Financial Accounting Intro Concepts Meth/Uses

14th Edition

ISBN: 9781285595047

Author: Weil

Publisher: Cengage

expand_more

expand_more

format_list_bulleted

Question

Hi expert provide correct answer general accounting

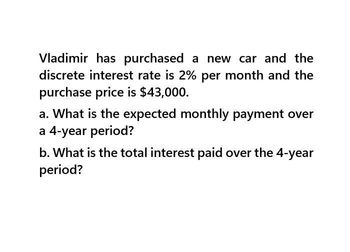

Transcribed Image Text:Vladimir has purchased a new car and the

discrete interest rate is 2% per month and the

purchase price is $43,000.

a. What is the expected monthly payment over

a 4-year period?

b. What is the total interest paid over the 4-year

period?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps with 2 images

Knowledge Booster

Similar questions

- To help finance the purchase of a house and lot, a couple borrows P350,000. The loan is to be repaid in equal monthly installment over a period of 8 years. If the interest rate is converted monthly, how much is the monthly payment at 15% interest, m=12?arrow_forwardSuppose James will have $25,000.00 for a down payment on a house in 6 years. How much would he have to invest today (present value) if his investment earns a nominal rate of 5 ¼ % compounded monthly? b. How much interest did James’s account earn during the 6 years?arrow_forwardA man plans to take a vacation in 4 years. He wants to buy a certificate of deposit for $1200 that he will cash in for the trip. What is the minimum annual interest rate he must obtain on the certificate if he needs at least $1700 for the trip? Assume that the interest on the loan is computed using simple interest The rate he must obtain is ___%arrow_forward

- a. If you borrow $2,200 and agree to repay the loan in five equal annual payments at an interest rate of 12%, what will your payment be? b. What will your payment be if you make the first payment on the loan immediately instead of at the end of the first year?arrow_forwarda. If you borrow $1,100 and agree to repay the loan in six equal annual payments at an interest rate of 11%, what will your payment be? b. What will your payment be if you make the first payment on the loan immediately instead of at the end of the first year?arrow_forward11) Max purchases a lot for $300,000. Max will pay $25,000 dollars at the end of each year. the interest rate is 4% compounded annually, how many full payments must be made? a) what will be the size of the payment one year after the last full payment?arrow_forward

- Tony has taken a $12,000 car loan. He wants to pay off this debt quickly, so he chooses to pay it in just two years. The loan has a 12% nominal interest rate, compounded quarterly.a. He will make quarterly payments. Draw the cash flow diagram. b. What is his quarterly payment?c. Complete the amortization table, showing the amounts for each payment, interest, and principal.arrow_forwardSuppose that you buy a car costing $14,000. You agree to make payments at the end of each monthly period for 4 years. You pay 7% interest, compounded monthly.(a) What is the amount of each payment? (b) Find the total amount of interest you will pay.arrow_forwardYou would Ilike to have $59,000 in 5 years for the down payment on a new house following graduation by making deposits at the end of every three months in an annuity that pays 4.25% compounded quarterly. (a) How much should you deposit at the end of every three months? (b) How much of the $59,000 comes from deposits? (c) How much of the $59,000 comes from interest? (Round UP to the nearest dollar. For example, $247) OPensyrooo n 21 l 1e0 (6)' s 6Tei 0hcc doirdW (b)Saaviz wDi 26. 7 1 0 59.000 6 00arrow_forward

- You borrow $11,000 and promise to make payments of $3,359.50 at the end of each year for 5 years. What is the interest rate earned? Round your answers to the nearest whole numberarrow_forwardYou purchase a car priced at 750,000 Php. You paid 10% as the down payment and the remaining balance under a bank amortization plan. At an effective monthly interest rate of 0.4%, How much will be your monthly payments if the balance should be paid in 10years? How much interest will you pay in the 3rd yearConstruct an amortization tablearrow_forwardAn individual needs $12,000 immediately as a down payment on a new home. Suppose that he can borrow this money from his insurance company. He must repay the loan in equal payments every six months over the next eight years. The nominal interest rate being charged is 7% compounded continuously. What is the amount of each payment?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you