FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

skip if you already did this otherwise downvote

follow my instructions otherwise downvote

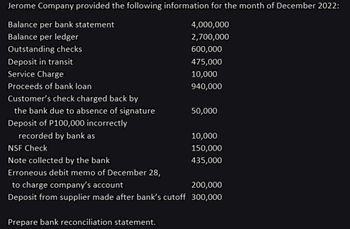

Transcribed Image Text:Jerome Company provided the following information for the month of December 2022:

Balance per bank statement

Balance per ledger

Outstanding checks

Deposit in transit

Service Charge

Proceeds of bank loan

Customer's check charged back by

the bank due to absence of signature

Deposit of P100,000 incorrectly

recorded by bank as

NSF Check

Note collected by the bank

Erroneous debit memo of December 28,

4,000,000

2,700,000

600,000

475,000

10,000

940,000

Prepare bank reconciliation statement.

50,000

10,000

150,000

435,000

to charge company's account

200,000

Deposit from supplier made after bank's cutoff 300,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Ch1 Question 2: A long-text entry will be truncated if the cell to the right is in use. Answer: A. True B. False Question 1: Which of these is true about using Undo? Answer: A. It can only be used in certain circumstances. B. Previous actions can be undone in any order. C. The Redo command must be used before the Undo command is available. D. The user must be aware of those commands that cannot be undone, as Excel will not provide any indication of these.arrow_forwardAccess the Recurring Transactions List from the: Multiple Choice Navigation Bar Gear icon (+) New icon None of the choices is correct.arrow_forwardCan someone check and tell me if my answer is correct?arrow_forward

- QUESTION 2 Suppose you are working in Excel and you notice that the A column header and the 1 row label are both highlighted in yellow as shown: What can you conclude from this state of the workbook? Tables IustialioNIS 1 2 3 O A1 A B C D cell A1 is the active cell there is an error in your worksheet the worksheet is locked to keep users from changing itarrow_forwardAutoSave Off File Home Insert Page Layout ch04_p24_build_a_model v Search Data Review View Automate Formulas 10 AA =1 Arial Paste BIU v Clipboard Z BA Font v General $%90-00 2 Alignment E Number [ M64 fx A B C D E F G H 79 80 Help H Insert く Delete Formatting Conditional Format as Cell Table Styles Format Styles Cells 81 f. Now assume the date is 10/25/2021. Assume further that a 12%, 10-year bond was issued on 7/1/2021, pays 82 interest semiannually (January 1 and July 1), and sells for $1,100. Use your spreadsheet to find the bond's 83 84 Refer to this chapter's Tool Kit for information about how to use Excel's bond valuation functions. The model finds the 85 price of a bond, but the procedures for finding the yield are similar. Begin by setting up the input data as shown below: 86 87 Basic info: J K Σ WE◊ David N M << Z ANSE So Filt Ed 88 Settlement (today) 89 Maturity 90 Coupon rate 91 Current price (% of par) 92 Redemption (% of par value) 93 Frequency (for semiannual) 94 Basis…arrow_forwardAutoSave On Exam 2 ch 14-16.xlsx - Saved - O Search Rolando Borjas Jr. 困 File Home Insert Page Layout Formulas Data Review View Help A Share P Comments E A I AutoSum - Fill v X Cut - A A° 22 Wrap Text Calibri 11 General B Copy Paste BIU v A v EEE E E E Merge & Center $ • % 9 8 -98 Conditional Format as Cell Insert Delete Format Sort & Find & Ideas Sensitivity S Format Painter Formatting v Table v Styles v O Clear v Filter v Select v Clipboard Font Alignment Number Styles Cells Editing Ideas Sensitivity AG28 fe P R S V Y AA АВ AC AD AE AF AG АН Al AJ AK AL AM AN AO AP AQ AR AS 16 The Annapolis Corporation's stockholders' equity accounts have the following balances as of January 1, 2016: 12% preferred stock, cumulative, $50 par, 10,000 shares issued and outstanding $ 500,000 5 Common stock, $10 par (100,000 shares issued and outstanding) 1,000,000 Additional paid-in capital: common 1,000,000 6 1,000,000 7 Retained earnings 3,750,000 8 Total stockholders' equity 6,250,000 9 10 Annapolis…arrow_forward

