FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

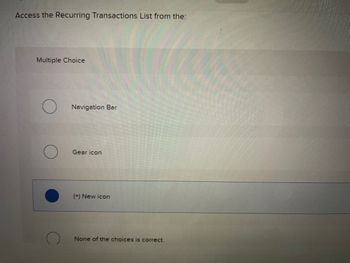

Transcribed Image Text:Access the Recurring Transactions List from the:

Multiple Choice

Navigation Bar

Gear icon

(+) New icon

None of the choices is correct.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Can someone check and tell me if my answer is correct?arrow_forwardTo reconcile a payment batch a separate calculator tape is run for all payments, withheld amounts,and adjustments Yrue or falsearrow_forwardBlossom Company purchases various types of beach toys for sale to consumers. Listed below are the transactions for the month of June. Blossom uses a perpetual inventory system. June 1 Purchased 25 water tubes for $260 each terms n/30 FOB destination. 8 Returned 4 tubes purchased on June 1 due to defects. Received a full refund for the defective tubes. 10 Freight charges of $100 for the June 1 transaction are paid by the responsible party. 11 Made a complaint about competitive pricing. Received a $400 credit for the water tubes purchased on June 1. 15 Purchased 110 water tubes for $235 each on account, terms 2/10 n/30. 18 Made payment for the amount owing for the June 1 transaction. 20 Made payment for the amount owing for the June 15 transaction.arrow_forward

- 42 O Browser geNOWv2 | Online teachin X + n/takeAssignment/takeAssignmentMain.do?invoker=&takeAssignmentSessionLocator=&inprogress=false DSU AcadCalendar C crunchy roll crunchy roll A Home - Hudl Spotify EReadir U D2L O DSU Support PDSU WebMail O DSU Account Monaco & Associates Use the following five transactions for Monaco & Associates, Inc. to answer the question(s). October 1 Bills are sent to clients for services provided in September in the amount of $800. Dravo Co. delivers office furniture ($1,060) and office supplies ($160) to Monaco 6 leaving an invoice for $1,220. 15 Payment is made to Dravo Co. for the furniture and office supplies delivered on October 9. 23 A bill for $430 for electricity for the month of September is received and will be paid on its due date in November. 31 Salaries of $850 are paid to employees. Based only on these transactions, what is the total amount of expenses that should appear on the income statement for the month of October? Oa. $1,280 Ob. $430…arrow_forwardLutoSave 日 Off UnitlILabAssignment_Question1 O Search (Alt-Q) Protected View Home Insert Draw Page Layout Formulas Data Review View Help PROTECTED VIEW Be careful-files from the Internet can contain viruses. Unless you need to edit, it's safer to stay in Protected View. Enable Editing fx Formula: Multiply, Subtract; Cell Referencing A D E F G H. K Formula: Multiply, Subtract; Cell Referencing Using Excel to Record Stock Entries Student Work Area PROBLEM Required: Provide input into cells shaded in yellow in this template. Select account names from the drop-down lists. Use cell references to the data area. Use mathematical formulas to calculate any amounts not given. On May 10, Jack Corporation issues common stock for cash. Shares of stock issued Par value per share 2,000 24 %24 10.00 Amount at which stock issued 18.00 Journalize the issuance of the stock. 10 11 Date Debit Credit 12 May 10 13 14 15 16 17 18 19 20 21 22 23 25 26 27 28 29 30 31 32 33 Enter Answer Ready 24arrow_forwardQuestion Completion Status: QUESTION 2 Posting: transfers journal entries to ledger accounts. a. transfers ledger transaction data to the journal. Ob. is an optional step in the recording process. c. normally occurs before journalizing. d. QUESTION 3 Q5. All statement are limitations of trial balance Except: Click Save and Submit to save and submit. Click Save AlZ Answers to save all answers.arrow_forward

- True or false? In a manual system, it is proper to splits journal entry at the bottom page.arrow_forwardSubject : Accounting what is the lowest subscription level of QuickBooks online that allows custom fields to be added to purchase orders?arrow_forwardThe easiest way to change the order in a chart is in the __________. Multiple Choice underlying spreadsheet slicer chart options chart itselfarrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education