental taxes is less than $10,000 by more than the property taxes allocated to the rental use of the property. Assume Tamar uses the Tax Court method of allocating expenses to rental use of the property. Assume 365 days in the current year. Note: Do not round apportionment ratio. Round all other dollar values to the nearest whole dollar amount. Required: a. What is the total amount of for AGI (rental) deductions Tamar may deduct in the current year related to the condo (assuming she itemizes deductions before considering deductions…arrow_forwardBarbie and Ken purchase their personal Dreamhouse residence 15 years ago for $440,000 for the current year they have 110,000 First Mortgage on their home which they pay $5,500 in interest they also have a home equity loan to pay for the children's College tuition secured by their home with a balanced throughout the year of 142,250 they paid interest on the home equity loan of 14225 for the year. calculate the qualified residence acquisition debt interest for the current uear and the qualified home equity debt interest for the current yeararrow_forward

- This year, Major Healy paid $35,500 of interest on a mortgage on his home (he borrowed $710,000 to buy the residence in 2015; $810,000 original purchase price and value at purchase), $5,500 of interest on a $110,000 home equity loan on his home (loan proceeds were used to buy antique cars), and $8,000 of interest on a mortgage on his vacation home (borrowed $160,000 to purchase the home in 2010; home purchased for $400,000). Major Healy's AGI is $220,000. How much interest expense can Major Healy deduct as an itemized deduction? Interest Deductiblearrow_forwardTamar owns a condominium near Cocoa Beach in Florida. In 2022, she incurs the following expenses in connection with her condo Insurance Advertising expense Mortgage interest Property taxes Repairs & maintenance : Utilities Depreciation $1,100 550 3,850 945 700 1,000 9,500 During the year, Tamar rented out the condo for 75 days, receiving $10,000 of gross income. She personally used the condo for 35 days during her vacation. Tamar's itemized deduction for nonrental taxes is less than $10,000 by more than the property taxes allocated to the rental use of the property. Problem 14-58 Parts a, b, c, d & e (Algo) Assume Tamar uses the IRS method of allocating expenses to rental use of the property. Required: a. What is the total amount of for AGI (rental) deductions Tamar may deduct in the current year related to the condo? b. What is the total amount of itemized deductions Tamar may deduct in the current year related to the condo? c. If Tamar's basis in the condo at the beginning of the…arrow_forward2.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education