- AutoSave Normal 因 Document1 - Word Search badiya aldujaili ff BА EN File Home Insert Draw Design Layout References Mailings Review View Help A Share O Comments X Cut Calibri (Body) v 11 - A^ A Aav A E E O Find - AaBbCcDc AaBbCcDc AABBCC AABBCCC AaB AABBCCC AaBbCcDa 自Copy Paste S Replace В IUvab х, х* А 1 Normal 1 No Spac. Heading 1 Heading 2 Title Subtitle Subtle Em.. A Select v Dictate Editor Format Painter Clipboard Font Paragraph Styles Editing Voice Editor 2 3 4 Winter Company reported the following for the most recent month: Physical Units 700 Beginning work in process (60% complete) Units transferred in (started) during month Ending work in process 4,800 950 Materials are added at the end of the process and conversion costs are added evenly throughout the process. If equivalent whole units of production for conversion using the weighted average were 4,816, what percent complete was ending work in process at the end of the month? (Round to the nearest whole percent.) а. 20% b. 16%…arrow_forwardAutoSave Off File Home Module ThreeProblem Set Question3 ⚫ Saved to this PC Search Insert Page Layout Formulas Data Review View Automate Help ✗Cut Calibri 12 Α' Α' ab Wrap Text Text Copy ▾ Paste B I U ~A~ Merge & Center $ % 9 +0.00 Format Painter Clipboard √☑ Font Б Alignment √☑ Number Г A1 A B C D E F G H Accent3 Accent4 Accent5 Conditional Format as Formatting Accent6 Comma Comma [0] Table ▾ Styles Katherine Apuzzo KA Comments Share ☐☐ > AutoSum ✓ ĄT பப Fill Insert Delete Format Sort & Find & Add-ins > Clear Filter Select Cells Editing Analyze Data Add-ins J K L M N о P Q R S T U V W X Y ✓ ✓ ✓ fx Function: MAX; Formulas: Subtract; Divide; Cell Referencing 1 Function: MAX; Formulas: Subtract; Divide; Cell Referencing 2 3 BE5.7 - Using Excel to Determine Profitability Given a Constrained Reso 4 PROBLEM 5 Rachel wants to use her knitting skills to make a little extra money so she 6 can enjoy a theatre weekend with her besties. She's got the pattern down 7 for a hat, scarf, and mittens,…arrow_forwardAutoSave C. Home Insert Draw Page Layout Formulas Data Review X Times New Roman v 10 A A == Paste B I U v V A > Chapter 15 Build A Model.xlsx Automate General $%9 Read-Only Tell me Conditional Formatting Insert v Format as Table Delete v 00 20 .00 <-→0 Editing Cell Styles v Format View B C D E F G H I 0% 10% 20% 30% 40% 50% 60% 70% 80% 175 65 Xvfx A 66 67 68 69 Additional: using the (hypothetical) free cash flow stream below, calcuate and graph the NPVs (y-axis) against the various 70 Debt/Value Ratios (x-axis) in the space below (similar to Figure 15-8): 71 72 Time 73 FCF 74 0 1 2 3 4 5 -1200500 200000 350000 425000 350000 265000 Debt/Value WACC (from NPV (aka 75 Ratio above table) Firm Value) 76 0% 8.900% 77 10% 8.640% 78 20% 8.488% 79 30% 8.462% 80 40% 8.796% 81 50% 9.520% 82 60% 10.724% 83 70% 12.078% 84 85 86 $1.20 Build a Model + Ready Accessibility: Investigate MAY 6 44 Warrow_forward

- LutoSave 日 Off UnitlILabAssignment_Question1 O Search (Alt-Q) Protected View Home Insert Draw Page Layout Formulas Data Review View Help PROTECTED VIEW Be careful-files from the Internet can contain viruses. Unless you need to edit, it's safer to stay in Protected View. Enable Editing fx Formula: Multiply, Subtract; Cell Referencing A D E F G H. K Formula: Multiply, Subtract; Cell Referencing Using Excel to Record Stock Entries Student Work Area PROBLEM Required: Provide input into cells shaded in yellow in this template. Select account names from the drop-down lists. Use cell references to the data area. Use mathematical formulas to calculate any amounts not given. On May 10, Jack Corporation issues common stock for cash. Shares of stock issued Par value per share 2,000 24 %24 10.00 Amount at which stock issued 18.00 Journalize the issuance of the stock. 10 11 Date Debit Credit 12 May 10 13 14 15 16 17 18 19 20 21 22 23 25 26 27 28 29 30 31 32 33 Enter Answer Ready 24arrow_forwardList Paragraph For the... badiya aldujaili BA AutoSave ff Search EN File Home Insert Draw Design Layout References Mailings Review View Help A Share O Comments X Cut - A^ A° Aav A E - E - E E E O Find - Calibri (Body) 11 AaBbCcDc AaBbCcDc AaBbC AABBCCC AaB AAB6CCC AaBbCcDa 自Copy Paste S Replace В IUvab х, х* А I Normal 1 No Spac. Heading 1 Heading 2 Title Subtitle Subtle Em... A Select v Dictate Editor Format Painter Clipboard Font Paragraph Styles Editing Voice Editor 1. 2 4 5 6. 7 If Busby Corporation's variable cost ratio is 0.75, targeted after tax net income is $27,580 (tax rate of 20%), and targeted sales volume in dollars is $219,000 then Busby's total fixed costs are: a. $27,170 b. $71,380 c. $20,275 d. $136,670 e. $129,775 f. $26,350 g. $54,750 Page 3 of 3 331 words English (United States) Focusם 160% 8:28 PM O Type here to search ENG 2/11/2021 (凸) . I . I ..?. . . E • . . L. . . t .. I ..arrow_forwardQuestion 3 Listen What are the values of r and r² for the below table of data? Hint: Make sure your diagnostics are turned on. Enter the data into L1 and L2. Click STAT, CALC, and choose option 8: Lin Reg(a+bx). A r = -0.862 r2=0.743 B r=0.673 2=0.820 X y 5 C r=0.743 r2=-0.862 8 22 23.9 14 9 14 17 20 5.2arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education